Author: Robin Langford

Guest comment: Why omnichannel retailers reign supreme

In light of the challenges facing retailers now many of their customers are in lockdown, and high streets are closed, Paul Kirkland, Retail and Hospitality Business Development Director, Fujitsu, looks at why an omnichannel presence has become more than just a novelty – but essential to staying buoyant in this new retail landscape.

Why stock music presents great creative avenues for musicians

Today’s brands are increasingly using more music to help tell their stories to consumers. As a result of this, there is now increasing demand for stock music. Kate Cooper, Music Producer at Shutterstock discusses how contrary to belief, stock allows creatives to be employed in their profession whilst they work on their personal portfolios of … [Read more…]

5 tips for effective online messaging

Tone of voice is a crucial component of a brand’s identity and new channels of digital communication, such as messaging apps, all need subtly different approaches to make them effective. Julien Rio, Director of Marketing of RingCentral Engage Digital, outlines 5 tips for ensuring consistent messaging across all your digital communications.

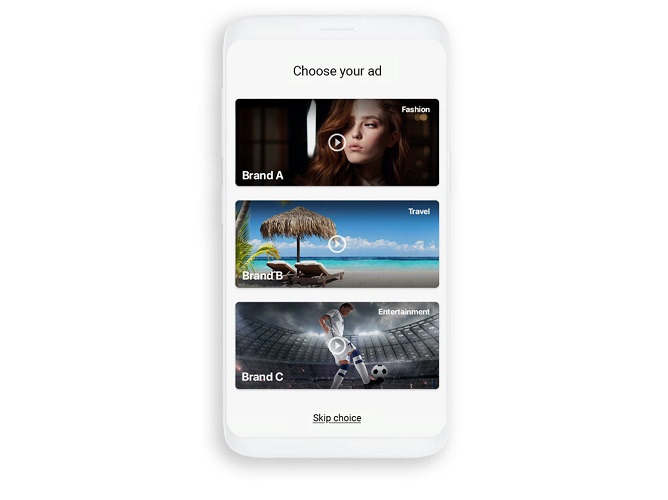

Guest comment: Agile platforms – their rise and reign of customer engagement

As the number of devices is exploding, customers have more channels than ever to interact with brands. This has created a shift in consumer engagement, one that clunky legacy platforms are not equipped to cope with – why? Because their multiple solutions don’t talk to each other. James Manderson, General Manager of engagement platform Braze … [Read more…]