Online will replace TV as the leading global advertising medium by 2020, according to new research by IHS Markit.

The Global Advertising Trends report from IHS Technology’s Advertising Intelligence Service indicates that while the TV market still benefits from big brand budgets, online will take pole position within the next four years.

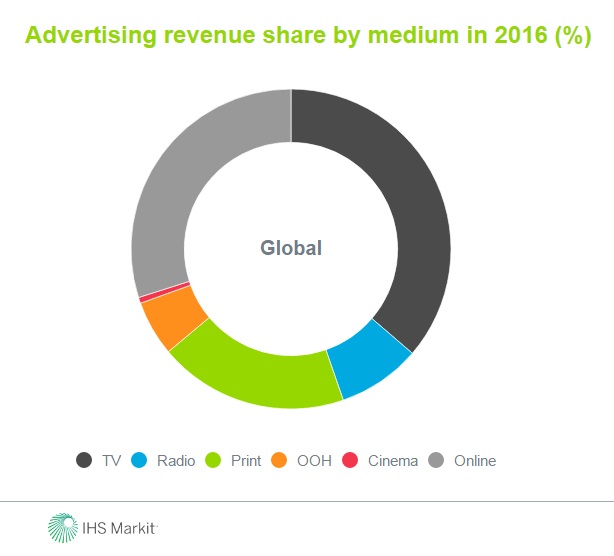

Global ad revenue grew 7.1% in 2016 to $532bn with TV the top performer accounting for $192bn, or 36%, of global revenue.

By comparison, online advertising accounted for almost $160bn, or 30% of global revenue, followed by print advertising in third with an estimated $101bn/. Radio came in as the fourth most lucrative channel with $47bn in revenue.

“In some countries such as the UK, online already accounts for almost 50% of total advertising revenue and will only keep getting stronger,” said report author and IHS Technology principal analyst Eleni Marouli.

“Quadrennial events such as the Olympics, the European Football Championship and the US elections helped keep TV on top,” said Marouli.

In the US, TV advertising revenue accounted for roughly 38% of the country’s ad total last year, but online was just behind at 36%. In China, online advertising revenue was estimated at 17% greater than TV ad revenue, a difference of $15 billion.

Key findings:

Top 10 markets

The top 10 markets make 75 percent of the global revenue figure. “The top 10 markets still account for the lion’s share of global advertising revenue,” Marouli said. “However, their collective power has dropped due slowdowns in the Chinese and Brazilian economies, which were the rising stars in the top 10 in 2015.”

The top 10 accounted for 76 percent of global ad revenue in 2015; it dropped to 75 percent in 2016.

Fastest growing region: Africa

Four out of the five fastest growing countries in 2016 were in Africa. “Ghana and Kenya have been high on the list of many media companies’ expansion plans, and we are seeing growth above 20 percent,” Marouli said. “These markets are still growing from a low base, but the sheer size of their populations means they are becoming interesting targets for big brands.”

TV remains number one, but online will overtake by 2020

TV was the number one medium globally for advertising revenue, accounting for $192 billion, or 36 percent, of global revenue. “Despite the incredible growth of online giants like Facebook, Google and Snapchat, the TV market continues to benefit from big brand budgets,” Marouli said. “Quadrennial events such as the Olympics, the European Football Championship and the US elections helped keep TV on top.”

Israel, Switzerland and the US top the ad spend per person

The most mature markets are mostly high GDP per capita markets, according to the IHS Technology report. Israel topped the list at $719, followed by Switzerland and the US. China generated only $65 per person in advertising, despite being the second largest advertising market. Zimbabwe was the last on the list with $0.002 ad revenue per person per year.

Expect double-digit growth in 2017

“We expect global advertising revenue will grow to $590 billion in 2017,” Marouli said. “The strongest growth will come from the Middle East and Africa, followed by Asia Pacific, where India and Indonesia will steal the show.”

Developed markets are likely to slow down in an “event-light”, following the high spending for the Olympics and the US elections, the IHS Technology report said. Online will continue to be the fastest growing medium at 14 percent, however, a slowdown in the revenue growth of Google and Facebook, is likely as the two are not attracting TV budgets to their online video offerings as fast as they had hoped.