The average UK household now owns 7.4 devices that connect to the internet, leading to a huge rise in digital ad spend driven by mobile, according to new research.

The study, from the IAB, found that this rise in digital technology in homes has driven advertisers to spend a record £7.2 billion on digital advertising in 2014.

The research was conducted by PwC and accompanied by YouGov consumer data.

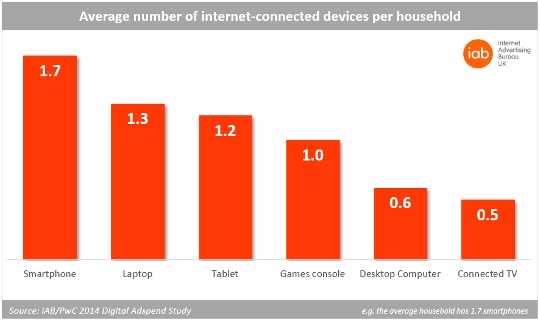

Among Britons online, smartphones are the most common internet-enabled device (1.7 per household)¹, followed by laptops (1.3) and tablets (1.2). Four in 10 (40%) households now own one tablet, one fifth (19%) have two, while 11% own three or more. According to the IAB/PwC data, tablet-dedicated ad spend alone² grew 118% to reach £87.4 million.

Digital advertising hits annual record £7.2bn – funding free services people increasingly rely on

Alongside the rise in internet-enabled devices, IAB/PwC data shows advertisers increased digital ad spend, like-for-like³, by 14% to £7.19 billion in 2014 – up from £6.26 billion in 2013 (an absolute increase of £936m).

“Advertisers are increasing their digital budgets to reach people as they go online through an increasing array of devices,” says Tim Elkington, Chief Strategy Officer at the UK’s Internet Advertising Bureau. “It’s a win-win for consumers, because digital advertising pays for the wide range of free online services they increasingly rely on in their daily lives, but don’t necessarily want to pay much for.”

The YouGov study reveals the average British adult online is willing to pay a maximum of £1.53 a month for their email service, £1.33 to use search engines, £1.10 for video content, 92p for news websites, 88p for social media, 55p for online games and 52p for price comparison sites⁴.

Banking/finance is the area of people’s lives that would be most affected without the internet or mobile phone – cited by over half (51%)¹ of adult Britons online – followed by keeping up with current events (42%), shopping (38%) and their relationships with friends and family (37%).

Mobile ad spend up 63%; accounts for nearly one-quarter of digital advertising

With smartphones accounting for nearly eight in 10 (78%) handsets, mobile advertising grew 63% to £1.62 billion in 2014. Mobile now accounts for 23% of all digital advertising spend – up from 16% in 2013.

Consumer goods biggest display advertisers

The biggest spending sector on display ads in 2014 was consumer goods, which had a 19% share, followed by travel & transport (14%) and finance (13%). Consumer goods was also the biggest spender on mobile display ads – accounting for a 19% share, followed by entertainment & media (18%) and retail (14%).

Digital advertising formats

Boosted by video and social media, display advertising across the internet and mobile grew almost twice the overall digital rate (14.0%) at 26.4% to £2.27 billion in 2014. Display now accounts for 32% of digital ad spend – its largest ever share.

Elkington comments, “Display advertising’s record share shows marketers are increasingly seeing online as a viable ‘brand awareness’ ad medium – as with traditional media – not just one for generating an immediate ‘direct response’. The internet has been characterised as the latter since the start due to its unrivalled measurability but this shows online advertising has come of age.”

Social media ad spend grew 65% to £922 million, with 56% (£517 million) accounted for by mobile.

Content and native advertising spend hit £509 million – 22% of digital display advertising.

Video advertising grew 43% year-on-year to £442 million in 2014 – compared to just £53m five years ago. Mobile video advertising, alone, grew 142% year-on-year to £164 million.

Paid-for search marketing increased 8.7% to £3.77 billion in 2014.

Classifieds including recruitment, property and automotive listings, grew 11.6% to £1.05 billion – accounting for 15% of digital ad spend.

“Despite digital’s continued stellar performance, there remains significant growth opportunities to be exploited on mobile and tablet devices,” says Dan Bunyan, Senior Manager at PwC.“These are the two areas where ownership and usage is extremely high but where advertising investment is disproportionately low. For instance, over half of web pages are viewed via mobile phones but they account for just 23% of digital spend.”

Methodology:

Total sample size was 2090 adults. The survey was conducted online between 16-17th March 2015. The figures have been weighted and are representative of all GB adults (aged 18+).