Despite the continued competitive onslaught from tech firms and over-the-top (OTT) providers, telco communication and data services will still command 50 percent of the overall digital consumer services industry by 2023, according to Ovum’s Consumer Digital Revenue Opportunity Model.

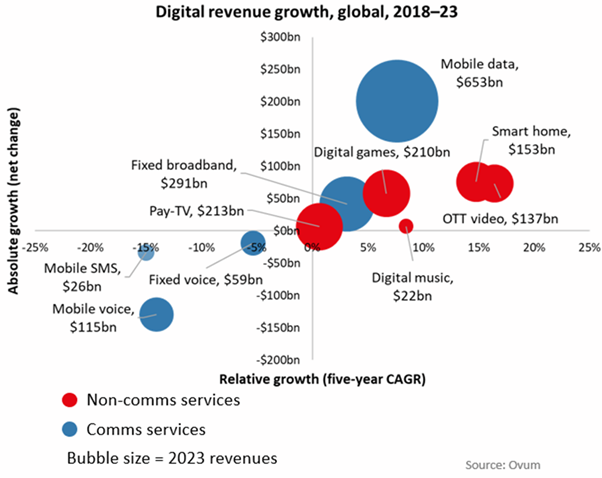

However, the telcos’ share is in steep decline, with a reduction of 6 percentage points from 2019 through 2023 as global revenues from mobile data and fixed broadband start to slow and all other service areas continue their sharp drop. Pay TV, a business that telcos have invested heavily in, will also be nearing market saturation by 2023. As a result, the average household spend on traditional telco services will decline during the next five years.

Smart home, OTT video and digital gaming represent the biggest new growth opportunities for telcos. Based on telco relevance scores, Ovum’s opportunity model shows that OTT video remains the largest opportunity due to the telcos’ heavy investment in pay-TV. In contrast, smart home represents the fastest growing opportunity, with the digital games market providing perhaps the most attractive prospects due to its size and the rapid changes the industry is experiencing.

However, with fierce competition in all three areas, developing successful business cases is far from easy. New technologies such as 5G, artificial intelligence (AI) data analytics, and smart Wi-Fi platforms are enabling innovative new bundles as well as more efficient methods of delivering new services and applications.

Such technologies can certainly enable new telco business models. However, with such fierce competition from large tech companies, only the most innovative telcos are likely to be successful in creating services under their own brand names. Therefore, future success will require an understanding of which segments telcos add value and where they fit into the supply chain in each specific area.

“Today’s telcos need to answer complex questions about their businesses, including what value can they can deliver to customers beyond services already offered by OTT players—and what strategies should they adopt to ensure future success,” said Michael Philpott, senior practice leader for consumer services at Ovum. “To complicate matters further, it’s clear that these opportunities differ significantly on a country-by-country basis. So, whatever strategy telcos decide on, it needs to be adapted to their individual capabilities as well as the market they are operating in.”

Ovum’s Quantifying the Consumer Telco Opportunity report provides top-level analysis and key conclusions and recommendations from Ovum’s Consumer Digital Revenue Opportunity Model. The model analyses the biggest business opportunities for service providers in the consumer digital services space including all telco communication and broadband and data services, as well as smart home and digital media applications.