Marketers have expressed overall optimism about the economy for the first time since 2015, according to the latest IPA Bellwether Report.

The research, from the Institute of Practitioners in Advertising (IPA), draws data from a panel of around 300 UK marketing professionals from the UK’s top 1,000 firms every three months.

The data reveals that UK marketing budgets dipped for the fifth consecutive quarter in a row in the first quarter of 2021. However, the downward trend is softening, with marketers reporting increased optimism for the short-term future as the economy tentatively reopens following a year of turmoil.

In the three months to March 2021, just over one in 10 marketers reported a contraction to total marketing budgets, marking a substantial improvement on Q4 where a quarter of brand bosses admitted to tightening their belts.

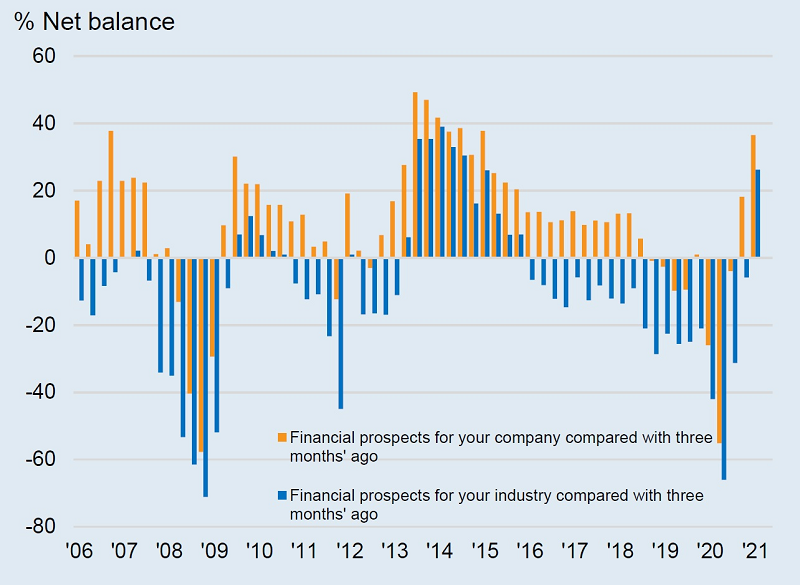

Overall, 41.2% of those surveyed for the Bellwether said they were more confident about the financial prospects of their sector than three months ago, with only 15% less so, giving a net balance of 26.2%, compared with -5.8% three months ago.

It is the first time this figure has risen above zero since the end of 2015, and the highest it has been since the start of that year.

Sector breakdown

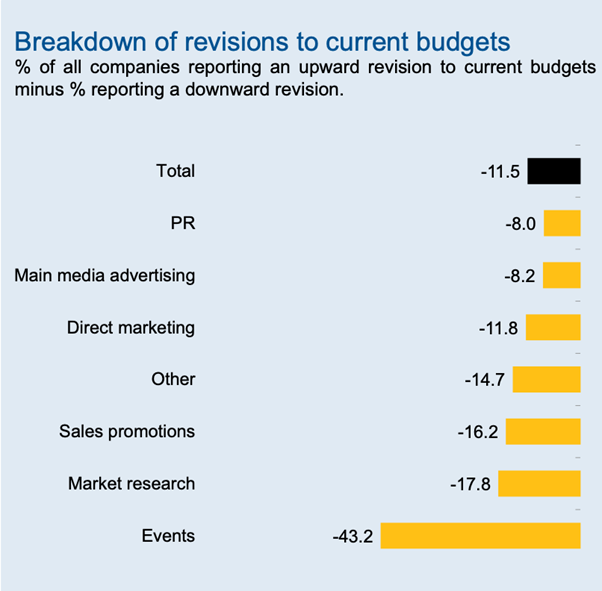

In terms of sector, main media advertising (which includes digital as well as traditional above the line media) is looking to be in a relatively healthy shape, down by a mere 8.2%, while PR is down 8%.

The biggest loss continues to be felt in the events sector, down 43.2%. Pre-pandemic, this was always one of the faster growing sectors, but experience of the cheaper virtual options for industry get togethers could have also changed this category for the long term.

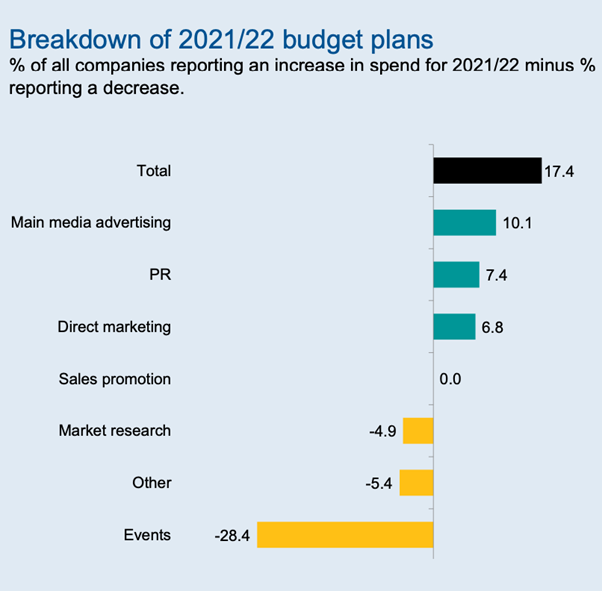

Main media is also expected to lead the way to a fuller recovery in 2022, according to the report.

Paul Bainsfair, IPA director general, said: “The vital signs from this quarter’s Bellwether Report are looking ‘V’ encouraging for a bounce back in UK marketing investment. As the nation comes out of lockdown consumers will be actively seeking out new products, experiences and entertainment, for which it will be more important than ever for companies to build and rebuild their brand awareness.”

Industry comment

Ali MacCallum, CEO UK, Kinetic Worldwide

“We hope that these will be the last figures we see that are so heavily affected by the pandemic. If so, there’s a lot to be excited about for marketers. OOH has suffered through the cold snap of the winter lockdown, but with the public now allowed out and a return to normal within our grasp given the vaccine roll-out, it means that we’re now actively seeing a recovery and a kickstart to demand. Our own research shows we’re set for a real surge in consumer activity this Spring – best symbolised by pub patrons braving the snow for a pint on April 12th and the queues outside Primark.

“The renewed zest and vigour for all things outdoors will advance as restrictions ease, the weather improves, and we remember the collective and community activities that make us happy. OOH as a medium is well placed to encourage and enable that sense of community spirit – and reach consumers in a localised, but scalable way. OOH didn’t waste the quiet months and we can now pinpoint audiences through useful data and respond with tailored messaging in near real-time. As the world goes cookieless and life is lived outside again, OOH will return to strong growth as budgets and audiences return.”

Azlan Raj, Chief Marketing Officer EMEA, Merkle

“After a year of on-going restrictions and record reductions in budgets, it’s encouraging to see further signs of outlook brightening for the industry. While it comes as no surprise that advertising and media remain in a difficult place after such a tough year, lockdown easing coupled with the widespread vaccine rollout are cause for growing consumer confidence and cautious optimism from brands keen to re-engage.

“If marketers have learned anything in the last 12 months, it’s the need for adaptability and cultivating a healthy appetite for change at speed and scale. Those companies that had already embraced digital transformation were well placed to meet their customers’ experience demands. Unfortunately, those who hadn’t already taken the necessary steps to swiftly enable more personal experiences with agility, have fallen far behind. With the market forecast to recover into the next financial year – there’s now a pressing imperative for those businesses to play catch-up, which must start with value-driven investments in data and technology to tackle whatever uncertainties may lay ahead.”

Nitin Rabadia, Managing Partner, Infectious Media

“Marketers have spent the last year adapting their marketing in line with the change in consumer media consumption and this has meant a sharper focus on digital channels and ecommerce sales. As lockdowns ease, media consumption will change again and marketers need to continue on this path and plan for a world where historical marketing strategies are no longer an indicator for future performance. This will require a more nimble, real-time approach to media planning and marketing teams will need to work closely with their agencies to create flexible marketing budgets and plans that can fast-follow success and maximise immediate opportunities using real-time measurement. We also expect to see a rise in emerging real-time channels including audio, programmatic OOH and CTV as marketers look to modern alternatives to traditional ATL channels.

This positive outlook is however coupled with numerous challenges for marketers. The third-party cookie will be as good as dead in 2021 and this will have a huge impact on data usage, marketing tools and measurement. Marketers will need to commit to ID solutions or accept that there will be short term limitations on measurement. It would not be surprising if the number of firms that increase their spending in 2021 is greater than the 17.4% forecast and we expect a strong Q3 “Indian summer” that leads straight through to an early Q4 “Autumn/Winter” as marketers try to capitalise on every opportunity to take a bigger share of wallet to aid their recovery.”

Dom Waghorn, strategy director, SYZYGY

“While these are promising signs, it’s worth remembering that recovery is uneven. For channel or category spend, but also when it comes to business sector. We’ve seen hugely different journeys for our clients, some who have had ‘good’ pandemics. Clearly there is no one size fits all playbook for the next 12 months; every company needs to address its own specific category, competition and customer status. This requires a good hard look at strategies – things have shifted over the last year, and customers are not in the same mindset. This is why the continued reduction in market research is huge cause for concern. Critical business strategies being developed without research into consumer behaviour is a dangerous game. This also runs contrary to the (quite right) obsession with delivering brilliant customer experience. As there are now more nimble ways to develop this insight, we would advise all our clients to retain some level of budget for knowing their audiences and customers inside out.”

Andy Ashley, International Marketing Director, Digital Element

“The positivity across the country is tangible and there is a feeling of progress in the air as the UK’s Covid-19 restrictions ease. While this latest report indicates that marketing budgets continued to fall last quarter, it is clear the industry is gradually making its way towards growth once again. As the retail and hospitality industries pick up business once again, we can expect this to continue in the months to come.

“We’re about to see a rapid shift in customer behaviour, making the implementation of accurate and agile data sources an absolute priority for achieving marketing success. It is not enough to rely on existing insights. Advertisers must ensure they are up to date on their audience’s current needs to make sure their strategies remain effective and efficient as we make the journey back to normality.”

Pablo Dopico, Head of Gaming & EMEA Agencies, VidMob

“Despite an overall decline in marketing budgets, some 14.2% of surveyed companies saw an increase in available ad spend, and forward looking data suggests that budgets could recover in the next financial year, giving brands a potential end in sight and something more to work towards. However, with the current industry shift towards data privacy, there are still challenges ahead and we’re on the verge of a tectonic shift in the handling of consumer signals that will soon echo across every platform.

“Marketers need to be gaining a better understanding now of how all the elements in the anatomy of an ad impact digital campaign performance and how to optimize them. This will become essential for the success of any digital marketing activation, and help justify budget allocation. Creative will soon become the most important driver of digital campaign performance. Those still relying mostly on delivery optimization algorithms and not paying enough attention to creative data will be in for a rough awakening going into the summer season and beyond.”

Ross Nicol, VP, EMEA, Zefr

“As the world inches towards normalcy, video has retained its position as the growth engine of the advertising ecosystem. Not only was video one of the least impacted formats in Q4 2020, recording just -3.5% reduction in ad spend, but in Q1 2021, it was the sole category to bounce back – where a net balance of +3.3% of firms recorded an increase in available spend compared to three months ago.

“Consumers are turning to video platforms as their preferred content destination of choice, with YouTube, Facebook and TikTok dominating consumer attention and audience growth. As more marketers shift their traditional media budgets to these platforms, it is imperative they ensure ads are placed adjacent to videos in brand suitable and responsible environments with transparency and context top of mind. As this contextual capability improves, the growth of video platforms is set to get stronger.”

Bill Swanson, EMEA Strategy Lead, IRIS.TV

“Consumption of video content across devices is rising rapidly, particularly within connected TV (CTV) environments. With 19.0% of survey participants reporting elevated digital video budgets, the first marked increase in the segment since Q1 2020, it is clear there is an associated growth in CTV opportunities available to advertisers.

“Yet, reservations around the transparency of the video ecosystem across CTV continues to hinder its adoption into marketers’ media mix. Streaming providers have found it nearly impossible to utilise video level data at scale for buyers to optimise programmatic ad investment and as a result this data is scattered and siloed. To ensure video ad spend carries on its strong growth trajectory, marketers must learn how to securely onboard video-level data and connect it with the programmatic advertising ecosystem, albeit in a neutral, privacy-first way.”

Zack Sullivan, UK CRO, Future

“Most businesses had to be reactive through the turmoil in 2020, but now is a pivotal time to shift focus to winning the battle for consumer spending, as both COVID-19 restrictions and budget cuts begin to ease. Our recent research into post-lockdown purchasing power found that Brits have amassed over £245 billion in savings since the pandemic began, 25% of which will be spent immediately or soon after lockdown ends. While holidays and trips to pubs and restaurants are top of the list (53% and 42% respectively), consumers will continue to spend on the items that saw popularity during lockdown, including home decoration (11%), garden products (10%), and personal and home technology (10% and 9% respectively).

“These findings highlight how the pandemic has caused a lasting shift in consumers’ wants and needs, meaning marketers must think carefully about how they connect with audiences if they wish to stay ahead of their competitors. Partnering with established media brands will be a vital strategy to achieving this; with a combination of high-intent audiences, quality content and customer loyalty, they provide a potential for ROI that should put them at the top of every marketers tick list in 2021.”

Faye Daffarn, Managing Director, UK, Tug

“The IPA’s latest Bellwether report is an accurate reflection of what we are seeing as an agency – cuts to UK marketing budgets have eased and consumers are longing for the unique interactive experiences to which they have become accustomed during lockdown. As restrictions lift, it’s clear that marketers must find innovative ways to link digital and physical experiences to bring added value to consumers.

While apps and AI technologies are great for online targeting, they also present the opportunity to build relationships with consumers that are out and about post-lockdown. Looking ahead, the winners will be the value-adding brands who can adapt to offer ‘phygtail’ experiences, utilising first-party data to connect both in-person and online experiences. This will become even more important with sun setting on third-party cookies this year.”

Lisa Menaldo, Co-Founder, The Advisory Collective

“It should not come as a surprise that brands have remained cautious in the first quarter of 2021; the ongoing pandemic, a nation in lockdown and the logistical tailwinds of Brexit continue to hinder marketer’s efforts. However, there is a strong sense of optimism and positivity for the forthcoming quarters, notably in Q3. The vaccine rollout combined with the easing of lockdown and the demand from consumers to return to a level of normality will further encourage confidence in media investment across the marketing categories.

“To win back the consumers who have adapted to an online environment, many businesses will need to make their media budgets work harder, particularly in sectors that were forced to close, namely retail, entertainment, and hospitality. By the same token, however, online environments will also need to invest heavily in retaining those newfound customers. While there are factors that could derail the anticipated growth, such as new strains of the virus or delays in vaccines across countries, there are certainly reasons to be cheerful for now.”

Filippo Gramigna, CEO, Audiencerate

“This report is a welcome indication that we are slowly returning to some stability. There is of course still room for recovery, and as the industry continues to evolve in the way it can use third party cookies and other identifiers, there is the potential of change for the better. By using the myriad of tools available to them, such as predictive audience modelling, identity resolution and analytics, marketers can source granular data to boost both effectiveness and efficiency in their advertising campaigns, ensuring they continue to move in the right direction.

“The ability to be flexible in advertising strategies will be paramount now for brands and marketers, not just ahead of the changes to cookies, but also as UK consumers get back to living their lives outside of lockdown. Consumer needs are changing fast and technology continues to evolve, so being agile and tuned in to your audience needs to be a top priority.”

Vikram Kulkarni, Head of EU Customer Success – Marketing Effectiveness, Nielsen

“It is encouraging to see the fall in marketing budgets soften for the third quarter in a row, indicating that despite the huge impact of the pandemic, the industry is on a consistent journey in the right direction. As we start to see the impact of the latest ease in lockdown restrictions driving increased consumer spend, we’re set for more positive results in the next few months.

“However, advertisers must not rest on their laurels. To secure their route to success post-pandemic, advertisers need to ensure their strategies address a rapidly changing and unpredictable set of consumer needs while also contributing to business growth. A focus on ROI is crucial to selecting the marketing tactics that are most likely to deliver on a brand’s unique goals, and effective campaign measurement will deliver the insights needed to achieve this. Real-time, trustworthy data should be at the top of every advertiser’s must-have list to not only understand how consumer behaviours shift but also how their campaigns are adapting to these changes to drive tangible business results.”

Nick Morley, EMEA Managing Director, Integral Ad Science (IAS)

“As the UK eases out of lockdown restrictions, and confidence increases, marketers will remain focused on ways to efficiently spend budgets and maximise ROI. By utilising granular data points, advertisers can understand performance, drive engagement, and achieve valuable business outcomes.

“Looking ahead, we can expect to see more marketers make investments in programmatic and contextual advertising. Using first-party data is not only more cost efficient and scalable than third-party audience tracking data, such as cookies, but will also address data privacy concerns. Those that make investments now will reap the long-term benefits, particularly when considering that the majority (70%) of UK consumers say that their perception of an online ad is impacted by the surrounding content on the page.”

Steve Carrod, Co-Founder & Managing Director, DMPG

“Perhaps a pertinent point to explore when looking at marketing budgets, is why would these increase or even go beyond pre-pandemic levels when there is so much room to improve with existing customers? The number one rule in sales is that it is infinitely easier to sell more to an existing customer than it is to acquire a new paying customer. As diversity of customer touch-points reduces – sighting more towards digital devices – and the level of control one can have over that experience increases, it stands to reason that brands can and should be putting much more focus on the entire experience, and not just driving an initial click, lead or sale.

“The pandemic has increased the focus on digital transformation dramatically, and the focus on customer experience, retention and reactivation has never been stronger; we are seeing this demand across most of our clients. In parallel there is an increasingly difficult landscape – when you consider ITP and GDPR concerns – for attributing marketing spend to true ROI. Over time we expect marketing budgets will continue to decline on non-digital channels, and while digital will continue to grow, it will be slower than expected, and budgets will shift towards improving end-to-end customer experience and retention. We see an average of 7.5% incremental revenue growth from our clients taking the customer experience centric approach. With such strong demonstrable results, it’s clear that it should be a future area of focus, rather than just pumping more cash into the top-of-funnel marketing acquisition approach. As all signs point to recovery, businesses must embrace digital transformation and focus on customer experience, retention and re-activation.”

David Barker, SVP of Global Commercial Partnerships at Samba TV

“With the latest IPA Bellwether Report indicating subdued ad spend in linear while video has moderately increased, these findings point to shifting priorities for advertising budgets. Brand advertisers are following the trends in consumer attention away from traditional channels such as linear TV, toward digital channels such as subscription-video-on-demand (SVOD).

“Within this broader shift from linear to digital viewing, audiences are spending their time across more services than ever before, from Disney+ and Amazon Prime Video to YouTube and Twitch. The findings show advertisers recognise the ability to resonate with audiences via these digital channels, but effective targeting relies on a comprehensive, and privacy-compliant understanding of audiences first and foremost. As consumers are increasingly spread across different platforms and channels, we’re likely to see advertisers invest more in learning about where their audiences are to ensure future online spending is as relevant and well-targeted as it can be.”

Rich Ashton, Managing Partner, FirstPartyCapital

“The global lockdown has accelerated the shift to digital in three main areas: streaming (video and audio), gaming, and ecommerce. This is providing advertisers with emerging channels through which they can reach their target audiences. Whilst we expect there to be a resurgence in offline purchasing and advertising as the world opens up, consumer habits under the ‘new normal’ will result in irreversible and transformational changes in the way advertisers communicate with their customers.

“A key piece that has been overlooked by many commentators is the shift from in-store marketing to online. Advertising within ecommerce platforms like Amazon, Instacart, Ebay, Zalando, etc. is exploding and will be the beneficiary of billions of pounds in ad spend as brands look to increase their conversion at the bottom of the funnel and drive more sales. We see this as one of the biggest opportunities in the next 5 years.”

Jenny Kirby, Managing Partner, GroupM

“Seen within the context of continued Covid-19 restrictions, there are some promising signs of confidence coming out of the latest IPA Bellwether ad spend findings. For example, the digital advertising category has remained stable since the last quarter, while video investment at +3.3% has seen its strongest improvement within the past year.

“It shouldn’t come as a shock that digital and video categories are strong performers. The pandemic acted as an accelerator for increasingly digital entertainment consumption habits. Higher investment in areas such as over-the-top video (OTT) reflect these behaviour changes, but also the attractiveness of advanced targeting capabilities, cross-device measurement and programmatic buying methods available with OTT inventory. The ability to better reach audiences, accurately measure the impact of creative, and ultimately achieve desired business outcomes mean digital channels such as OTT are well-placed to gain as the recovery gathers pace through 2021.”

Alison Harding, VP Data Solutions EMEA, Lotame

“Whilst budget plans for the year ahead point to a recovery, marketers will need to prove their hard-won spend is working. This will require a data strategy that enables them to understand, find, and accurately target and message their customers without using third-party cookies. Identity can solve this challenge but education is needed on how identity (probabilistic and deterministic) and non-identity (context, FLoC) solutions can work together. Importantly, marketers are clear that they need multiple identity solutions which are interoperable, so we can expect to see them seeking collaborations across the industry that will enable them to build up their data supply with other first-party data and high-quality third-party data.”

Virginie Dremeaux, Executive Director, Product and Sales Marketing International, FreeWheel

“It’s encouraging to see from the latest IPA Bellwether report’s figures that marketing budgets are beginning to stabilise with signs of growth in ad spend across all categories. Video stands out in particular, with spending at +3.3%, which is the first time it has been positive since early 2020.

“The strong performance of video is evidence that marketing spend is closely following the consumer trends towards online channels that accelerated throughout 2020. For the UK in particular, the vast majority of homes now have a TV connected to the internet, with the result being audiences spending increased time across both linear and digital channels. As confidence builds throughout 2021, we can expect brands to tap into these audiences through data-driven Connected TV inventory, which offers marketers extended reach to capture those diversified audiences within the premium, safe TV environment needed to build brands in the long term.”

Lucy Hinton, Head of Client Operations, Flashtalking

“The latest IPA Bellwether report indicates that we are reaching a key point for advertisers and brands to apply the lessons learned from the past 12 months. With ad spend predicted to increase by 3.5% during 2021, marketers will still want to make the best use of their budgets, with premium ad formats and data-driven creative front of mind, to provide the relevant ads that digital-savvy consumers have come to expect.

“Marketers will be looking at more engaging, visual formats to grab the attention of those consumers; it’s no coincidence that video ad spend is the first sector to return to growth. Meanwhile, for the ad tech industry hoping to make the most of this increased investment, there is the need for a reset. This will involve providing more transparent ways of reaching audiences that don’t solely rely third-party cookies as the industry prepares for the shift towards a cookieless future, and a willingness to tackle fraud and improve measurability to create the most efficient campaigns.

Mark Inskip, chief executive UK and Ireland of Kantar’s media division

“It’s been a tough year for businesses but there are spring shoots of hope coming through. While Covid-19 has hit some British households’ finances hard, others have managed to save during the pandemic and people will be looking forward to doing the things they love again as restrictions ease. Consumers with cash in their pockets will have choice of where to spend it and are likely to be more discerning. Understanding what they will prioritise first will be vital for brands to capture a slice of that spend and to hitting the right note with their advertising, making sure it cuts through.”

Phil Duffield, VP of UK at The Trade Desk

“After what has been a frankly tumultuous year for the industry, it is encouraging to see that cuts to marketing budgets are continuing to soften. All signs point towards a positive step change for the industry coming soon.

“To thrive going forwards, marketers need to remain agile in their approach, accounting for those aspects of life that may never go back to normal. CTV and digital OOH advertising in particular have massive potential for return on investment. As the majority of Brits gear up for a new hybrid work pattern, flexible, targeted advertising on digital display boards will come into its own. At the same time, the appetite for streaming content is going nowhere. It’s no surprise that video spend was the first to return to growth in Q1 and is perhaps the most promising channel for brands to reach highly engaged audiences through. Only by utilising smart, data-driven advertising with measurable ROI can marketers seize the opportunity to get back on the front foot as the advertising industry glimpses the light of a robust recovery at the end of the tunnel.”

Brian Kane, Chief Operating Officer at Sourcepoint

“While we’re not out of the woods yet, it is great to see an improvement in marketing spend. As the UK continues to ease lockdown restrictions and the population receive their vaccinations we should see a gradual increase in investment. However, as the impact of COVID-19 begins to wane, the evolving privacy regulations and restrictions from big tech giants are putting further pressure on the ecosystem to adopt a privacy-first frame of mind.

“As budgets start to return it will be necessary for advertisers to ensure they are complying to the latest privacy regulations, but also improving the customer experience and streamlining their approach to consent. As privacy regulations continue to emerge around the world, the role of data ethics will continue to grow, and marketers will look to future-proof their strategies by going beyond compliance. Looking ahead, I am optimistic about the future despite the upcoming challenges. Our industry is incredibly robust and capable of adapting to big changes. This new privacy landscape where persistent IDs and third-party cookies are no longer guaranteed will be a steep learning curve for all. However, if we collaborate and continue to invest in media and new technologies we can build a compliant and privacy-first tomorrow..

Karin Seymour, Client Strategy Director, News UK

“It’s hugely encouraging to see cuts to marketing budgets easing as we make our way through 2021. With less uncertainty expected in the macro environment, brands can begin to explore the consumer landscape as the economy opens up, so we expect to see a gradual improvement in ad spend throughout the year.

“One of the things that’s stood out during the pandemic is the public hunger for stories on how ordinary people have overcome adversity in these trying times. Whether it’s Captain Tom, our NHS and key worker heroes or local volunteer networks, it’s the human stories that have cut through and brought the country together. Brands should continue to share these stories and show what they are doing to support the country as we emerge from the pandemic. It is the human stories that connect with consumers who are looking for positive news in these difficult times. As coronavirus restrictions begin to lift, consumers will also be looking for excuses to spend. Brands need to be agile in order to flex strategy quickly and keep up with expanding demand, making sure their messaging is aligned with the current climate at all times. Brands should use the new environment to emotionally engage with their audience, on a human level.”

Justin Taylor, Managing Director UK, Teads

“The IPA Bellwether report reflects the cautious optimism that we have all felt this week. The fact that the first stage of the government’s plans has stuck to timings has buoyed the mood of the public, and we’ve seen hairdressers, retailers and hospitality venues all benefiting from that footfall. We’re confident that trend will continue.

“However, this confidence in ad spend is also due to the fact that businesses are now better prepared than ever for lockdown scenarios. So if the rest of the government rollout is delayed, e-commerce, home delivery and virtual events will continue to grow and thrive. Brands have found new forms of creativity, engagement and planning to drive growth – whatever the scenario – so it makes sense that media spend is looking bright. It’s also great to see online budgets stabilising, with video returning to growth, showcasing its unfailing ability to drive consumer sentiment through medium to long term branding.“

Silke Zetzsche, Head of Commercial Partnerships, A Million Ads

“Despite budgets still falling, the report from Q1 shows a positive outlook on the year ahead as we see marketing budgets begin to recover. We are now seeing brands starting to move away from traditional ways of buying, planning and creating media and embrace a more strategic, dynamic approach. The Start-Stop-Change of the last year has really made the need for agility evident and every meeting I’m now in with clients, personalisation is being mentioned. Indeed, the combination of creativity and agility can give brands a positive outlook over the coming months as the advertising industry is recovering.

“As we gradually emerge from restrictions, the rules are in a constant state of flux. Moving forward, brands need to seize this opportunity to be as creative and savvy as possible, conveying to their audiences the most up to date information whilst continuing to connect with them on a personal level. By taking advantage of dynamic audio, brands will be able to react to the different stages of restrictions at a global, regional and local level and adapt their messaging accordingly. For instance, messaging on opening times or deliveries can be edited in real time, without having to rework the creative from scratch; saving money and connecting with consumers in one fell swoop. As Mark Read, WPP CEO, has said: we need to focus more on the creative message and experience.”

Greg Isbister, Founder and CEO at Blis

“As the UK starts to make a move to normality it’s positive to see that marketing budgets are slowing in their decline and client confidence is returning. While current restrictions have weighed heavy on some industries such as travel, retail and beauty, as they reopen investment in marketing budgets will most likely see a boost to meet pent up consumer demand. In fact, ‘COVID- proof’ industries are already seeing a return in buying confidence and, as we move further into 2021, consumer engagement is likely to increase as they look forward to a summer of freedom.

“Simultaneously however, our industry is at a major inflection point, as we pivot away from targeting based on IDs and personal data. In fact, our recent client survey revealed that 78% of senior marketers are concerned or very concerned by the loss of third party cookies, whilst 61% felt the same about the disappearance of IDFAs. As a result when brands begin to replenish their marketing budgets it is vital they work with partners that can find new ways to drive key business outcomes through personalised and high-performing digital advertising. Indeed at Blis, we have been investing heavily in technology to reinvent location-powered advertising for a privacy-first world.”

Tim Geenen, Managing Director, Addressability Europe, LiveRamp

“The stabilisation of marketing and ad spend this quarter points positively towards 2021 being earmarked as a year of expansion as industries reopen following the lockdown. However, it’s important to remember that it’s not only the pandemic that has impacted the industry in recent times; new privacy regulations continue to be implemented globally, the countdown to cookieless ticks on and Apple’s ATT’s framework is scheduled to materialise imminently.

“As a result, many marketers have migrated their strategies towards a more sustainable set of technologies. It’s no secret that third-party cookies are an imperfect solution, and marketers have used this period of upheaval to embrace the opportunity to transform the way they approach digital advertising once and for all. Sustainable solutions emphasize building first-party relationships with consumers—an ecosystem whereby consumers authenticate in exchange for trusted and valued engagements.. Ultimately, marketers want to reach consumers based on authenticated identity attributes — supplied actively and with permission — which enables greater addressable reach, improved measurement, and better ROI.”

Claire Burgess, Director of Paid Media at Incubeta

“As the UK prepares to return to normal it’s incredibly positive to see that marketing budgets are slowing in decline. At Incubeta we’ve already seen a high percentage of budgets return to normal across several industries as they prepare for the end of lockdown. While some sectors may take a little longer to return to normal due to the heavy impact of Covid-19 such as Travel, Automotive and Beauty, we will hopefully start to see an incline in budgets as consumer confidence returns and restrictions are lifted.

“It is encouraging that marketers expect budgets to bounce back in 2021/2022, and that we are already seeing increased client confidence with increases in spend. However, as the world slowly returns to normal, the digital acceleration and innovation that has taken place over this past year will not be discarded. Instead the investment in digital agility and adaptability will continue to work in parallel as the offline community returns. It will be important for advertisers to remain engaging and relevant while delivering brand messaging to its consumers. Now, there will be more competition from both online and offline, as restrictions ease continued investment in digital innovation and a data-driven, multi-channel attribution strategy will be crucial to grab customers’ attention.”

Alexander Gosswein, VP Key Accounts, EMEA at Criteo

“After a tumultuous year in advertising, it’s encouraging to see optimism within in the industry. The pandemic caused havoc on marketing budgets, but with a greater reliance on digital, brands are finding new and creative ways to reach their audiences.

“Today, the world is starting to look more like it did prior to the outbreak, but consumers aren’t going back to their old shopping habits overnight. It’s therefore vital that brands devise an online strategy which compliments offline channels; to satisfy customers at every touchpoint and achieve a balanced customer experience. However, going into Q2 and Q3, brands will also have to stand out in a saturated online marketplace and hit that sweet spot where offline and online converge, for one channel cannot thrive without the other. This can be achieved through connecting with consumers by targeting them at all touchpoints; allowing them to discover, evaluate, engage and ultimately buy into a product or service. Secondly, an agile approach is needed, for too long has the ad industry rested on its laurels, producing the same batch and blast tactics that are unlikely to connect with consumers in a meaningful way. With Covid-19 causing a seismic shift in the industry, it caught many out, leading to 9 out of 10 marketers across all verticals stating they had made changes to their strategy due to the pandemic – agility and innovation is now the norm, not a nice to have.

“As we see the beginnings of an economic rebound in the UK, marketers need to get ahead of the new digital advertising landscape. This especially rings true as we move into a post-cookie era, where targeted advertising will have to be more granular and accurate to consumers’ ever-changing habits. Looking forward, Above the Line (ATL) advertising will continue to take a back seat even as we emerge into a post-Covid-19 world. For brands to generate the highest ROI, targeted advertising is the way forward and a failure to capitalise on this technology may result in short-comings.”

Marc Brodherson, Partner at McKinsey & Company

“While some companies are cutting budgets and retrenching, we’re seeing others reduce spend in unproductive areas and reallocate those savings for growth. It’s a shift of 10 to 20 percent of the overall budget into data-driven growth programs. This refocus is very much needed to stay ahead of the competition. Between March and August 2020, one in five consumers switched brands, and seven in ten tried new digital shopping channels. We expect these changes will shape consumers’ habits even beyond the effects of COVID-19. This has left marketing departments with no option but to consider agile marketing practices.”

Leigh Gammons, EMEA CEO of Wunderman Thompson Technology

“It’s fantastic to see some cautious optimism reflected as marketers will be looking to hit ambitious targets for the coming financial year. To make up for revenue missed in the past 12-18 months it’s imperative that brands prioritise investment in marketing as life begins to open up. Even the last few days have shown that many consumers have money that they want to spend and brands need to ensure they are top of mind.

“But even as physical stores open, brands are continuing to harness the power of online to capture the attention of customers wherever they are located. There will be a spotlight on seamless digital experiences across all channels, including physical stores, as consumers take the relationship that they have built with brands in the last year back to the high street. We therefore expect investment in apps, online and the digital experience to increase as we move through 2021. Ultimately, businesses who invest to ensure the customer experience is personalised, consistent and seamless, will put themselves in the best position for growth.”

Shumel Lais, Founder & CEO, Appsumer

“As cuts to marketing budgets ease in the first quarter of 2021, it is welcoming to see that online spending budgets have stabilised and video ad spend has returned to growth. However, if you were to look at mobile as a standalone channel, we’d expect to see a completely different trend. According to Statista, consumers were spending 132 minutes daily on smartphones in 2019 compared to a projected 155 minutes this year. Indeed our own mobile advertising benchmark report found that mobile ad spend actually recovered in Q3 2020 with overall spend increasing quarter on quarter by 53% with both gaming and non-gaming advertisers growing.

“Ultimately, ad spend follows consumer behaviour and we’ve already seen an increase in usage of mobile services such as D2C subscriptions, delivery services, exercise apps and gaming. It’s unlikely we should expect consumer habits to return to pre-Covid normality and as such we shouldn’t expect the advertising mix to either. That said, what’s going to be interesting is seeing how the industry reacts to the impending rollout of iOS14.5 and Apple’s App Tracking Transparency (ATT) framework. We predict this will likely drive shifts in the media mix of mobile app advertisers and our last snapshot of the Share of Wallet for mobile app advertisers found that Facebook likely has the most to lose from iOS 14.5. In the early days of ATT, app advertisers are likely to tread with caution and budgets could shift to Apple Search Ads and Android devices in the short-term for the security of known outcomes. To succeed in the coming months app advertisers will need to work with trusted partners that can compare, combine and enrich different data sources to get a complete performance view to then ensure campaigns are optimised accordingly.”