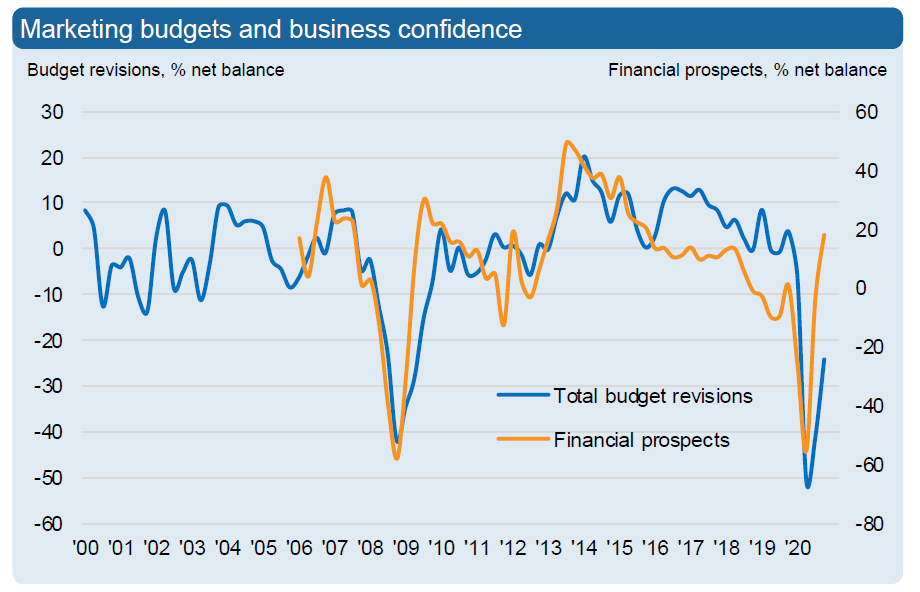

Marketers have enjoyed a confidence boost with a net balance of 18.1% more confident about the financial prospects of their company than three months ago, according to the latest IPA Bellwether report.

Leading IPA director general Paul Bainsfair to postulate that adland “can dare to ready ourselves for the roaring twenties after all”.

Optimism for a recovery in marketing budgets in the 2021/2022 financial year is growing despite a continued fall in spend during the fourth quarter of 2020.

The latest IPA Bellwether data finds the worsening pandemic and Brexit reality took a toll on marketing budgets during the fourth quarter, but optimism is growing that the sector will bounce back.

The last time the figure was higher than that was at the end of 2015, before the Brexit referendum kicked off a period of instability in the UK.

In six of the last seven quarters the net balance was negative – and in Q2 2020, hit an 11-year low of -55.1%.

Pressure from the coronavirus pandemic, combined with the end of the Brexit transition period, saw total UK marketing budgets decline markedly in the fourth quarter. A net balance of -24% of Bellwether panel members noted a contraction in marketing budgets over the period. Just 16.4% of companies reported an increase in available funds, while 40.4% saw a decline.

Although marked, the reduction was considerably less severe than those seen in the second (-50.7%) and third (-41%) quarters of 2020. In fact, the budget cuts were at their softest level since before the escalation of the pandemic in spring last year.

Covid-19 and its impact were, however, cited as the main reasons for budget cuts. The IPA Bellwether survey found anecdotal evidence of widespread cost-cutting as businesses adapted to new market conditions and restrictions.

Budgets for event marketing experienced the harshest cuts, with a net balance of -62.9% of companies experiencing decreased funds in the fourth quarter. Events had already been hit by a balance of -64.1% during the previous quarter.

A quarter of respondents reported a fall in spend on market research, compared to a balance of -32.6% during the third quarter. Spend on main media advertising fell by a net balance of -21.8%, with declines also seen in spend on direct marketing (-13.9%) and public relations (-8.5%).

Out of home budgets hit hardest

Within main media advertising, changing consumer behaviour hit out-of-home budgets hardest. It remained the worst-performing category in terms of spend during the fourth quarter at -36.7% (from -50% the previous quarter). The data shows spend was also down on video (-13.5%) and audio (-21.6%).

The only category within ‘main media’ to record a positive net balance was ‘other online,’ which was up by 0.7% (from -6.5% in the third quarter).

IPA director general, Paul Bainsfair, was not surprised to see UK marketing budgets remain in negative territory during the fourth quarter: “We are still in the grip of the pandemic and the impact of Brexit is uncertain, with some marketers citing concerns regarding the potential for tariffs, and increased paperwork, delays and costs.”

The confidence is not broadly spread. In main media advertising, a net balance of 4.6% of firms anticipate higher ad spend in 2021/2022, while 3.3% expect an increase in spend on direct marketing and 3.2% on PR.

Forecasts for events marketing are most subdued, expected to be down 30.9%, followed by market research (-4.7%) and sales promotions (-3.7%).

Bainsfair admits that while the situation remains bleak for now, the report reveals “significant promise” of green shoots ahead.

“Budget plans for 2021/2022 are into positive territory. As the vaccination roll-out continues, as the lockdowns begin to ease and as firms adapt to post-Brexit rules, perhaps we can dare to ready ourselves for the roaring twenties after all,” he suggests.

“Those brands that have withstood the storm, kept their voices heard and their subsequent market share up, will be the ones consumers turn to first in the good times.”

Eliot Kerr, economist at IHS Markit and author of the Bellwether Report, agrees that although advertising budgets continued to fall sharply at the end of 2020, it was promising that the rate of decline softened following the unprecedented contraction seen during the second quarter.

“Firms are now looking forward to a recovery in domestic economic conditions, which will likely begin in the second half of 2021 as the UK’s coronavirus vaccination programme starts to take effect. As such, businesses are now forecasting an increase in total marketing budgets for 2021/2022, although growth will likely be limited to certain areas,” Kerr adds.

“Given the current Covid-19 restrictions in the UK that could last for several more months, it is unlikely that categories such as events spending will start to grow. The recovery in those areas is more likely to begin in 2022, when we hope that the current economic climate is nothing more than a distant memory.”

Opportunities

Panellists were asked to comment on the main opportunities for their industries over the coming 12 months. A selection of responses are summarised below:

“Possible for a switch to UK manufacturers post-Brexit.” FMCG

“Opportunity to retain recently acquired online customers.” Retail

“There has been a sharp increase in hybrid working.” IT/Computing

“Potential for better opportunities in markets outside the EU.” Automotives

“Vaccine rollouts should improve overall demand conditions.” FinancialServices

“We have a chance to build on the competitive advantage that we have gained during lockdowns.” Consumer Durables

“Greater chance to sell renewable energy products.” Industrials/

Utilities“Government policies should remain accommodative while the economy recovers from COVID-19.” Public/Charities

“The UK property market may continue to outperform expectations.” Other Services

“We are expecting a sharp rise in travel after Easter.” Travel/ Entertainment“Opportunities for increased digitalisation in the new work-from-home era.” Media/Marketing

“We foresee more opportunities arising in healthcare and pharmaceuticals because of the pandemic.” Industrials/Utilities

Threats

Panellists were also asked to comment on the main threats to their industries over the coming 12 months. A selection of responses are summarised below:

“We foresee significant supply chain disruption following Brexit.” FMCG

“Departure from the EU will likely increase shipping costs both in and out of the UK.” Retail

“Overestimation of the power of AI would set us back.” IT/Computers

“We need consumer confidence to improve drastically from current levels.” Automotives

“The threat of negative interest rates remains a concern.” Financial Services

“Competition continues to grow in China and South Korea.” Consumer Durables

“Unfavourable government policy would be detrimental to us.” Industrials/Utilities

“Prolonged COVID-19 travel restrictions are a major threat.” Travel/ Entertainment

“Regulatory change associated with Brexit.” Public/Charities

“Continued downward pressure on prices as client budgets are reduced.” Media/Marketing

“Brexit could cause import and export delays.” Other Services

“Delays in the rollout of vaccines.” Consumer Durables

“A slow recovery in demand for industrial goods.” Industrials/Utilities

“Further mutations of COVID-19 could worsen the situation.” Travel/Entertainment

Industry comment

Mark Inskip, CEO UK & Ireland, Kantar (Media Division), commented: “The vaccine rollout certainly gives hope for the future and that’s reflected in the slight fall in the rate of marketing cost cutting in this latest IPA Bellwether report. But business leaders are still keeping their budgets under close scrutiny as the pandemic continues to shape – and inhibit – our daily lives and uncertainty remains around the long-term effects of Brexit. Now, more than ever, advertising and marketing teams will need a strong pitch with a laser-like focus on the consumer to convince budget holders that they can deploy investment smartly and help deliver commercial returns.

“It’s critical for marketeers and their partners to show they really understand what makes people tick at the moment – their motivations, their fears and their hopes – and can predict future trends, including what patterns of behaviour will stick long after the lockdowns ease and what new ones will emerge. Slashing marketing budgets can seem like an easy solution for a business under pressure, but it is often a false economy. Brands that remain visible, accessible and relevant will be front of mind when consumers reach for their wallets as the economic recovery picks up in the next financial year.”

Michele Arnese, Global CEO and founder, amp, said: “The 2020 decline in UK marketing budgets is not a surprise as we’ve seen other media markets around the globe impacted similarly by COVID-19. Even with a more positive outlook on the horizon, some verticals such as, OOH and promotions/sales are still bearing the brunt of marketing’s declining spend, through lockdown. As some traditional channels have simply ceased to be in lockdown, with in-store marketing another notable example, marketers need to consider new ways to engage with consumers and adapting their customer experience. We believe sound and voice can play a major role in 2021. Many consumers have indicated that they are looking for touchless or digital ways to engage with brands post COVID. So, making your brand more recognizable across digital streaming content or across touchless voice and mobile interactions will be key. A holistic sonic strategy that considers all of these touchpoints and makes the brand heard in an authentic, immersive, and contextually relevant manner can be a real differentiator. That’s the sound of salience!”

James Patterson, VP Client Services Europe, The Trade Desk:, said: “The continued decline in marketing budgets demonstrates the seismic impact the pandemic has had on our industry. Today’s report shows that the vast majority of marketers have had to do more with less, while adapting to changing consumer behaviours. This has forced marketers to be more agile, more deliberate – which means even more digital. We saw the same pattern after the 2008/2009 recession, with the key difference being that digital is set to lead the recovery this year instead of just supplementing it.

As marketers seek to claw back and grow their budget pots over the coming months, the ability to measure, compare and prove ROI will be key. More than ever before, advertisers will scrutinise every buying decision to ensure it’s driving tangible business outcomes. This will mean industry partners are held to higher standards of transparency and objectivity – elevating standards and leading to a healthier, more effective advertising ecosystem.”

Leigh Gammons, EMEA CEO of Wunderman Thompson Technology: “It’s unsurprising, given the ongoing disruption and lockdown restrictions implemented as a result of the pandemic, that overall marketing budgets continue to be under pressure. However, we are buoyed by the fact that online spend increased in Q4 as brands continue to try and catch the eye of consumers at home.

“In fact, our recent ‘Experiences Customers Want’ research found that 74% of businesses have accelerated their investment in online experiences as a result of the pandemic, with 76% claiming their online offerings saved their business. These figures, along with the IPA’s findings, show that marketers continue to have faith in online as a key channel, and that they are pivoting their strategies to adapt to evolving customer behaviour.

“With more and more consumers turning to digital to manage and live their lives, marketers need to ensure they’re investing in the right technology to allow them to deliver seamless online experiences to customers in order to hone a competitive edge. Those brands that prioritise leveraging the right tools and back end processes, to put customers at the heart of their brand experience, will ultimately be in the strongest position to drive growth in 2021.”

Matt Andrew, UK MD of Ekimetrics,said: “It will not come as a surprise to marketers to see that marketing budgets have decreased across the board in the past year. The impact of Covid-19 has been felt by consumers and businesses alike. However, with the promising outlook for marketing budgets in 2021 and into 2022, marketers have a real opportunity to re-evaluate their budgets and strategies so that they can come back stronger. Now is the time to consider the impact that data can have for businesses. From gaining live consumer behaviour insight to macro trends, advanced data analytics can allow businesses to be smarter and see greater ROI from optimising marketing spend to defining price promotions.

“Last year has taught brands to be more agile and to adapt to rapidly changing circumstances. This is a lesson that should not be forgotten. Advanced analysis of data can set businesses up to take advantage of opportunities or respond to important market, category or consumer behaviours as they arise. Embedding a flexible planning approach from the outset that is driven by data allows for rapid but considered responsiveness. For example, there have been many opportunities for brands to steer and maintain their share of voice across channels throughout 2020, particularly as costs within the media market have fluctuated. This has meant that there have been greater opportunities on channels such as TV that have increased viewership, particularly during the daytime, at a lower-than-usual cost, as well as diverting budgets to centre on digital ads rather than OOH. In the year ahead, we’ll be supporting our clients to help them optimise their marketing budgets, to gain the best returns both for the short- and long-term.”

Kirsty Giordani, Executive Director, International Advertising Association (IAA), UK , said: “There’s no doubt marketers in the UK have had a turbulent year. As the latest report highlights, this was further impacted by Brexit uncertainty in Q4 2020; when the Brexit vote result was first announced more than a fifth of UK agencies reported immediate losses in business. With the end of the transition period in December 2020 coinciding with the ongoing impacts of the pandemic, it’s not surprising marketers were continuing to err heavily on the side of caution with ad spend; many had no other option but to do so. However, with the final agreement in place, and provisions outlined to promote trade cooperation in digital services, including emerging technologies, UK agencies specialising in this sector of the ad industry should have some more clarity. Compounded with the vaccine rollout, this could be a time for tentative planning for recovery.

“The UK industry has always been innovative, and while it is still operating under difficult circumstances, there are some signs of predicted growth, with more expected to come over 2021 and in following years. As an industry we need to continue providing support and practical solutions to all who are part of it; this includes an emphasis on retaining and developing the young talent here who will help grow future success.”

Faye Daffarn, Managing Director, UK, Tug, said: “The IPA’s latest Bellwether report is an accurate reflection of what we are seeing as an agency. Businesses are being forced to prioritise agility and efficiency above all else, cutting marketing budgets and fluidly moving what is left between the best-performing channels. However, there are industries that appear to be bucking the trend – for example, software clients, who we are seeing actually increase budgets and invest fairly heavily in media. In particular, using programmatic and search marketing as an accessible and cost-effective way to take control of their brand during these difficult times. As 2021 unfolds, we hope to see more industries increase their use of digital advertising and think outside the box to bring added value to customers.”

Pablo Dopico, Head of Brand & Agencies EMEA – VidMob, said: “The Q4 2020 report has highlighted again how the impacts of the ongoing pandemic are still damaging marketing budget recovery in many areas, particularly when compared to some of the predictions seen in the Q2 report. What the report does show promisingly enough, is the willingness for brands to get back to spending; or at least start planning for this. From brands forecasting their own uptick in ad spending, particularly in the areas of digital video, to panel members predicting a rise in budgets, and even the improved sentiment in own-company financial prospects, all signs point to a recovery. The exciting prospect is that while we don’t know exactly what the landscape will look like, it will be different, and there will be innovation behind this. 2020 brought rapid ecommerce growth and brands have learned to flex new muscles to survive, and for many, to thrive.

“The pandemic has underscored the need for performance-driving creative solutions that are backed by technology to allow for maximum flexibility and efficiency. With the deprecation of 3rd party cookies and IDFA, marketers will experience major signal loss which puts added pressure on creative to deliver results. 2021 will be the year of creative intelligence and optimization. We are still hopeful for a ‘summer of love’ in 2021 as some brands rebound from the Covid slump with creative ad campaigns featuring shows of exuberance, but it seems we may have to wait until 2022 for marketing budgets to be back on a truly high note.”

Pierce Cook-Anderson, Country Manager Northern Europe Smart AdServer, said: “The UK looks to be heading into a secondary recession; Government debt is at its highest since the 1960s and there is tacit understanding that taxes will have to rise to offset the debt. We have therefore seen ad spend come in more cautiously in January 2021, with some advertising budgets still paused or on hold until further notice. The lack of clarity surrounding an end to the nation-wide lockdown affects consumer confidence and advertising commitments, but there are still a number of different verticals experiencing growth as we lean into the ‘stay at home’ revolution – most notably, Gaming, Video, CTV/OTT and Chat/Communications apps.

“Overall, the companies that have shown great gains in 2020 are those exposed to digital technology and online services – as such, we have seen a number of ad tech IPOs with some surprisingly high valuations as investors try to capitalise on the rapid pivot to a digitally-led world. It will be interesting to see how this plays out for our sector in 2021. Ultimately, if we look at the year ahead within the context of 2020, I expect we may see a similar level of caution in Q1 and Q2, followed by optimism in the summer months, and then a rush to spend marketing budgets in Q4.”

Katarzyna Bargielska, CMO & Co-Founder, AdTonos, said: “While reductions in ad spend might be ongoing across the board, they are increasingly less steep and there are welcoming signs that a return to growth is on the horizon. Audio in particular has seen the pace of budget reduction slow significantly, now down from -32% in Q3 to -21.6% for Q4. This is testament to the ability of audio to continue to sustain strong advertising interest – encouraged by recent spikes in digital listening across live streams, podcasts and smart speakers – despite the current challenges.

“As marketing focus stays fixed on maximising reach and returns, we can only expect the appeal of audio to rise, accelerated by a larger stay at home economy and audio’s capacity to build emotional connections with the listener. In tandem, programmatic capabilities are making it possible for cross-channel audio campaigns to be targeted with ever-sharper precision and measured at an equally granular level. It’s no coincidence that the preliminary estimates for investment in 2021/2022 are at their highest for the Main Media Advertising category, which includes audio and video. Moreover, brands want to know that their valuable budgets are securing optimal exposure for increasingly fractured and elusive audiences and the best chance of positive response; that’s exactly what today’s diverse audio landscape offers.”

Jenny Kirby, Managing Partner, GroupM, said: “The continued Covid-19 restrictions in the UK clearly weighed heavily on overall ad spending in the final quarter of 2020, which would traditionally be a bumper period for the industry. However, within the bigger picture of restricted spending, it’s important to note that general digital advertising grew by 0.7% in Q4 2020, compared to -6.5% in Q3 2020, which stands in stark contrast to the overall trend.

“This ad spend anomaly reinforces much of what I’ve found in working with brand clients and something our own research has supported: ad spend is increasingly moving online. In fact, 2020 was the first year digital accounted for over half of all ad spend. This indicates that despite the continued uncertainty at the end of 2020, marketers have increasingly identified digital channels as effective ways to reach and resonate with audiences, accurately measure the impact of creative, and achieve the desired business outcomes for their brands. As we move through 2021, and overall ad spend recovers, it will be important for media agencies to offer suitable solutions to match, if demand for digital continues to outpace other channels.”

Rachel Powney, VP of Marketing, Dugout, said: “Although the overall ad spend figures suggest the industry is not out of the woods, the performance of digital advertising (+0.7% in Q4 2020) is a promising sign and an indication of the way the sector is moving. The shift to digital channels looks set to last in the longer term, with a continued reliance on online services and content reflecting the varying rates of recovery from the global pandemic. Aside from this, the convenient and accessible nature of digital content means it’s an area that will attract more time spent regardless of Covid-19 policies. As a result, brands will be considering how best to boost their digital advertising – particularly through the most engaging medium of all: video. AIA is one brand that’s been building up its online presence beyond social channels on premium publisher websites through video already, for example, with a campaign to encourage healthier living featuring footballers such as Harry Kane and Dele Alli.

“As we head into 2021 and consumers continue to adopt digital channels in more areas of their lives, and spend more time on them, we can expect brands to invest increasing amounts in these areas to effectively retain relationships with their audiences.”

Virginie Dremeaux, Executive Director, Product and Sales Marketing International, FreeWheel, said: “The latest IPA Bellwether Report offers a more positive outlook for ad spend in 2021 for the main media channels, with initial estimates showing budgets heading in the right direction. There will certainly be more opportunities this year when it comes to advanced TV advertising, thanks to the growth of viewership on CTV platforms, and new developments in addressable TV across the UK and EMEA.

“Our own recent survey, conducted in collaboration with independent research firm CoLab across a pool of media agencies and advertisers in Europe, shows that marketers are increasingly looking at how CTV inventory can be used to meet their high priority objectives for 2021; in particular, 65% are focused on customer acquisition and 61% on revenue growth. And yet, there’s increased understanding of the need to balance upper funnel with lower funnel objectives, with 60% of marketers ranking increasing customer loyalty as a priority.

“With this in mind, we will see a more balanced approach from marketers who will lean on CTV as a channel that can offer both extended reach – capturing those audiences increasingly spread across different digital platforms and connected devices – and the premium, safe environment needed to drive sales and build brands.”

Joe Martin, Product Marketing Team Lead, Scoro, said: “The continuing squeeze on ad budgets in Q4 will be hard reading for media agencies that had to cut costs for most of 2020. And, as Covid-19 restrictions are set to continue until the end of Q1 2021, this pressure is not likely to lift anytime soon. As a result, these findings should focus agency leaders on improving efficiency while resources are limited.”

“To do this, robust business management systems that enable teams to focus on billable activities will be key. Agencies that don’t already do so will have to improve data collection and real-time monitoring so they can quickly reallocate resources where they are needed most. Efficiencies can also be found from the unproductive practices that many agencies adopted in March 2020 to cope with remote working; specifically relying on too many tech tools and communications apps. The multiple platforms agencies now rely on means data is spread across silos, making it difficult and time-consuming for employees to find and interpret. The Q4 ad spend figures should be seen as a sign that some early spring cleaning is needed to remove surplus technologies and streamline processes.”

Phil Acton, Country Manager, UK & BeNeFrance, Adform, said: “Businesses did a good job of adapting to evolving market conditions last year, as shown by findings that budget declines consistently fell with each quarter. It’s positive to see this has given companies greater confidence and driven them to re-prioritise advertising — with 12% predicting spending increases that will accelerate marketing recovery across 2021/22.

“The coming months will bring a mixed hangover from 2020. Brexit and COVID-19 will remain considerations, but there will be opportunities to capitalise on media consumption trends that emerged during lockdown periods. The most successful marketers will therefore be those who double down on cross-device strategies, focusing particularly on channels that have experienced the most growth; including CTV, audio and video.

“In the longer term, we can also expect other familiar themes to remain a priority. Transparency will retain its top billing as more brands and agencies turn their attention towards supply path optimisation (SPO) and making maximum use of reduced ad budgets. The fast-running countdown to third-party cookie deprecation will keep marketers focused on reviewing available options, from new ID partners to contextual targeting alternatives, while big tech forces such as Google will continue to fall under close scrutiny, which may end up with some parts of their business being spun off or sold.”

Chris Hogg, Managing Director EMEA at Lotame, said: It’s not surprising that spending remains depressed considering the present economic and health environment. Couple this with the enormous changes in digital advertising driven by the sunsetting on the third-party cookie – as well as its impact on brand marketing tools such as frequency capping, optimisation, and measurement – and UK advertisers have more unknowns on their plates than ever. As a result, marketers may be pulling back preemptively as a “wait and see” approach to the digital ad changes yet to come.

“Whilst it’s promising to see spend forecasted to improve from Q2, there will be opportunities for those marketers that have been keeping their ad lights on to retain and further nurture the new customers they have attracted. As restrictions ease and vaccinations are rolled out, consumers who have been pent up over the last year will be out and ready to spend. It seems like a waste to hold back until that moment to get top of mind with them rather than taking advantage of all the available downtime they have now to entertain or educate them on your products or services so that they’re then primed to buy.”

Vikram Kulkarni, Head of EU Customer Success – Marketing Effectiveness at Nielsen, said: “While the pandemic is continuing to have a significant impact on advertising budgets, it’s encouraging to see signs of positivity beginning to appear. As own-company confidence grows and the introduction of the vaccine helps push the country towards restrictions being lifted, we can expect to see this positivity grow as the year continues.

“As we all plan for the year ahead, agility will be key. If 2020 taught us anything it’s that the world we live in can change fast, and consumer behaviours will follow just as quickly. The accurate real-time measurement of campaign success is crucial to help marketers move quickly, while maintaining the quality and effectiveness of their strategies.”

Nick Morley, EMEA Managing Director, Integral Ad Science (IAS), said: “With recovery forecast in the latest IPA Bellwether report, it’s important to acknowledge that there are still opportunities for marketers to capitalise on media consumption and e-commerce trends that emerged over global lockdown periods. As roughly two-thirds (65%) of UK consumers have a more favourable opinion of brands that serve them contextually relevant ads, marketers will need to review audience targeting strategies in the new cookieless world. Employing contextual technology will be the differentiating factor for marketers in 2021.

“Marketers should not only be aware of increased media and e-commerce consumption, but also audience migration across platforms. The newly launched Open Measurement for Web Video SDK from the IAB Tech Lab will be a useful tool for marketers looking to understand the performance of their video advertising in all web placements. This update will help marketers to understand performance across platforms, as it provides access to a single standard across web and mobile apps that is trusted, transparent, and secure.”

Calum Smeaton, CEO, TVSquared, said: “The latest IPA Bellwether report further highlights the huge change the advertising industry experienced in 2020. TV advertising, in particular, was already experiencing a massive evolution pre-pandemic, as it moved away from legacy measurement and toward impressions and outcomes. As TV consumption rose – especially across streaming platforms – the shift to “measuring TV how people watch it” was established faster than anyone could have predicted.

“Viewers will continue to watch TV across time, channels and screens, making real-time, cross-platform TV measurement integral to ad success. In 2021, we’ll see a focus on scale, flexibility, and transparency as we set new standards for TV advertising. By empowering marketers with the analytics needed to maximise campaign reach and frequency, reach extension and performance, brands will not only survive but thrive in this new age of cross-platform TV.”

Filippo Gramigna, Strategic Advisor, Audiencerate, said: “While this report poses no real surprises, what we can glean from the data is that the rate of recovery is slow, and brands need to remain agile and reactive to avoid getting caught up in the turning tides. On the whole industry budgets are still suffering, but it has been encouraging to see some slight upward trends as marketing budgets aim to recover and with the successful roll out of vaccinations, businesses should prepare for times of steadier growth over 2021.

“While marketing budgets haven’t returned to normal just yet, this is still a pivotal time period and pausing brand campaigns should not be an option, especially as many have more time to engage with brands right now. To gain a competitive advantage and be in a strong position for when market conditions stabilise, marketers should see this time as an opportunity to experiment with new technologies and digital strategies to support customer acquisition and brand loyalty. Therefore, data solutions that can support these priorities are a must-have this year and beyond. By adopting predictive audience modelling and analytics, brands will be able to forge a stronger understanding of their audiences to create highly targeted, effective ad campaigns to capture consumer engagement and stand out from the competition in a crowded marketplace.”

Andy Ashley, International Marketing Director, Digital Element, said: “While it’s easy to be disheartened by another quarter of declining ad budgets, it’s important marketers continue to look ahead and set themselves up to have the greatest chance of success in 2021. As the rate of budget reductions eases and sentiment around own-company prospects turns positive, the industry can start to prepare for the next phase of recovery.

“It’s important businesses are ready to adapt. Consumer behaviours are likely to shift once again as Covid restrictions ease, creating another ‘new normal’. As such, flexibility is vital and ensuring the data used to understand audiences is as up to date as possible will be crucial to building effective marketing strategies. Additionally, businesses must continue to streamline the tools they use. By choosing solutions that can address multiple challenges, companies can both improve efficiency and free up budgets to spend on the crucial activities that can drive engagement, and boost performance and revenues.”

Zack Sullivan, Chief Revenue Officer, Future Plc, said: “With the country in lockdown, it comes as no shock that marketing budgets are still on the decline; however, preliminary adspend forecasts for 2021 and 2022 show there may be a light at the end of the tunnel.

“So, with budgets set to bounce back, marketers can begin to develop forward-looking strategies. However, it is vital they realise that consumer engagement has changed for good with people finding new ways to do research and make buying decisions on their path to purchase. The battle for consumer spend will intensify, so marketers must look to diversify their strategies if they are to build and maintain valuable connections with their audience – and stay ahead of their competitors. With a combination of high-intent audiences, quality content and powerful customer loyalty, media brands provide the means to build lasting relationships with consumers. As is true in all sectors, some have won more than others and those that have won audiences should be in every marketers arsenal moving forward.”

Nickolas Rekeda, CMO at MGID, said: “When it comes to ad budgets, brands will be more focused on results than ever before. Rationalising ad spend will take precedence over extravagant awareness campaigns as advertisers prioritise tangible business outcomes. Although many brands tightened their budgets due to the uncertainty of 2020, this led to the realisation that large volumes of traffic and digital ‘noise’ didn’t guarantee a boost to their bottom lines.

“In reality, issues with ad fraud and bot activity are skewing the alleged value of online traffic; research has revealed fake users and bots remain the most prevalent form of fraud in EMEA (47%), the US (68.7%), and China (65.6%). Going forward, brands will be extra vigilant with how they spend their budgets and make smarter choices in advertising partners, to ensure digital campaigns are brand-safe, fraud-free, and delivering maximum impact to their ad revenues.”

Shirley Smith, Sales Director, Flashtalking, said: “With ad spend forecasts for this year looking more positive across the main media channels, and with online advertising continuing to grow despite the challenges of last year, 2021 should be seen as an opportunity for marketers to harness the expanding digital audience. Changes to the way we work, shop and spend our leisure time have seen online usage grow, however the new digital-savvy audience has higher expectations when it comes to the relevance and quality of ads they receive, and how they are targeted online.

“Those brands who recognised this and leveraged the benefits of premium ad formats, putting their faith in dynamic creative during the difficult economic climate of 2020, were better able to adapt to the needs of the constantly evolving market. Data-driven creative will continue to be a key factor in reaching the ever-changing digital audience in the year ahead, and marketers should use their learnings from the Covid crisis to inform strategies and continue to develop personalised and targeted ad campaigns.

“It’s also in the interest of all that the ad tech industry takes this opportunity to clean up its act and collaborate to ensure a transparent and fair ecosystem that means marketers get maximum, measurable performance from their hard-won budgets.”

Ross Nicol, VP EMEA, Zefr, said: “Video has remained resilient throughout 2020; withstanding the twists and turns of a global pandemic it is on track to continue at the forefront of media campaigns. It’s no surprise that according to the IPA Bellwether Report, video was one of the least impacted formats in Q4 2020, recording just -3.5% reduction in ad spend.

“However, Q4 did not come without its hurdles. The industry saw first-hand how blanket legacy contextual targeting techniques came up short and had costly repercussions on ad revenues. For example, broad content keyword labelling (of trigger words such as Covid-19) meant that advertisers missed out on many other associated opportunities. This quickly drew attention to an intrinsic need for the adoption of more sophisticated data in order to effectively increase investment outlook.

“As a result, we are seeing a collective demand from users for increased relevance of ads from advertisers and brands respectively, and achieving this goes far beyond keyword associations. This requires working with contextual data partners to remove waste inventory and improve ad alignment with suitable video content that adheres to each brands’ standards. Looking ahead to the remainder of Q1 2021, brands will be under increased scrutiny to standardise their approach to brand suitability on video platforms in order to better reach their audiences.”

Zara Erismann, MD Publisher Europe, LiveRamp, said: “Positively, digital advertising is the one area of marketing to buck the trend and show an increase in budgets for Q4. To truly thrive in the current climate however, publishers and brands still need to constantly innovate to strengthen their relationships with consumers. It’s not just the pandemic that’s impacting the industry either; we’re operating against a backdrop of increasing privacy regulation and restrictions across the board: the deadline for the deprecation of third-party cookies continues to loom, as does Apple’s restrictions to IDFA and Google’s removal of DCM logs.

“There’s a huge opportunity here, however, to build a new and better ecosystem that places trust with consumers at the core. For publishers and advertisers, the key is adopting authenticated addressable solutions, allowing them to personalise and enhance the end-to-end consumer experience, whilst ensuring the individual’s privacy is front and centre. Indeed, this consumer-first approach benefits not just the individual, as there are also tangible benefits to publishers and brands, such as improved targeting and measurement. . This focus on the consumer will accelerate the ongoing trend and proliferation of people-based campaigns in 2021. Our prediction is that we’ll see an industry-wide commitment to creating a better, open internet for all, which will weather current and future challenges it comes up against.”

Claire Burgess, Head of Biddable at NMPi by Incubeta, said: “With the UK entering 2021 in yet another lockdown and having spent much of the last quarter under either stringent national, regional or local restrictions, these results are reflective of the ongoing adversity we face. With Covid-19 still stalling normal trade and many industries such as Travel, Automotive and Beauty struggling to recoup, the side-effects are naturally seen in our advertising budgets. Now, with the depletion of the high street and decline of footfall, retailers need to focus on their online user experience more than ever before.

“It is encouraging that marketers expect budgets to bounce back this year, though it should be noted that the survey was likely conducted after news of the vaccines but before the full extent of virus mutations and subsequent heavier precautionary measures announced. However, UK PLC is far better prepared than this quarter last year, when the first lockdown took businesses by surprise. There has been a sustained drive towards digital innovation, ecommerce and marketing efforts that support this and I expect this to continue. Marketers are unlikely to press pause on activity as many did last year.

“However, as the online community becomes increasingly saturated it will become vital for advertisers to remain engaging and relevant while delivering brand messaging to its consumers. It’s during these times of store closures, restricted movements, and an uncertain economy, that digital innovation and investment in a data-driven, multi-channel attribution strategy will be crucial to survival.”

Justin Taylor, Managing Director UK, Teads, said: “The Bellwether report reflects the mood of the nation. We are currently in the depths of the pandemic with nothing but bad news at a macro level, however surrounding this heartbreak is hope. We have hope that on a geo political scope that change is coming; we have hope that as we move from the pandemic we will increase focus on the macro environmental challenges, but perhaps the most tangible hope is that the vaccine will put halt to COVID-19 and allow us to all rebuild, rebase or revitalise our lives. This is what is reflected in the business confidence growth and why budget growth is slightly lower. As an industry we are scenario planning still, but the scenarios are not closed looped and negative, they are broader in scope with a positive ‘when’.

“Clients know that when we feel personally confident again, those who have not been adversely affected financially by the pandemic will want to spend. We are already seeing the +55’s consuming more travel content than any other demographic and in a recent survey we did almost 45% of adults are thinking about summer holiday plans. If this optimism transverses across other big ticket purchases we have held back on then ‘when’ it happens this year it will happen big. This is why we are seeing the surge in confidence.”

Niki Stoker, COO, A Million Ads, said: “The IPA Bellwether Q4 report holds no real surprises, but looking ahead, advertising in 2021 poses a new challenge for marketers, particularly with restrictions varying across regions and countries. Marketers must now rethink their advertising approach and assess what needs to change in order to stay relevant and competitive. Staying agile whilst being human and empathetic will be the key to success in the coming months.

“One way to do this will be through dynamic advertising – ad placements that account for a wide range of current data points including location, demographics, environmental data such as time of day or weather, and campaign information around special offers or promotions. By taking this approach, brands can create closer connections with consumers based on their current needs and contexts. Since the start of the pandemic, dynamic advertising has already seen huge growth and will continue to pave the way for brands to be able to future-proof their advertising strategies and plan for the unexpected.”

Chloe Grutchfield, Senior Vice President of Product at Sourcepoint comments: “A continued decline in advertising budgets is disappointing, but not necessarily surprising, as the UK continues to battle the pandemic and a lot of uncertainty remains from Brexit. This coupled with evolving privacy regulations across the globe continue to put further pressure on the ecosystem to adopt a privacy-first frame of mind.

“Diminished budgets mean it will be necessary for advertisers to invest wisely and maximise return on ad spend by purchasing inventory that will truly engage their target audience. Now is the optimal time to focus budgets on quality publishers engaged in a privacy-safe, fair and transparent value exchange with their users, rather than a long tail of potentially non privacy-compliant inventory.

“Although we’re in the midst of the storm the future is looking brighter with ad spend expected to recover throughout 2021 and 2022. As privacy regulations and frameworks as well as big tech restrictions continue to evolve during this time with the introduction of Apple’s IDFA opt-in and Google’s Privacy Sandbox pitched as a replacement to the third-party cookie, all players in the ecosystem must continue to invest in media and technologies that embrace this new era of consumer privacy and build compliant and future-proof solutions”