Consumers will no longer stand for a ‘one-size fits all’ approach to customer engagement from their banks, with nearly half of British consumers (48%) considering switching their bank as a result of receiving poor customer service, according to new research.

The research from Engage Hub, looked into the banking preferences of 2,000 UK consumers.

Key findings:

• Only a quarter of British consumers (24%) believe the communications their bank sends are always relevant to them, whereas just over half (51%) feel there is work to be done

• One in four (25%) consumers say their bank never communicates with them

• There are significant differences between the generations, in terms of what they want from their banks:

o The younger generation favour a slick app and tailored, digital communications over traditionally good customer service

o The older generation favour email as their communications channel of choice with their bank. The younger generation, in comparison, favour mobile-friendly comms such as push notifications from the banking app or text/SMS

The data reveals that poor customer experience is the main reason UK consumers would be encouraged to switch bank, with nearly half (48%) of consumers citing this as their biggest gripe.

UK consumers would also be highly likely (44%) to walk away from a bank if they didn’t feel they were being adequately protected from fraud. Other factors that could drive customers away, include banks sending irrelevant communications to consumers (23%), having a clunky, hard-to-use app (17%), or not offering the digital communication channels that consumers would prefer to communicate through (14%).

Interestingly, the figures for these three factors go up significantly when looking at those aged 18-24:

What factors would most encourage you to reconsider who you bank with? (Aged 18-24 years):

• My bank delivering poor customer service – 41% (down vs the 48% average)

• My bank not protecting me from fraud – 44% (level with the average)

• My bank is constantly sending me irrelevant messages – 31% (up vs the 23% average)

• My bank has a clunky, hard-to-use app – 24% (up vs the 17% average)

• My bank doesn’t offer me the digital channels I want to use – 20% (up vs the 14% average)

Mark Grainger, VP Sales Europe at Engage Hub commented, “Customer service is no longer defined by the interpersonal skills of your employees. Younger generations that have grown up with the internet and connectivity everywhere want to use technology to squeeze routine tasks into their busy lives. Their expectation to check balances, make payments and even set up a bank account at any time, in any location and on any device, is forcing traditional banks to reconsider their offerings to attract new customers, and retain existing ones.”

Grainger added, “There is a level of personalisation required when communicating with consumers, who will no longer accept an onslaught of irrelevant messages and advertising. Banks need to tap into the wealth of knowledge locked within the customer data they hold to glean a unique insight into what their customers want. Contextually relevant and personalised content, distributed via the preferred channel of the customer, could dramatically improve customer satisfaction.”

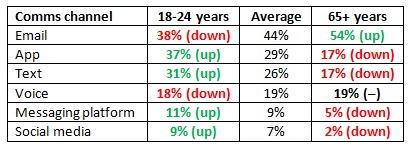

Email (44%) was identified by the research as the most popular method of communication identified by consumers, followed by banking apps with push notifications (29%) and text/SMS messages (26%). When looking at different age demographics, there were clear distinctions between younger and older consumers in terms of preferred channels of communication, and looking at the 18-24 vs the 65+ age groups, highlights the differences most significantly:

Which channel of communication would you most like your bank to use to communicate with you?

With such a range of channels available to them, it’s perhaps unsurprising that only 40% of customers are being communicated with via their preferred channel of communication, while 17% are never being communicated with via their preferred channel. One in 10 consumers (10%) believe their bank doesn’t know what communication channels they prefer.

While 24% of respondents believe the communications their bank sends are always relevant to them, 34% feel they could be more relevant. Worse still, 17% believe communications are always irrelevant, and one in four (25%) said their bank never communicated with them.

Grainger concluded, “It is well documented there has been a clear shift towards online banking in recent years, but what’s really upped the ante is the mobile centric behaviours of younger generations. The demand for anytime, anywhere access to banking has been propagated by the capabilities of modern smartphones, and streamlined, integrate systems, with a single customer view point, are the key to optimising customer experience. Those banks that utilise cross-channel communication technologies to deliver this will remain ahead of the curve.”

To find out more from Engage Hub, on the vital Role of Cross-Channel Communications in mobile banking today, you can download the latest whitepaper from the Engage Hub website.