The first sign that the U.S. video streaming market is approaching saturation is revealed in a new forecast which shows the growth rate slowing for the first time.

The study, from research and consulting firm, Strategy Analytics, is based on U.S. consumers spend of $6.62 billion on video streaming services (Netflix, Amazon Prime and Hulu) in 2016.

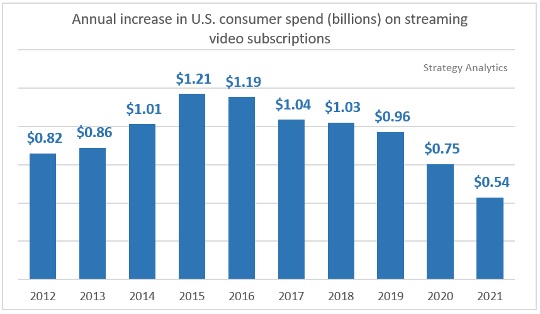

It found there has been a reduced amount of dollar spend from 2016 to 2015 for the first time ever:

Although this represents a $1.19 billion (or 22%) increase on 2015, it’s the first time ever that the $ increase in the amount people spend on these services will be lower than the previous year’s increase – in this case, the $1.21 billion increase in 2015.

Annual Increase in US streaming video spend

“Although the change in increase is relatively small, its direction is extremely significant,” says Michael Goodman, Strategy Analytics’ Digital Media Director. “It shows that, whilst actual market saturation is a few years off yet, the domestic U.S. streaming subscription market is now on the backside of the adoption curve. The incremental increase in annual $ spend will decline from here on.”

Netflix vs. Amazon

Nearly 60% of U.S. broadband households subscribe to a video streaming service. Goodman notes: “We put market saturation at 85% of broadband households – similar to saturation levels for pay TV. Within five years, annual growth will fall below eight percent.”

Netflix leads the market, accounting for 53% of subscriptions – over double the second player, Amazon Prime Video (25%) followed by Hulu (13%). However, nearly 40% of households subscribing to a video streaming service, subscribe to at least two.

“This multi-subscription behavior means growth relies on cannibalizing other services or getting people to subscribe to more than one – and companies seem to be betting on the latter,” says Goodman. “Most of the new services being launched today are in the $2-$5 range – clearly designed to be complementary to a Netflix or Amazon. The domestic situation is also a huge reason why international expansion is so important, this is underscored by Amazon’s recent video initiatives, and is particularly relevant for Netflix who has the least room to grow in the U.S.”

The total home video market

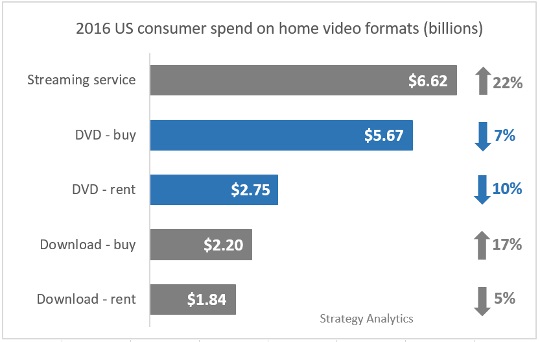

The 22% increase in streaming subscription revenue means the format will account for 35% of consumer spend on home video in 2016. DVD/Blu-Ray purchasing, the next most popular format, will decline 7% to $5.67 billion (30% of consumer spend) whilst disk rentals will decline 10% to $2.75 billion (14% share).

Downloading to buy will rise 17% to $2.2 billion, downloading to rent will fall 5% to $1.84 billion – accounting for 22% share combined.

Changing US spend on home video formats

Overall, the $19.09 billion Americans will spend on home video is a 3.6% rise on 2015 and the equivalent of $13.42 per household a month. However, advertising around paid video on demand content will rise 21% to $8.82 billion. Thus, overall revenues for the home video market will grow 8.3% to $27.3 billion.