The Competition and Markets Authority (CMA) has published its “shake up” of the UK’s banking sector with plans to implement a one-stop app where consumers can track their accounts across multiple banks.

The new initiative involves creating new apps that enable customers to manage all their finances from a single place, in a drive to promote competition between the more established banks.

The Open Banking standard is one of the CMA’s three “cross-cutting foundation measures” aimed at increasing competition between banks – the measures “have the object of increasing customer engagement and making it easier for personal and business customers to compare the prices and service quality of different providers and of encouraging the development of new services”.

The regulator also plans to make improvements to the Current Account Switching Service (CASS), and change the rules around personal current account overdrafts.

In addition, the CMA is introducing a set of measures “targeted at the specific problems in SME banking”.

The watchdog had initially planned to release the report in March, but then pushed the deadline back in order to properly consider the responses to its preliminary findings.

“The reforms we have announced today will shake up retail banking for years to come, and ensure that both personal customers and small businesses get a better deal from their banks,” said Smith.

“We are breaking down the barriers which have made it too easy for established banks to hold on to their customers. Our reforms will increase innovation and competition in a sector whose performance is crucial for the UK economy.”

Michael Allen, VP EMEA, Dynatrace commented on the potential problems developing these apps could create for banks. Who will be responsible for fixing it when something goes wrong?

“Providing access to an account from another bank through a mobile app is going bring with it a number of challenges and questions. From the consumer perspective this is great, but what happens when there is a problem with the app, like an account doesn’t load or the app runs slowly? Who will they blame for the problem and who will be responsible for solving it? For banks, this is going to raise some interesting questions about how they manage and control the consumer experience, even though they aren’t ultimately responsible for all the services being provided through the app.”

Central to the CMA’s remedies are measures to ensure that customers benefit from technological advances and that new entrants and smaller providers are able to compete more fairly.

The key measures, which will benefit personal and small business customers, include:

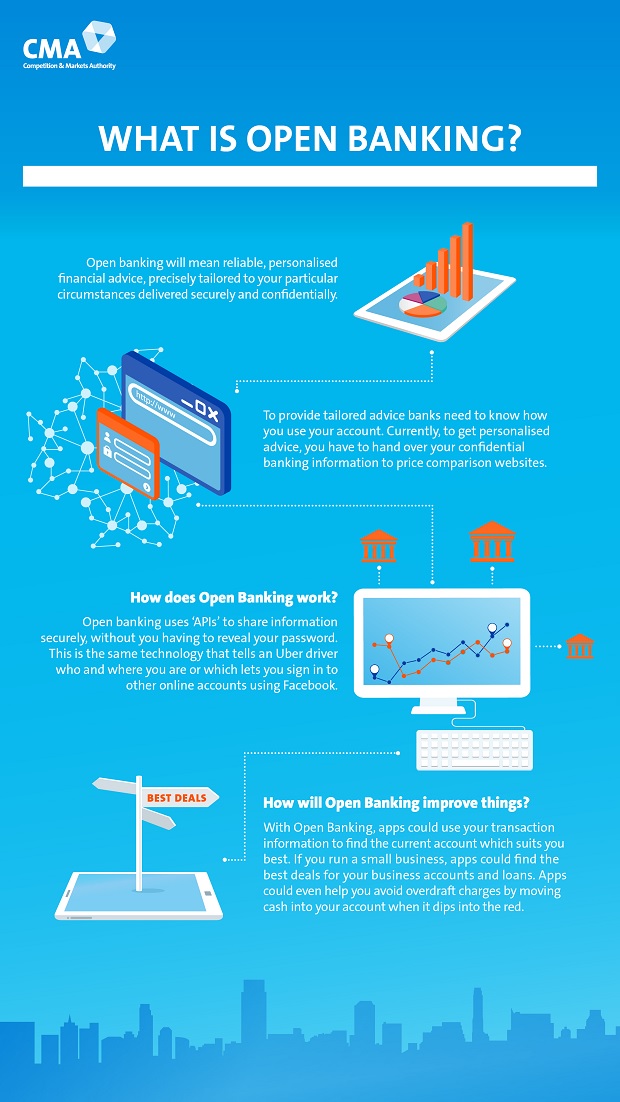

· Requiring banks to implement Open Banking by early 2018, to accelerate technological change in the UK retail banking sector. Open Banking will enable personal customers and small businesses to share their data securely with other banks and with third parties, enabling them to manage their accounts with multiple providers through a single digital ‘app’, to take more control of their funds (for example to avoid overdraft charges and manage cashflow) and to compare products on the basis of their own requirements.

· Requiring banks to publish trustworthy and objective information on quality of service on their websites and in branches, so that customers can see how their own bank shapes up. Whether a personal customer or small business is willing to recommend their bank to friends, family and colleagues will be a core measure but we will also be requiring banks to publish and make available through Open Banking a range of other quality measures.

· Requiring banks to send out suitable periodic and event-based ‘prompts’ such as on the closure of a local branch or an increase in charges, to remind their customers to review whether they are getting the best value and switch banks if not. Unlike many other financial products such as home insurance, current accounts do not have annual renewal dates to act as natural reminders and other possible triggers like business growth are not prompting customers to review what they are getting from their bank.

Underpinning these remedies, the CMA is introducing further measures to make it easier for customers to search and switch. At the moment only 3% of personal and 4% of business customers switch to a different bank in any year. This is despite, for example, personal customers in Great Britain being able to save £92 on average per year by switching provider, with savings of around £80 a year on average available for small businesses. Larger savings are available for overdraft users – for example, personal customers who are overdrawn for one or two weeks every month could save £180 per year on average.