Google has regained the crown as most valuable global brand ahead of Apple, while Vodafone retains UK top spot, according to a new report.

The 2016 BrandZ rankings from WPP and Millward Brown indicate that the telecoms sector was also the strongest performer in the 2016 UK ranking, with Vodafone and BT taking first and third places respectively.

Key findings:

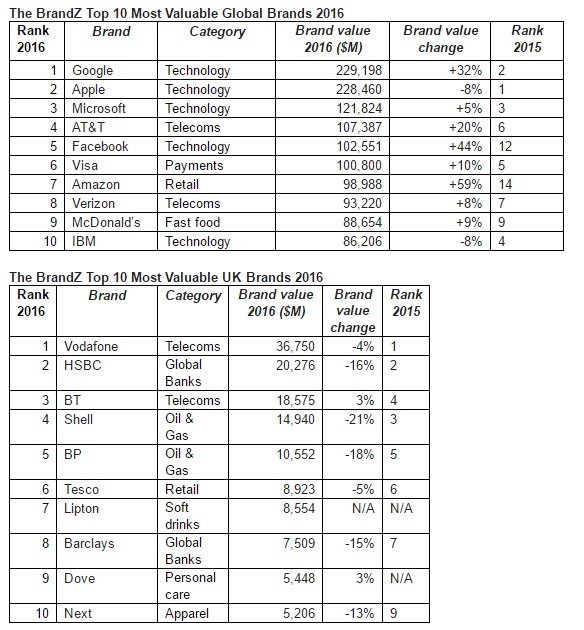

In the global Top 100, Google returned to the top from its second place position in 2015 to be named the world’s most valuable brand, having increased its value to $229bn, up 32%. Apple dropped back to no.2 with an 8% decrease in value to $228bn.

Notable additions to the global Top 10 were Facebook (+ 44%, no. 5) and Amazon (+ 59%, no. 7).

Vodafone maintained a strong communications campaign and held on to its top spot in the UK, despite its acquisition activity contributing to its brand value dropping 4% to $37bn. BT gained one place, rising to no.3 with a brand value of $18.5bn, up 3% from last year, as it reaped the rewards of entering the pay TV and mobile markets as a disruptor in 2015, and increased its focus on the overall customer experience.

Personal care brand Dove entered the UK Top 10 ranking for the first time since 2013, growing by 3% to be valued at $5bn, boosted by its commitment to innovative and thought-provoking communications campaigns, such as its ‘Choose Beautiful’ initiative. Lipton, the soft drink maker, was the other newcomer to the UK Top 10, with a value of $8.5bn as the brand continued to benefit from its focus on targeting increasingly health-conscious consumers and its strong performance in global markets such as India and the US.

Supermarket chain Tesco retained its no.6 position in the UK ranking. It dropped 5% in value to $9bn but this compares favourably to its 37% decline in 2015, indicating that its turnaround plan is taking effect and that it is adapting to the technology-driven challenges faced by the retail sector.

Overall, the BrandZ ranking indicates that it has been another challenging year for the UK, as the total value of its Top 10 brands dropped to $137bn, down 8% from 2015. This compares to an increase of 5% in mainland Europe. However, North America’s 10% growth was significantly less than its 19.1% increase last year, indicating that the influence of the economic slowdown in China, along with global financial issues and uncertainty cannot be under-estimated, with many UK brands exposed globally, and in troubled categories such as banking and oil and gas.

The brands that achieve high growth values in the BrandZ Top 100 Most Valuable Global Brands combine innovation with communication that is clear and relevant, as demonstrated by Google. This trend is also noticeable in the UK ranking, with BT building on its disruptive business activities of 2015 and ensuring that consumers understand the relevance of these. Dove continues to break new ground with advertising campaigns that challenge traditional stereotypes, while Lipton has ensured that its brand is seen as relevant in today’s market.

“It’s clear from the BrandZ rankings that innovation, whether that is delivering something new or disrupting an existing market, plays a critical role in a brand’s success, both in the UK and around the world. More than that, it is also about consumer perception so it is essential that they shout about their achievements and then deliver on their promises,” says Peter Walshe, Global BrandZ Director at Millward Brown. “Strong brands take this to heart which helps them build resilience. This is ably demonstrated by the notable success stories of brands such as Vodafone, BT, Dove and Lipton, which are thriving despite the impact that the current global outlook is having on the UK.”

Key trends highlighted in this year’s BrandZ Top 100 study include:

Strong brands outperform the market. Brands that appear in the BrandZ Top 100 Most Valuable Global Brands ranking consistently deliver a better financial performance than brands that are not included, thereby generating a superior return for shareholders.

Disruption is a catalyst for value growth. The categories that increased in value were all either shaken up by challenger brands founded on a unique and meaningful proposition, such as Under Armour and Victoria’s Secret in the apparel category (+14%), or innovated to a high degree in response to a new trend, such as the brands in the fast food category (+11%) which successfully responded to global demand for healthier products.

Innovation is the main growth driver – but it must be seen and felt by consumers. The brands that are the strongest innovators have increased their value the most over the 11 years of BrandZ Top 100 rankings. However, to have an impact on brand value, innovation must be clearly communicated and delivered through the brand experience: the brands that are perceived as innovative by consumers – which include Disney (no.19) and Pampers (no.37) – grew nine times faster than those seen as less innovative.

Apparel is the fastest growing category, rising 14% to $114bn. There is an emphasis on high performance, with brands including Nike (+26%) and Under Armour (a new entry) launching specialist premium lines, incorporating technology such as heart monitors into their clothing, and integrating sportswear with free apps to provide a total consumer experience.

B2B is a category of efficient businesses but inefficient brands. They are perceived as more responsible than B2C brands, better to work for, good value and stable, but not as exciting or dynamic. B2B brands are in fact highly innovative; ensuring they are credited as such requires strong and meaningful brand communication. SAP (no.22) and Adobe (a new entry at no.100) are among the B2B brands being perceived as innovative by customers.

Disruption extends to the ranking itself. Close to half (46) of the brands in the 2016 Top 100 entered the ranking after it was first launched in 2006; 54 have been there since the inaugural ranking. This shows how a strong brand can sustain its value over time, but also illustrates the potential that exists for new brands to successfully shake up the status quo.

Strong emotional connections are boosting local brands. With a clear understanding of their consumers’ needs, local brands are gaining market share at home and, with improved functionality and marketing, are also winning share in new regions. China’s Huawei (no.50, +22%), for example, has rapidly globalised and taken market share from both Apple and Samsung.

The BrandZ™ Top 100 Most Valuable Global Brands report and rankings, and a great deal more brand insight for key regions of the world and 14 market sectors, are available online here. A new suite of interactive smartphone and tablet applications is available for free download for Apple IOS and all Android devices from www.brandz.com/mobile or search for BrandZ in the respective iTunes or Google Play app stores.

The full global ranking is available from www.millwardbrown.com/brandz

Source: