Apple Pay is now live in the UK, and MasterCard has announced that it will offer its cardholders immediate access to the new service helping them to use their cards

Users of Apple’s iPhone 6, iPhone 6 Plus and Apple Watch can make payments at over 250,000 shops in the UK that accept contactless payments; and payments within apps using iPhone 6, iPhone 6 Plus, iPad Air 2 and iPad mini 3.

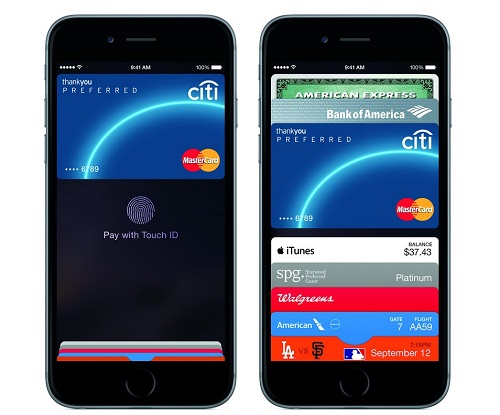

When you add a credit or debit card to Apple Pay, the actual card numbers are not stored on the device, nor on Apple servers. Instead, a unique Device Account Number is assigned, encrypted and securely stored in the Secure Element on your device. Each transaction is authorised with a one-time unique dynamic security code.

The MasterCard Digital Enablement Service (MDES) has been built with ‘EMV cryptography’ – ensuring that transactions can take full advantage of the most advanced payment security in the world.

Apple Pay incorporates additional security features such as Touch ID to authorise every contactless payment.

Apple Pay works exactly like a real card so users will still get all benefits such as points, cashback and insurance protection when you spend using Apple Pay.

Cardholders can locate shops which accept Apple Pay through MasterCard Nearby, a location-based app that identifies retailers that accept contactless payments.

New figures from MasterCard indicate that the UK is ready to embrace mobile payment technology1: a quarter of British consumers said that they intend to make a contactless payment with their mobile in the next year. Furthermore, one-third of potential users intend to link their credit card to their smartphone for contactless payments, for the added consumer protection it offers.

“Innovation in UK payments means it’s fast becoming the most advanced market in the world and the arrival of Apple Pay heralds this new era. We will see more change in the next five years than we’ve seen in the last 50, bringing even more convenience and security for consumers,” said Mark Barnett, President of MasterCard UK & Ireland.

“Regardless of the device they use, our aim is to give consumers a safe and seamless payment experience that offers all the benefits and guarantees of any MasterCard transaction. Our work with Apple embodies the digital transformation of our company and solidifies our commitment to more secure, digital payments.”

In shops, consumers can pay contactlessly simply by holding their iPhone over a contactless terminal and authenticating with Touch ID. For purchases within an app, consumers simply authenticate with their fingerprint or passcode for a seamless experience without having to enter their card number or leave the app.

In shops Apple Pay works with iPhone 6, iPhone 6 Plus and Apple Watch. When paying within apps, it is compatible with these products as well as the iPad Air 2 and iPad mini 3.

MasterCard is working with multiple banks, including: HSBC; MBNA; RBS/Natwest and Santander, to enable their customers to use their MasterCard credit or debit cards directly through Apple Pay. The company has already helped almost 100 banks in the US and UK to enable their cards for Apple Pay.