UK supermarkets have experienced the lowest sales growth over the Christmas period in five years, with sales growing by +0.5% in the last four weeks, according to new research.

This slump in sales is attributed to several factors including increased competition, price cuts and lower inflation.

The data, from Neilsen, indicates that grocery sales reached their peak at £6.2bn over the two weeks to 28th December, with sales in fresh turkey in the last four weeks reaching £70m, a +0.5% uplift. The best performing categories over the festive period included soft drinks which grew by +2.4%, as well as confectionery, with chocolate reaching £435m in sales.

Nielsen’s data also reveals that whilst consumers visited supermarkets more often over the Christmas period, shoppers were purchasing fewer items and spending less each time.

Nielsen found that in terms of traditional Christmas dinner groceries, sales in fresh turkey in the last four weeks reached £70m, a +0.5% uplift. However, sales for fresh beef dropped by -3.6%, and despite a -1.4% decline in fruit and vegetables, we still spent £858m on this fresh produce.

The best performing categories over the festive period included soft drinks which grew by +2.4%, and in particular, cola, which reached £125m in the last four weeks, growing +6.2%. As well as this, confectionery performed well growing by 2.2%, with chocolate ahead by +2.5%, reaching £435m in sales¹. However, despite the strong performance from these categories, the figures remain significantly less than 2018.

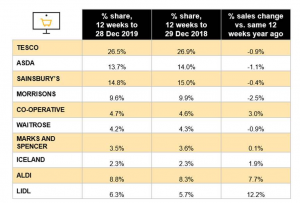

In terms of retailer performance over the 12 weeks to 28 December, the discounters Aldi and Lidl continued to outperform the major supermarkets. Sainsbury’s was the most successful out of the ‘Big Four’, despite a fall in sales of -0.4%. Meanwhile, there was a good performance from Co-op (+3%) and Iceland (+1.9%).

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, said: “It is unsurprising that sales have remained relatively low over the December period, given that momentum continued to slow in the run up to Christmas this year. This has given us the lowest Christmas sales growth since 2014, with shoppers choosing to visit stores more frequently, but spending less.”

Watkins continues: “Despite the festive season, consumers are evidently remaining cautious by taking advantage of greater price competition and special offers. It’s possible that shoppers have also turned to healthier options as sales of no and low alcohol beer, cider and lager increasing by +24% in the last four weeks, whilst total category sales in beer, wine and spirits have declined slightly by -0.1%¹. However, consumers have opted to indulge through other means – which helps to explain the uplift in sales for confectionery and soft drinks over the festive period.”

12-weekly % share of grocery market spend by retailer and value sales % change

The figures in the table are based on 12 weeks sales through to 28 December 2019 compared with the same 12 week period in 2018

Source: Nielsen Total Till, Nielsen Homescan