Nearly half (47%) of the world online population will be will be tuning into the FIFA World Cup either online or on TV this summer, with Facebook and WhatsApp the best platforms for brands to reach them, according to new research.

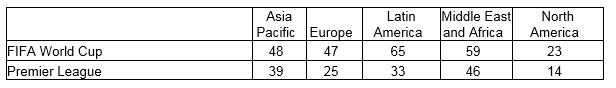

A global survey 80,267 internet users by GlobalWebIndex, reveals Latin American digital consumers are the most likely to be watching the FIFA World Cup, where 65% of internet users will be tuning in online and on TV. Globally, over half (55%) of male internet users watch the World Cup either online or TV; just over a third (37%) of female internet users will watch.

Key global findings in relation to FIFA World Cup:

• Globally 55% male and 37% female sate they will be watching the tournament

• Europe; 47% will watch the World Cup, compared to only 25% watching the Premier League

• Latin America has the largest number of viewers of the tournament; Europe comes in 4th place behind Middle East/Africa and Asia Pacific.

• WhatsApp and Facebook Messenger key to tapping global World Cup audience

Key UK Findings:

• 45% FIFA World Cup viewers, 42% Premier League

• Of the FIFA World Cup viewers in the UK, 31% are Female and 60% male

• The ‘grey pound’ will turnout in force for the tournament in the UK, with 42% over 55 due to tune in

% of internet users aged 16-64 who watch online or on TV

In Europe, the audience for the World Cup amongst internet users (47%) is significantly higher than that of the Premier League (25%), indicating the scale of the marketing opportunity for marketers with international vision. By comparison, at a local level, the World Cup audience in the UK is just 3% larger than that of the Premier League (42%).

Interestingly this increase is seen in female audiences in the UK as well as male audiences. 31% of women state they watch the world cup either online or on TV – this draws the audience proportionately level with Europe’s Premier League audience.

Marketers must also be aware of the relevance of the World Cup across generations. The ‘grey pound’ will turnout in force for the tournament with 42% of internet users in the UK over the age of 55 (55-64) stating that they watch FIFA World Cup online and/or on TV.

Playing the online field

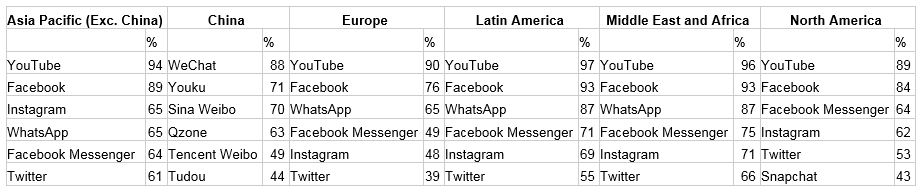

While YouTube dominates the findings as the channel most FIFA World Cup viewers are using, to reach these audiences, marketers need to be thinking far more about direct messaging campaigns.

Among audiences that watch the tournament online and on TV, WhatsApp and Facebook Messenger are now among the top five social platforms. WhatsApp, for instance, is in use by 87% of World Cup engagers in Latin America, Middle East and Africa. In Europe, this drops to 65%.

There’s been some great examples recently and with brands making tentative steps towards this massive media moment it could be the option that offers the best value agile campaigning – to be there in the moment with fans.

In China, things are starkly changed and WeChat is the go to with 88% of the audience using the platform. WeChat is followed by Youku (71%) and Sina Weibo (70%).

Methodology

World Cup audience/viewers are identified as those internet users who say they watch the tournament on TV or online. Among the Q4 2017 cohort of 80,267 respondents, there were 34,183 World Cup viewers.

Global sample includes the following countries: Argentina, Australia, Austria, Belgium, Brazil, Canada, China, Egypt, France, Germany, Ghana, Hong Kong, India, Indonesia, Ireland, Italy, Japan, Kenya, Malaysia, Mexico, Morocco, Netherlands, New Zealand, Nigeria, Philippines, Poland, Portugal, Russia, Saudi Arabia, Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, UAE, UK, USA, Vietnam

Source: GlobalWebIndex