Mobile ad spend has soared 159% in social and 66% in search, becoming the main driver of global ad growth, according to new research.

Mobile continues to be the key driver of growth in both social and search advertising, with spend targeted at phones and tablets increasing by 159% year-on-year (YoY) in social and 66% YoY in search according to

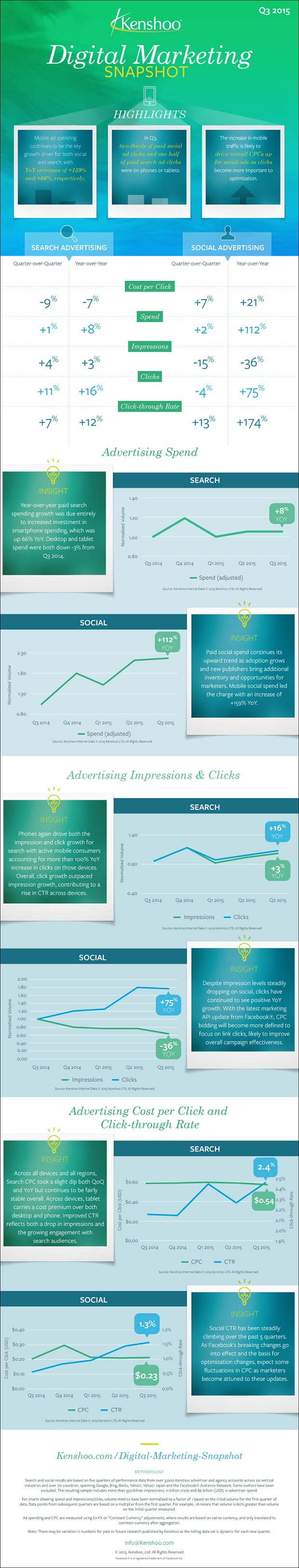

The global data from Kenshoo (www.Kenshoo.com), indicates that mobile devices accounted for 50% of all paid search clicks and 68% of all paid social clicks in the third quarter of 2015.

Paid social advertising continues to grow as new entrants come into the market and existing marketers raise budgets.

This has driven social ad spend up 112% YoY supported by the underlying +159% uptick in mobile advertising investment.

View this infographic below outlining key findings from the Kenshoo report:

Overall cost-per-click (CPC) is up 21% YoY in social advertising and despite impression levels steadily dropping, the volume of clicks on ads has continued to increase, rising 75% YoY. Social ad campaigns are continuing to deliver improvements in engagement levels with click-through rates climbing steadily over the past 5 quarters, rising by 174% YoY in Q3.

With Facebook recently revising its definition of CPC to focus on link clicks (rather than engagement clicks such as likes, comments and shares) Kenshoo expects marketers to see improvements in overall campaign effectiveness in coming quarters.

The company also expects recent changes to Facebook’s Marketing API (designed to make bidding and optimisation processes simpler) to cause initial fluctuations in CPC as marketers become attuned to these updates.

Spend on paid search advertising grew by 8% YoY in Q3, fuelled entirely by the 66% rise in budgets allocated to smartphone ads (search ad spend on desktop and tablet ads was down -3% over the period). Overall search clicks were up 16%, outpacing growth in impressions (3%) and leading to a 12% rise in CTR across all devices.

The increased activity on phones meant a rise in the number of ad impressions on phones and a greater than 100% increase in phone clicks compared with 2014. The increase in phone spend and clicks has helped to drive overall search CPC down by -7% (as clicks on smartphones are priced slightly lower than desktop and tablet clicks)

“Our data shows that mobile continues to be the most exciting area of positive change in both social and search advertising,” said Rob Coyne, Kenshoo’s Managing Director for EMEA. “As consumers spend more of their time on mobile devices, marketers are developing increasingly better optimised campaigns to make the most of the opportunity. Looking ahead, we expect to see these trends continue into the 4th quarter as retailers intensify their digital marketing activity over the holiday shopping season.”

Methodology

Search and social results are based on five quarters of performance data from over 3,000 Kenshoo advertiser and agency accounts across 20 vertical industries and over 70 countries, spanning the Google, Bing, Baidu, Yahoo!, Yahoo! Japan and Facebook ad networks. The resulting sample includes more than 550 billion impressions, 11 billion clicks and $6 billion (USD) in advertiser spend. Ad spending and CPC are measured using Ex‐FX or “Constant Currency” adjustments, where results are based on native currency, and only translated to common currency after aggregation.

Source: www.Kenshoo.com