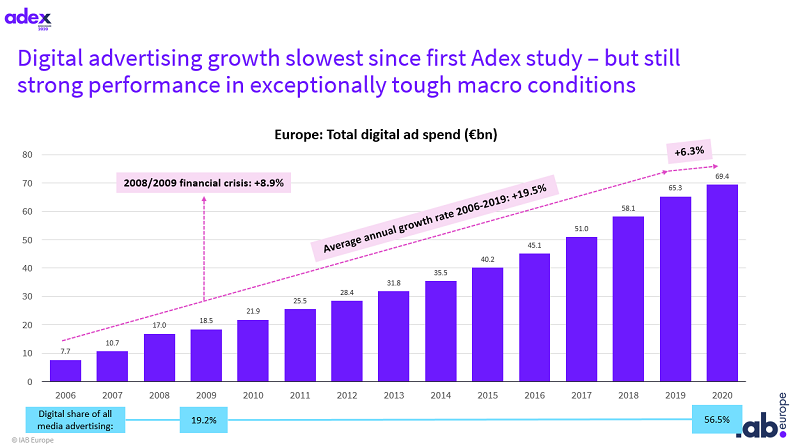

European countries had a combined digital advertising market value of €69bn, with only three countries seeing falls in growth for the year, despite lockdown disrupting business as usual, according to new research.

The report, from IAB Europe’s latest AdEX Benchmark report, found that digital advertising accounted for more than 50% of all media advertising spend in 13 of the 28 markets featured.

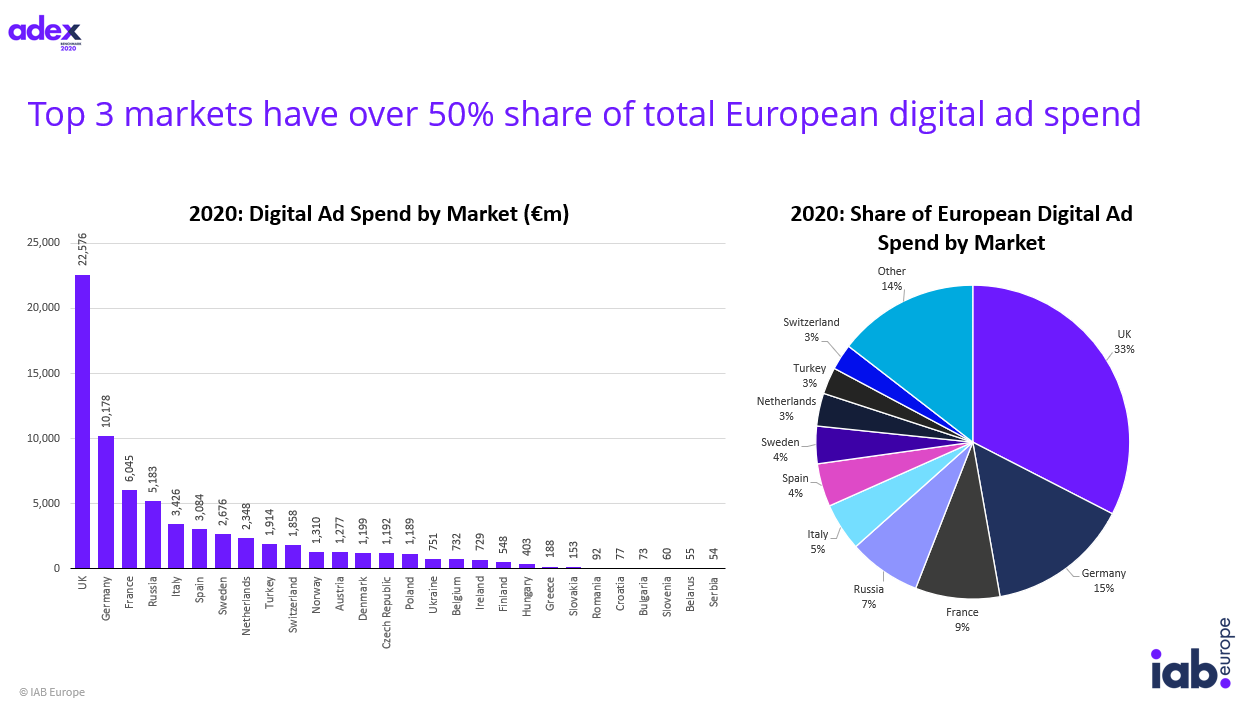

Digital advertising spend per capita was €87 on average across Europe, with the UK (€338 ) and Sweden (€260 ) topping the list.

Turkey was the fastest growing overall, with 34.8% compared with 2019, while Germany was the fastest growing western European country at 10.4%, with increases also seen in Italy, France and the UK.

In its AdEx Benchmark Report for 2020, IAB Europe found only Belgium, Spain and Belarus saw falls in growth for the year.

The findings are based on reported data from local IABs, estimates based on local insight and econometric modelling based on public company filings and financial databases.

Video advertising was 39.4% of all display spend across Europe and exceeded 50% in four markets. Two-thirds of all video advertising spending occurred in the UK, Italy, Germany, France and Russia.

AdEx Report Key Stats

• 2020 witnessed 6.3% growth, culminating in a market value of €69bn.

• Turkey led growth with 34.8% vs 2019, followed by other CEE markets. The fastest growing Western European market was Germany, up 10.4%.

• Digital’s share of all media advertising increased in all markets under study, often by mid-single percentage points, as other media channels suffered. Digital now commands more than 50% of all media ad spend in 13 out of 28 markets included in this study.

• Digital Ad spend per capita was €87 on average, with UK (€338) and Sweden (€260) topping the list.

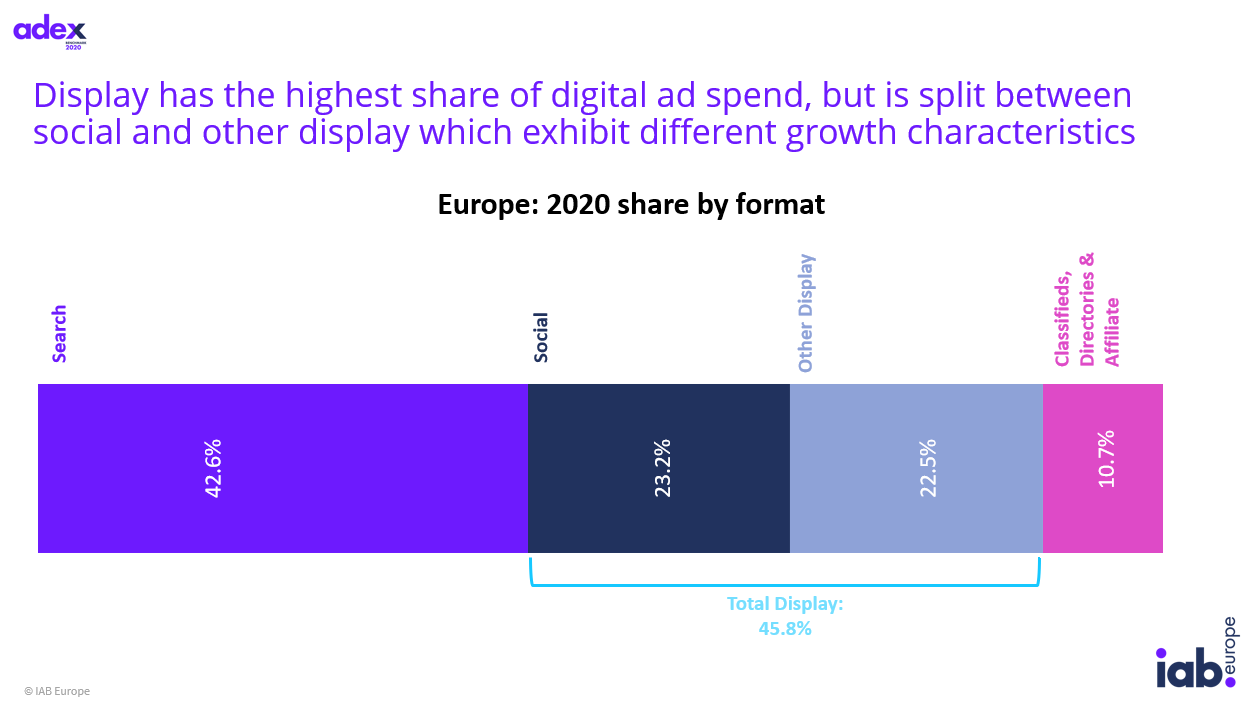

• Growth in 2020 varied by format: Display outperformed the market (+9.1%), followed by Paid-for Search (+7.8%). Classifieds, Directories and Affiliates declined (-9.1%).

• Display was driven by video (+16.3%) and social (+16.5%). Excluding social, programmatic was a key growth driver (+8.3%) as non-programmatic spend declined (-2.7%).

• Video now commands 39.4% of all display spend and exceeds 50% in 4 markets.

• Digital Audio advertising is growing fast (+16.7%) from a small base. It is nascent in terms of market size with €500m spent across the markets under study, or 1.6% of all display spend.

Commenting on the positive market growth in 2020, Townsend Feehan, CEO, IAB Europe said “Despite an inconceivably challenging year, it is really encouraging to see such positive growth in 2020. This is a testament to the people, products and services that help steer and grow the digital advertising industry, even in the most exceptional circumstances. As an industry association that aims to support digital business, we have worked extremely hard throughout 2020 to provide insights into the impact of COVID-19 on investment levels, and to support our members through these challenging times. IAB Europe remains committed to working with our members, both corporates and national IABs, to lead political representation and promote industry collaboration to deliver frameworks, standards and industry programmes that enable business to thrive in the European market. We look forward to seeing how the industry will continue to evolve and develop in 2021.”

A total of 7 markets experienced double-digit year-on-year growth

Turkey led the way with 34.8% growth vs 2019, followed by other CEE markets. The fastest growing Western European market was Germany, up 10.4%. Measured against the severity of the COVID-19 outbreak and the subsequent economic deterioration, only three markets recorded a decline in investment. Even some of the largest markets like Italy, France, and The UK posted solid performances in 2020.

Digital’s share of all media advertising increased in all markets under study, often by mid-single percentage points, as other media channels suffered. Digital now commands more than 50% of all media ad spend in 13 out of 28 markets included in this study.

Growth in 2020 varied by format

Display outperformed the market (+9.1%), followed by Paid-for Search (+7.8%). Classifieds, Directories and Affiliates declined (-9.1%). Display was largely driven by video (+16.3%) and social (+16.5%). Excluding social, programmatic was a key growth driver (+8.3%) as non-programmatic spending declined (-2.7%).

Social and video posted the strongest growth across all channels. Video now commands 39.4% of all display spend and exceeds 50% in 4 markets. Over 2/3 of digital video ad spend is generated by 5 markets – The UK, Italy, Germany, France and Russia.

Digital Audio advertising is growing fast

Whilst the audio market remains small, It is nascent in terms of market size with €500m spent across the markets under study, or 1.6% of all display spend.

Dr. Daniel Knapp, Chief Economist, IAB Europe, who compiled and presented the study commented “Digital advertising did not have a bad year in 2020, only a bad quarter. We saw rapid recovery already setting in in Q3 before double-digit growth in Q4. A strong reliance on performance channels during the height of lockdown was complemented with a fast redeployment of branding activity, in particular through digital video. The events of 2020 have fast-forwarded long-term socio-economic transformations that are altering how people consume and how companies operate. This provides a fertile ground for digital advertising and we expect the sector to accelerate its growth in 2021. ”