Online retail and take-away brands Ocado, Deliveroo and Just Eat are the UK’s fastest growing brands according to the 2020 BrandZ Top 75 Most Valuable UK Brands report, launched today by WPP and Kantar.

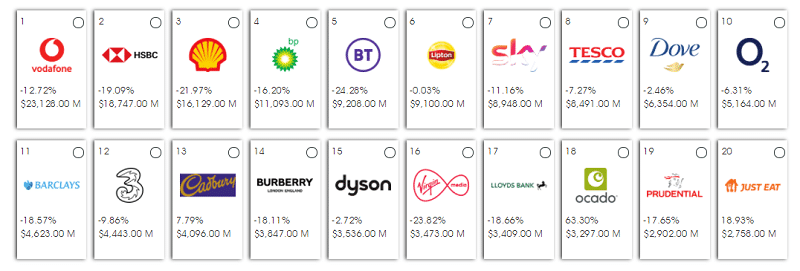

Already gathering pace pre-COVID-19, Ocado’s online capabilities and perceptions of strong differentiation from other grocery retailers made it take the coveted title of this year’s fastest growing UK brand, increasing +63% in brand value to $3.3bn (£2.7bn) and reaching no.18 in the Top 75 ranking.

Home delivery services threw the UK’s restaurant and takeaway industry a lifeline as it was locked out by COVID-19. Intense competition between Just Eat (no.20) and Deliveroo (no.29) increased due to takeover deals and accelerated consumer demand for home-delivered restaurant and take-away food over the last year. This allowed Deliveroo to grow by +40% in brand value to $1.9bn (£1.6bn), and Just Eat +19% to $2.8bn (£2.2bn), making them the second and third fastest growing brands respectively. Scottish Power (+13%; no.44; $1.4bn; £1.2bn) and Innocent (+12%; no.42; $1.5bn; £1.2bn) made up the remaining top five fastest risers.

Urgent call to action for UK brands

While some individual UK brands have performed well, growth in the BrandZ Top 75 UK brands as a collective has fallen by more than 15%, or $32 billion (£26bn) since 2017.1 There is further cause for concern due to a 13% decrease in value in the last 12 months which has fallen behind both the Global Top 100 Most Valuable Brands ranking published in June, and projections for the global economy by a large margin. Yet, despite very challenging macro-economic circumstances, the BrandZ UK Top 75 brands have still eclipsed the performance of the FTSE 100. Despite the impact of COVID-19, the BrandZ Top 75 UK portfolio showed strong recovery, outperforming the FTSE 100 by almost +5%.

The top five most valuable UK brands remained unchanged. Vodafone (-13%, $23.1bn; £18.9bn), which recently announced its intention to float its mobile towers business in a deal that could be worth £18bn, maintained its no.1 spot for the third year running. HSBC (-19%; $18.7bn; £15.3bn) and Shell (-22% $16.1bn; £13.1bn) make up the top three respectively.

Dyson (no.15; $3.5bn; £2.9bn) is by far the fastest rising brand since the UK ranking’s inception in 2017, fuelled by differentiation, innovation and product excellence. Increasing +51% in brand value over the last three years, it scores high on ‘difference’ (200) and ‘innovation’ (125), where 100 is the average index score.

Jane Bloomfield, Chief Growth Officer, Kantar UK said: “Despite massive headwinds in COVID-19 and Brexit, a small number of UK brands have performed well over the last 12 months, but they are the exception. Many of our UK Top 75 continue to trade on size and stature, which is a precarious position in a highly competitive global landscape. A lack of innovation and differentiation leaves them exposed as household budgets fall and consumers re-evaluate brand choices, often permanently switching to new brands they have found during the pandemic. This is a ‘do’ moment for brands and positive action is needed to ensure survival. No brand is too big or too well known to fail in the current climate. Understanding the drivers of brand growth and acting on them quickly is business critical.”

Pampering during the pandemic

Some brands have met the pandemic trends in self-reliance and resourcefulness that have seen consumers amusing themselves and seeking more indulgent moments, particularly during lockdown. Cadbury’s (no.13; $4.1bn; £3.3bn) creative communications campaign in support of Age UK and KitKat’s (no.34; $1.8bn; £1.5bn) product innovation and expansion into gifting and seasonal confectionery helped both brands increase their brand value by +8% and attract younger, affluent shoppers.

Entering the BrandZ UK Top 75 for the first time, at no.70, gin brand Gordon’s ($651m; £531m) commitment to innovation has revitalised the brand’s equity in the UK. Fuelled by flavoured gins and liquors, the category has exploded in recent years, more than doubling its shopper base from 14% in 2015 to 34% in 2020, while helping establish gin as the nation’s favourite tipple. Seeking escapism and excitement, UK consumers also helped to drive growth in the games console entertainment brand Grand Theft Auto (no.53; $1.1bn; £0.9bn) as it crashed into the Top 75 for the first time as this year’s highest newcomer.

Mark Chamberlain, Managing Director of Brand, Kantar UK said: “What BrandZ has demonstrated time and again is that there are no shortcuts to sustainable growth. BrandZ helps business leaders balance the pressure for short-term results with long-term sustainable and profitable growth. Brands that are bold enough to invest in making consumers’ lives better in creative and innovative ways, even during times of recession, have the potential to reap the rewards.”

Other key trends highlighted in this year’s BrandZ UK Top 75 study include:

● BooHoo enters Top 75 ranking at no.73 as the share of fashion spend continued to grow after lockdown

● Fintech newcomer Revolut (no.75; $582m; £474m) is defined by a sense of purpose, innovation and online credentials, while traditional banks rely on greater consumer awareness

● Categories in decline include Gambling (-34%) which has been impacted by cancelled sporting events, Cars and Logistics (-32% each) and Travel Services

(-27%)

● Entertainment category rises by +8%, but BBC (-19%; no 31; $1.9bn; £1.5bn) and ITV (-20%; no.41; $1.5bn £1.2bn) lose brand value as consumers subscribed in massive numbers to online streaming brands such as Netflix, Amazon Prime and Disney+

● The Top 75 UK brands perform well on each component of ‘Responsibility’ and ‘Inspiring expectations’ but, in a wider global context, their credentials must improve in all areas