Just 10% of Brits are now likely to pay in cash, with London seeing the highest proportion of card transactions while Bristol is the contactless Capital, according to new research.

With the use of contactless almost tripling in 2016, and forecasts expecting it to make up more than one in four (27%) of all payments by 2026, new data released by Paymentsense reveals the UK cities leading this growth with, those in the top 10 expected to go cashless first.

Analysing data of nationwide transactions from 2017, Paymentsense have created an interactive map exploring the UK’s cashless capitals, detailing the cities with the highest proportion of debit, credit, contactless and all transactions.

To further understand consumer spending habits and opinion, payment solutions specialists Paymentsense also conducted a study of 2,000 UK residents to reveal their payment preferences.

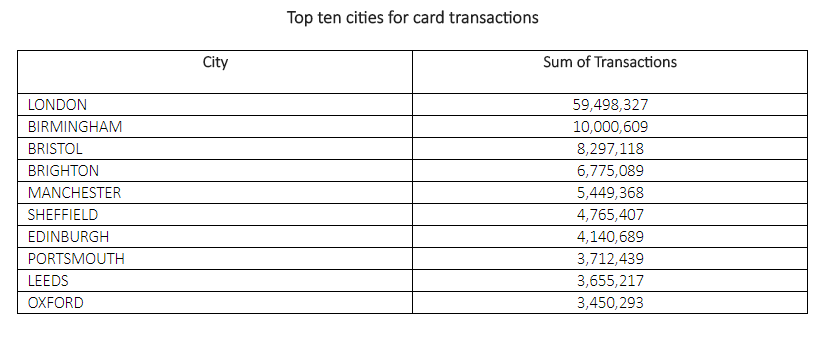

Top ten cities for card transactions

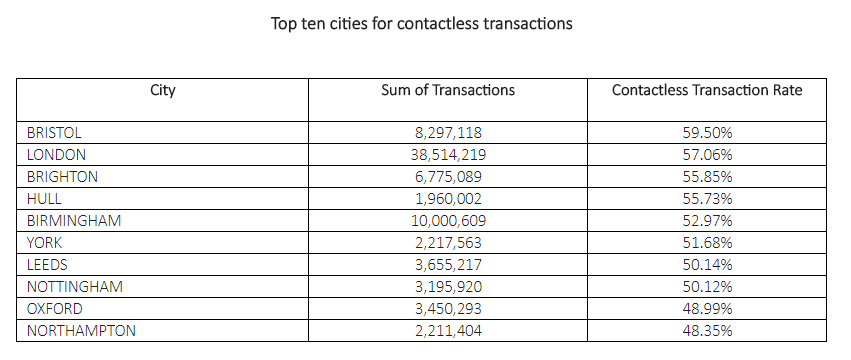

Top ten cities for contactless transactions

46% UK worried about security of card transactions

80% of Brits said card transactions, including contactless, were their favourite form of payment. However, 46% said they were worried about the security of card transactions.

Could the rise of contactless payments be causing this fear? Contactless payments are becoming more popular with over 24% of Brits saying it’s their favourite form of payment.

Contactless transactions are more popular among younger spenders, as 41% Brits aged 18-24 said it was their favourite form of payment compared to just under 10% of people aged 55+. This suggests that even though many are worried about security, increasing numbers are using this form of payment.

Spenders need to check payment amounts and be aware of the location of their cards at all times, to ensure contactless payments maintain a high level of security.

50% Brits want card payment solutions in car parks

Almost half of the Brits surveyed said they would like car parks to accept card payments. This was closely followed by public transport (42%) and taxis (40%). Businesses could lose out on custom if they refuse to adapt to the contactless revolution, as 30% people in the UK would go to another shop if the vendor didn’t accept card payments.

This highlights the importance of card transactions if a business is going to be able to survive today’s market.

Cash certainly still has its uses though, as nearly 70% of Brits said they pay their children’s pocket money in cash.

Guy Moreve, Head of Marketing at Paymentsense, says: “As a society, we’re close to becoming cashless, as our asset highlights which UK cities are the most advanced in terms of payment solutions. There’s areas of the UK that are adapting to this movement, but others that haven’t made the list need to improve and move with the times.

“The study further highlights the average person’s diminishing availability of cash, as many struggle when it comes to everyday, cash-only services such as car parks and taxis, and the importance of accepting card payments within these businesses.”

Credit source: https://www.paymentsense.co.uk/capital-of-card-payments/

Methodology

Survey was conducted by OnePoll using 2000 UK participants on behalf of Paymentsense. Paymentsense are a low cost card payment solutions company. All data or a data breakdown can be sent on request. Card transaction data compiled by Paymentsense and a full breakdown can be provided on request. Each section of the asset reveals the top performing city based on total transactions. This is then broken down to Contactless, Credit and Debit cards.

Source: https://www.paymentsense.co.uk/