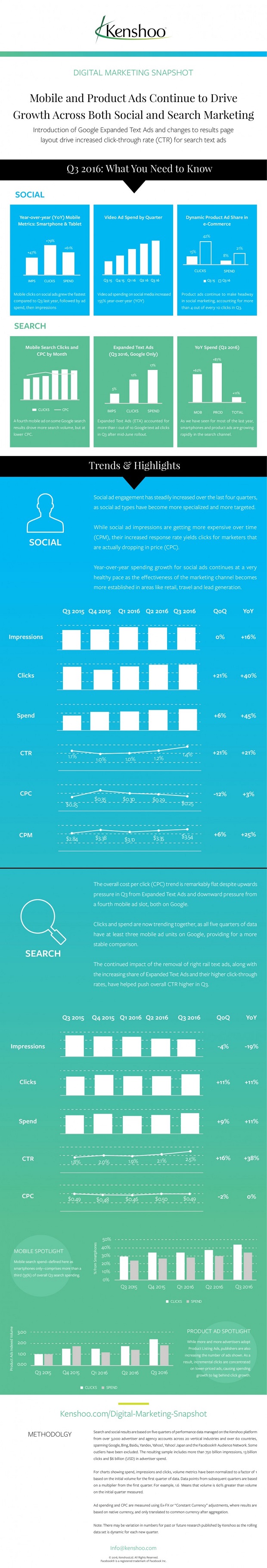

Online retail advertisers are flocking to specialised product focused ads on the likes of Facebook, Instagram and Google according to a new global study of search and social advertising.

The research, from Kenshoo, indicates that video advertising on social media has also increased dramatically and mobile continues to be a key driver of growth.

Engagement rates (CTR) in paid search are increasing as Google’s search listings page becomes more unified around the mobile experience.

Key findings of the research, which is based on an analysis of more than 750 billion impressions, 13 billion clicks and $6 billion (USD) in advertiser spend, are:

• Spend on Dynamic Product Ads on Facebook and Instagram, introduced in 2015 to help online retailers promote multiple products through social, has nearly doubled (up 95%) since the traditionally busy fourth quarter of last year. They, now make up more than four out of every ten clicks (42%) and 21% of spend on online retailers’ social ads.

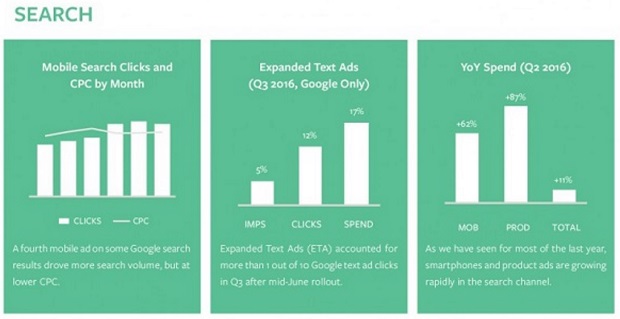

• Search advertising spend on retailers’ Product Listing Ads (PLAs), which include product images and information appearing in the “Shop for” boxes in Google search results, has shot up 87% in a year. PLAs now account for 37% of online retail search clicks and 22% of spend, with 59% of clicks coming from smartphones.

• Spend on social video ads, available on both Facebook and Instagram, has increased 155% in a year and video now accounts for 22% of social ad spend

• Consumers are engaging more with social and search ads. The click-through rate (CTR) on social ads is up 21% since last year. In search CTR is up 38% – influenced by the evolution of Google’s search listings page as it becomes more unified around the mobile experience

• Social ad spend directed at mobile (smartphone + tablet) has increased by 61% YoY with mobile devices now accounting for 70% of all paid social clicks. In search, mobile spend and clicks are up 39% and 48% respectively since last year. Mobile now accounts for 35% of all search spend and 43% of all clicks

Spend on Dynamic Product Ads on Facebook and Instagram, introduced in 2015 to help retailers promote multiple products through social, has nearly doubled (up 95%) since the traditionally busy fourth quarter of last year. They now make up more than four out of every ten clicks (42%) and 21% of spend on online retailers’ social ads.

At the same time, search advertising spend on retailers’ Product Listing Ads (PLAs), which include product images and information appearing in the “Shop for” boxes in search results, has shot up 87% YoY, surpassing the seasonal peak reached in Q4 last year. PLAs now account for 37% of online retail search clicks and 22% of spend, with 59% of clicks on these ads coming from smartphones.

In paid search the click-through rate (CTR) has jumped significantly – 38% YoY – influenced by the evolution of Google’s search listings page as it becomes more unified around the mobile experience. Changes contributing to this trend include the reduction in the number of ad slots since right hand side ads were taken away on desktops, and the emergence of the new Expanded Text Ads (ETAs), which have more headline space and more ad text to attract searchers. Many advertisers have started switching to the ETA format, which was introduced in mid-June and by September 2016 Kenshoo’s data suggests it accounted for 29% of spend on keyword ads.

The findings of the Kenshoo study are presented in a new infographic, Kenshoo Digital Marketing Snapshot: Q3 2016, highlighting key quarterly global metrics and benchmarks for social advertising and paid search based on five quarters of performance, analysing more than 750 billion impressions, 13 billion clicks and $6 billion (USD) in advertiser spend through the Kenshoo Infinity Suite.

The growth of social video advertising, available on both Facebook and Instagram, has been another significant trend, with spend increasing 155% YoY and video now accounting for 22% of social spend and 16% of clicks. The increasing specialisation of social ad types, including greater use of dynamic product ads, video and app ads on Facebook and Instagram, combined with improvements in targeting, has contributed to higher engagement on social advertising, with CTRs up 21% YoY and a 40% jump in total clicks in Q3 compared with last year.

In both social and search mobile continues to underpin growth. Social ad spend directed at mobile (smartphone + tablet) have increased by 61% YoY. Mobile devices now account for 70% of all paid social clicks, 59% of spend and 49% of impressions, making mobile a key factor in why overall spend on social advertising has risen 45% since last year. In search, mobile spend and clicks are up 39% and 48% respectively since last year so mobile is a major driver behind the 11% overall rise in paid search spend since last year. Mobile now accounts for 35% of all search spend and 43% of all clicks.

Rob Coyne, Kenshoo’s Managing Director for EMEA, said: “In both social and search, advertisers are showing increasing sophistication and embracing the opportunities and changes. The growth in product ads and video demonstrates social advertisers’ growing confidence in using the available ad types – while rising CTRs reveal that consumers are more willing to engage. In search there’s a similar trend towards product advertising with the continuing rise of PLAs, and advertisers are adapting to the changing layout of the search page and the emergence of Extended Text Ads. The ever-increasing role of mobile continues unabated in both channels.”

Methodology

Search and social results are based on five quarters of performance data managed on the Kenshoo platform from over 3,000 advertiser and agency accounts across 20 vertical industries and over 60 countries, spanning Google, Bing, Baidu, Yandex, Yahoo!, Yahoo! Japan and the Facebook® Audience Network. Some outliers have been excluded. The resulting sample includes more than 750 billion impressions, 13 billion clicks and $6 billion (USD) in advertiser spend.