Convenience stores thrive of distress purchases and impulse needs. Their business has been largely untouched by ecommerce -until now.

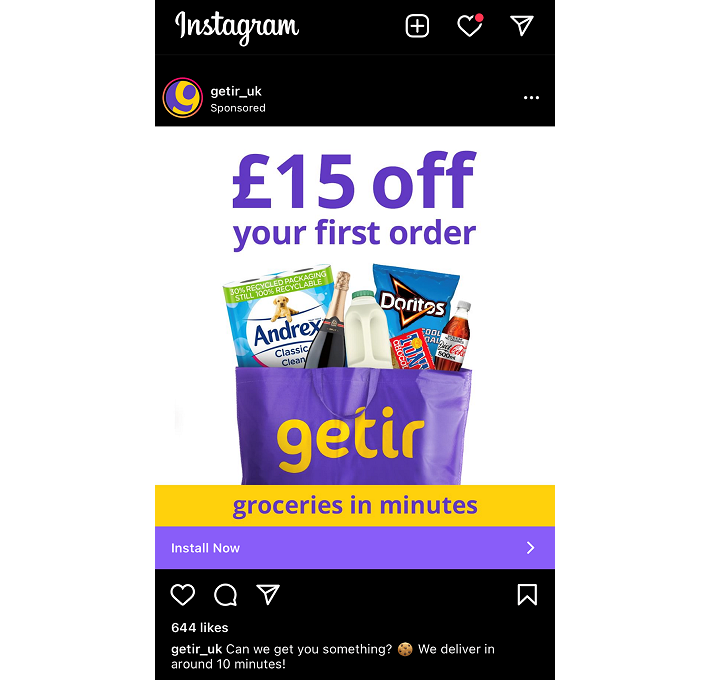

Delivery companies like Glovo in Barcelona and Getir in Istanbul spotted a gap in the market several years: delivering a range of a few thousand household items within minutes to the door. Now venture capitalists have seen the market potential, they’ve gotten their funding and are rolling out fast. And there are a dozen me-too businesses all fighting to create brands that will be synonymous with quick delivery and being a fast acting supermarket.

How do 15 minute deliveries work?

A new era of home delivery has begun, with the promise of thousands of grocery items delivered to your door within minutes of placing an order. This is a game-changer in ecommerce, because it turns convenience store shopping into ecommerce shopping for the first time.

• These businesses like Glovo and Getir carry stock in small local warehouses nick-named “dark stores”

• The marketing proposition is all about speed

• The business model of bike couriers is geared to cities

• To retain market share, traditional retailers are fighting back – forming new distribution partnerships to match or chase the delivery times

• This is a disruption model within ecommerce that itself was disrupting shopper behaviours

Supermarkets fighting back

So what of the sleeping giants – the Wallmarts and Tescos that dominate grocery in so many countries? Those giants are awakening, and the developments in the UK are a good laboratory for exploring what other many countries are starting to see – or at least will be.

This month the national Asda chain in the UK launched its “1 hour delivery” express service. Tesco, who’s £36bn turnover gives a sense of the value they want to protect, are believed to be evaluating similar.

Asda, currently the UK’s third-biggest supermarket, has entered the rapid delivery battle with a trial to give customers the option to order 70 items from its full range of 30,000 products and receive them within 60 minutes.

The Express Delivery service will be limited to customers near three shops in Halifax, Rotherham and Poole with the potential to launch at more stores if it proves popular. Asda is also expanding its Uber Eats fast service to 300 shops.

Asda customers can also order a larger basket and select a slot within the next four hours, with no limit on the number of items able to be purchased. There is potential to quickly roll out the service to more stores if it proves popular with customers.

Express Delivery customers can also use a new feature letting them track the progress of their order from store to doorstep in real time. Each delivery will be charged at the flat rate of £8.50 and there is no minimum spend per basket.

In addition to launching a new Express Delivery service, Asda is also extending its partnership with Uber Eats from 200 to more than 300 stores, offering customers the opportunity to shop a range of 500 products including fruit, vegetables, beer, wine and spirits and meal solutions for rapid delivery.

Simon Gregg, Asda’s Vice President of Online Grocery, said: “After successfully trialling an Express Delivery service, we know this is something that our customers want as part of our online grocery proposition and we are delighted to be able to offer this service to even more customers.

“The launch of our new Express Delivery service and extension of our existing partnership with Uber Eats to 300 stores means that customers can get their order delivered to the doorstep at market-leading pace.”

The move follows Tesco saying that it would be expanding its own Whoosh one-hour service to more stores across the UK. The Supermarket launched the rapid delivery service, which would allow the supermarket chain to deliver groceries to customers within an hour, in late May.

It has seen soaring online growth during the Covid-19 pandemic but has so far refrained from following rivals into the on-demand grocery space.

The retailer recently saw its sales rise 0.5 per cent year-on-year to £10 billion in the 13 week period ending May 29.