The UK tech industry has expanded 10 fold in the last 10 years, enabling the creation of hundreds of fast growing tech companies that are set to challenge Silicon Valley in the coming decade, according to analysis by Dealroom.co and the Digital Economy Council.

Key findings:

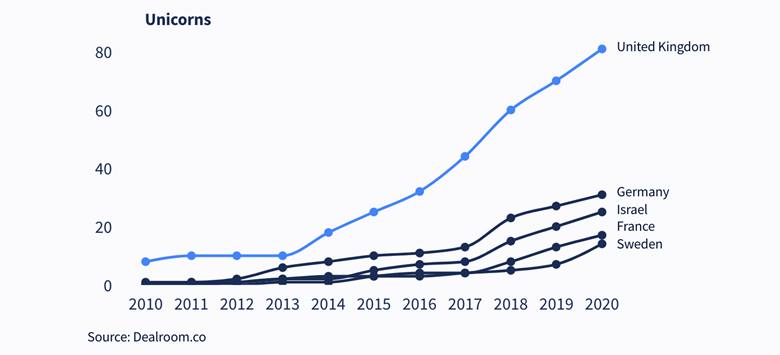

• In the early days of the industry in 2010, the UK had 8 unicorns. By 2020, it was 81

• At the same time, tech investment grew from £1.2bn in 2010, to £4.1bn in 2015, and £11.3bn in 2020

• By comparison, France, Germany, Sweden and Israel has created a combined 85 unicorns by 2020 and only France and Germany raised over £4.3bn in VC funding last year

• This demonstrates the strength of the UK tech industry, with sustained investment helping to develop the world-beating tech companies that have transformed how we live and work

Since 2010, the UK has experienced a sustained increase in the venture capital flowing into the tech sector, which has resulted in a huge expansion in the number of startups that are scaling rapidly in sectors as diverse as fintech, food delivery, e-commerce and healthtech. This week UK businesses meet to take part in Scaleup Week, which brings together companies from across the UK to discuss the challenges and opportunities of building a fast-growing business.

10 years of unicorns and futurecorns

Over the course of 10 years, the number of unicorns – private tech companies valued at $1bn or more – has increased from 8 in 2010 to 81 in 2020. Unicorns from 2010 including Betfair, Admiral Group and Ocado are now household names. Meanwhile the number of futurecorns – companies capable of growing into a unicorn – has accelerated from 10 to 126 in 2020. Over the same period, venture capital investment into the UK has increased from £1.2bn in 2010 to £11.3bn 10 years later.

These numbers demonstrate the extent to which the UK is catching up with the US and China in tech, with London now fourth behind the Bay Area, Beijing and New York, when it comes to the number of startups and unicorns created. No other European country has been able to grow at such a speed.

While France has invested millions of euros in its startup ecosystem, in 2020 it had only 17 unicorns, up from zero in 2010. Germany had 1 unicorn 10 years ago and 31 in 2020 – including companies such as insurtech platform Wefox, neobank N26 and travel e-commerce platform Omio.

Digital secretary Oliver Dowden said: “UK tech has seen record levels of growth over the last decade, turning a nation of startups into one of scaleups. Investors are interested in backing UK startups because of a combination of cutting edge research, skilled engineering and tech talent and operators who understand how to build a strong, sustainable business. This Government will do all it can to support the entrepreneurs who have created this vibrant new part of our economy and which now employs almost 3 million people right across the country in both our world-renowned tech centres like London and Cambridge to our cities, suburbs and rural areas.”

Growth continues in 2021

During 2021, the total number of unicorns and futurecorns has continued to grow. The UK has now created 91 unicorns – private companies valued at $1bn (£718m) or more – which are transforming how we live and work, including Hopin valued at £4bn, Zego, which recently reached unicorn status and Wise, valued at £3.5bn. A further 132 companies are now regarded as ‘futurecorns’ – companies with a value of between $250m (£179m) and $1bn (£718m) – which are on a path to unicorn status.

The UK’s top 15 futurecorns by valuation in 2021:

1. Zopa – digital bank (London)

2. Moonbug – global kids entertainment company (London)

3. Atom Bank – the UK’s first neobank (Durham)

4. Wejo – global leader in connected car data (Manchester)

5. Vashi – ethically-sourced engagement rings and fine jewellery (London)

6. Gigaclear – rural broadband provider (Abingdon)

7. Bloom & Wild – direct to consumer letterbox flowers (London)

8. Truphone – global leader in digital connectivity software (London)

9. Zilch – buy now pay later fintech provider (London)

10. Tripledot Studios – mobile gaming company (London)

11. Gryphon Group Holdings – insurtech revolutionising family insurance (London)

12. Pollinate – fintech giving banks a modern toolkit for small businesses (London)

13. Agriprotein – creates insect-based protein to replace fishmeal (Guildford)

14. Bulb – renewable energy provider (London)

15. Thought Machine – next-generation core banking platforms (London)

Though the majority of the futurecorns are based in London (83), high-growth scaleups can be found all across the UK. Cambridgeshire and Oxfordshire have 10 scaleups and 11 scaleups respectively, including Oxbotica, which is building autonomous vehicle technology and Cambridge Quantum Computing, which develops quantum solutions to tackle some of the industry’s most pressing challenges like cybersecurity.

The North West has five futurecorns, most recently Matillion which allows businesses to harness the power of data and raised $100m (£70.7m) in funding in February. In Scotland there are four fast-growing scale-ups including Amphista Therapeutics in Motherwell, a biopharmaceutical company creating therapeutics that harness the body’s natural processes to remove disease-causing proteins, and Roslin Technologies in Edinburgh which is developing pioneering innovations to make the agriculture and animal health sectors more sustainable. The fintech company Sonovate is Wales’ only futurecorn. An invoice finance and back-office recruitment platform for agencies and consultancies, Sonovate raised £110m in its latest Series C funding round.

Sustained investment provides the environment for growth

Tech companies across the UK raised a collective £11.3bn in funding last year, 10x the investment raised in 2010 at £1.2bn. That’s more than every other country except China and the United States, and 250% more than the EU’s largest economy, Germany. Since 2015, total UK venture capital investment has been higher in every year than that in France, Germany and Israel. Overseas investors from the US and Asia have been increasingly attracted to the UK’s fastest-growing companies.

Whilst venture capital investment used to be concentrated at early stages, with 64% of funding going to companies at Seed, Series A and B rounds in 2016, for the past two years more than half of VC investment has been at later stages. This is helping to build the UK’s next generation of tech stars, contributing significantly to the maturity of the UK tech sector and the increasing number of potential unicorns across the country.

Over the decade, the sectors that have created the most unicorns in the UK were fintech (32), enterprise software (14) and health tech (13), including companies such as Wise, Starling Bank, Darktrace and Babylon Health. This correlates with UK venture capital investment figures where the fintech, health and enterprise software sectors consistently attract the most capital. In 2020 alone, UK fintech companies raised £3.2bn and this steady flow of investment is helping to support and develop these innovative companies

Industry comment

Stephen Kelly, chair of Tech Nation, said: “The rate of growth in the UK tech ecosystem in the last 10 years has been immense and we are confident that there is more to come. The UK now has an incredible 132 futurecorns, more than France and Germany combined which demonstrates the extent to which the UK is leading Europe. Tech Nation will continue to work closely with entrepreneurs and the Government to give us the best chance of building truly dynamic and sustainable tech businesses.”

Renè Rechtman, Moonbug co-founder and CEO, said: “We set out to create the next generation kids’ entertainment company and now only three years later we are amongst the world leaders. We have created some of the most influential kids’ brands today and we are continuing to expand our franchises to more shows, platforms and products. The UK has been a great hatching ground for us as we are building a global business across the US, UK and Asia.”

Vashi Dominguez, Vashi founder and CEO, said: “Jewellery should be an expression of your story, not another brand’s story. For generations you have had to buy the same ready-made jewellery as everybody else, to express something that should be personal, unique and individual to you. Based in tradition, but reinvented for now, Vashi makes truly personal jewellery more accessible and transparent through technology. It’s a pleasure to work daily with people I admire, but we have only achieved 1% of my vision to date. We have exciting plans for Vashi to scale in the UK and go global imminently.”

Ralph Steffens, Truphone CEO, said: “Since day one, it’s been in our DNA to innovate, to adapt and to drive transformation for our customers and for the industry. The UK has proven remarkably fertile ground for this journey. Now, our engineering hubs here and around the world are developing new software and new solutions to fully digitise cellular connectivity — at a speed and specificity that is blowing past the rest of the industry.”

Philip Belamant, Zilch founder and CEO, said: “At Zilch we’re transforming the buy-now-pay-later market, putting consumer financial wellness at the heart of our business. We use Open Banking technology combined with soft credit checks to ensure consumers are only borrowing what they can afford and we’re one of the first fully FCA-regulated BNPL product. We’ve had an amazing few years growing in the UK and we can’t wait to launch Zilch in the US and Europe.”

Yoram Wijngaarde, Dealroom.co founder and CEO said: “UK startups raised €1.3B in the whole of 2010. They raised the same amount in the first three weeks of 2021. Emerging hubs continue to be inspired by the UK ecosystem’s journey from an eccentric cluster of companies around a grim roundabout to the successful global companies we see now. With continued policy innovation, research investment, and the right talent, the UK can build on the momentum into the next decade, as the beating heart of a European tech ecosystem turning global heads.”

Julian Rowe, general partner at Latitude, said: “With everything we’ve gone through over the past year, UK tech has been integral to supporting people throughout the pandemic. Tech is increasingly a need to have, not a nice to have, and innovative, research-based companies like Vaccitech, which was integral to the development of a Covid-19 vaccine, demonstrate how the UK is producing world leading tech and life science companies.”

Suzy Pallett, London Tech Week Festival Director said: “It’s an incredible achievement for London to become the fourth biggest city in the world for tech start-ups and unicorns, but it’s not surprising. The Capital has a thriving support structure driving the success of tech companies of all sizes, from creating and attracting the best talent, to nurturing world-class innovation and R&D; all of which is a magnet for domestic and international investment.”

Russ Shaw CBE, founder of Tech London Advocates and Global Tech Advocates, said: “The extraordinary growth of the UK’s tech sector is now held up around the world as a model that new tech hubs seek to emulate. The increase in unicorns and investment over the last decade is testament to the unique combination of entrepreneurs, tech talent, investors and Government support that has made the country such a vibrant tech nation. The UK has become a global capital for fintech and billion-dollar tech companies, my hope is that in the next ten years it becomes equally renowned for its diverse and inclusive tech ecosystem, for enabling everyone to access digital skills and for championing emerging verticals like AI, cybersecurity and e-commerce.”

Rana Yared, general partner at Balderton Capital and investor in Darktrace and Revolut, said: “The strength and variety of the unicorn companies here demonstrate the calibre of tech talent coming out of the UK, and Europe broadly. From fintech to healthtech, insurtech and food, these businesses will go on to be global leaders in the same way that companies like THG, Checkout.com and Revolut have. It’s a really exciting time to be a part of the UK tech ecosystem and to have a front-row seat to how these companies grow and develop over the next few years.”

Harry Briggs, managing partner at OMERS Ventures, said: “The UK has a great track record for high-growth tech companies, thanks to careful cultivation of the ecosystem that attracts some of the world’s best entrepreneurs to set up here. We must continue to provide the conditions for start-ups and scale-ups to thrive, to ensure that the UK hosts more of the next generation of world-leading companies.”

Andrew Elder, partner at AlbionVC, said: “Given the year we have had it is not surprising to see the healthtech sector gaining ground. This is something we’ve been particularly keen to support at AlbionVC. The healthtech futurecorns being developed in the UK will go on to transform how we treat and manage conditions all around the world and we couldn’t be more proud to be part of this brilliant industry.”