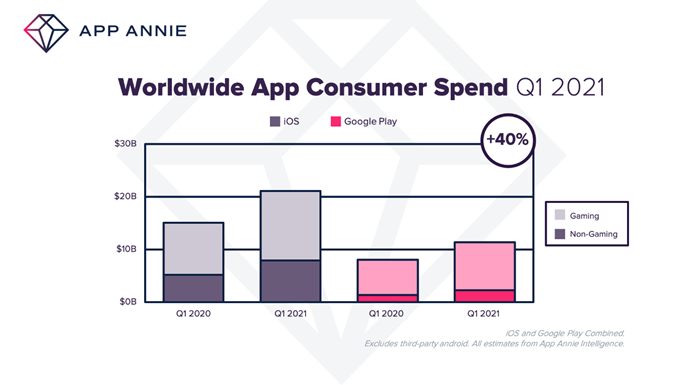

Global spend on apps rose 40% in one year, as lockdown increased time spent on phones and tablets, according to new data.

The research, from App Annie, looked at the full impact of global lockdowns as global spend on apps, with $32 billion on in-app purchases across iOS and Google Play globally in Q1 2021. It’s the biggest quarter since records began – and the figure is 40% up on the same quarter for 2020.

The numbers illustrate the remarkable impact that the pandemic has had on the app market. Q1 2020 was the first period of global lockdowns. Stay at home orders forced consumers to seek out indoor stimulation, and they found it on their smartphones, through games and other highly engaging apps such as video streaming and social sharing platforms.

As a result, the market grew at unprecedented speed.

- Smartphone users spent around $9 billion more on apps in Q1 2021 than they did in Q1 2020.

- The growth in Q1 2021 was shared equally by the two platforms. Consumer spend grew 40% year over year to $21 billion on iOS, and by the same percentage year over year to around $11 billion on Google Play.

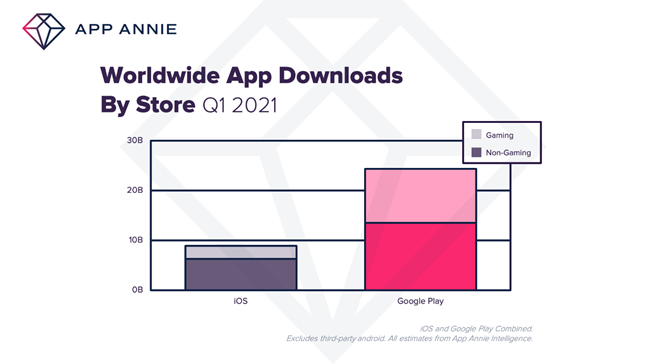

- Total downloads also grew significantly. Downloads on both iOS and Google Play combined rose by around 10% to 31 billion in the quarter.

Downloads of iOS Health and Fitness Apps Rose 25% Quarter Over Quarter

- On Google Play, in terms of spend, Games, Social and Entertainment saw the strongest quarter over quarter growth.

- On iOS, the largest categories by growth were Games, Entertainment and Photo & Video.

- The best performing categories by downloads were slightly different. On Google Play, Social, Tools, and Finance enjoyed the biggest growth quarter over quarter. But there were strong showings from Weather (40%) and Dating (35%).

- On iOS, the biggest gains were recorded by Games, Finance and Social Networking.

- However, the most eye-catching move was Health and Fitness. Downloads of these apps rose 25% quarter over quarter as consumers look for new, interactive ways to keep moving while staying at home.

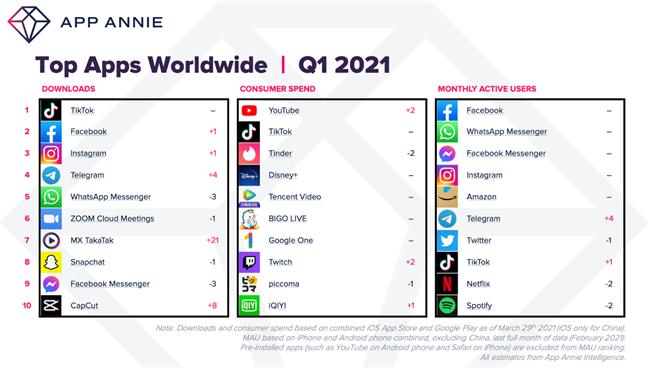

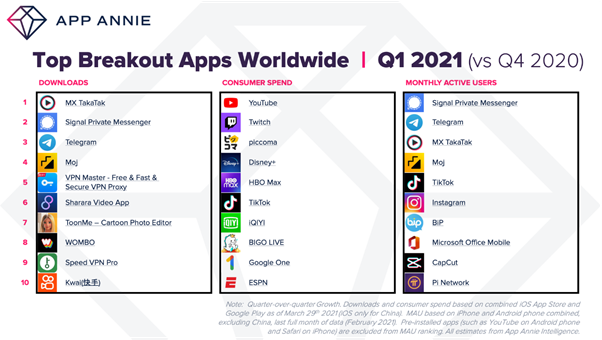

- The list of the world’s most popular non-gaming apps is populated by the expected evergreen products. TikTok, YouTube and Facebook were the top apps by downloads, spend and MAU. However, the breakout chart of apps that gained the most quarter-over-quarter growth reveals some interesting insights.

- It’s telling that Signal, a privacy-focused messaging app, was the quarter’s fastest growing product by downloads and MAUs – and that the similar Telegram was at number 3 and 2. The other notable breakout app was MX Takatak, which serves the growing demand in short user-generated video content in India, part of the current trend of rapid growth of home-grown publishers. According to App Annie estimates, it was the fastest growing app by downloads in Q1 2021.

Gaming Smashes it Again as Total Consumer Spend in Q1 2021 Hits $22 billion

- In Q1 2021, as ever, gaming proved to be the most influential category in the overall app market.

- Gamers downloaded around a billion titles every week in the quarter, while total consumer spend on gaming hit $22 billion. iOS gamers spent the most at $13 billion (up 30% year over year), while gamers spent $9 billion on Google Play (up 35%).

- The growth in downloads was less pronounced, but still impressive. In Q1 2021 gamers downloaded around a billion games every week. This is 15% up on 2020, and 35% up on the weekly average for Q1 2019. Google Play game downloads grew 20% year over year to 11 billion.

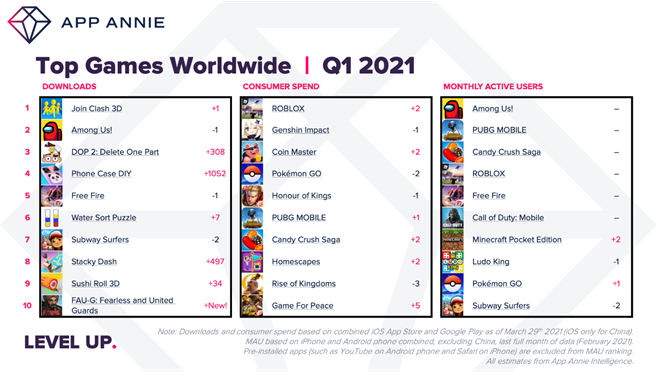

- The quarter’s most downloaded game was Supersonic Studio’s hyper casual survival game Join Clash 3D. It swapped places with Among Us! at number 2. But further down the chart there were some eye-catching new arrivals.

- In at number 3 – rising 308 places – was DOP 2: Delete One Part. SayGame’s brain teasing title challenges players to swipe part of a drawing and see what lies behind it. The puzzles get harder as the player progresses.

- At number 4 is Phone Case DIY, which leapt 1052 places in the quarter. The app was created by Australia’s Enter Crikey and published by CrazyLabs. It’s a hyper casual game that invites players to design their own phone case. Enter Crikey developed it after spotting a viral trend for phone design videos on social media.

- There was less change in the games charts by spend and monthly active users (MAU). Genshin Impact remained the second most successful titles by consumer spend, after securing top spot in Q4 2020. The continuous success of the title further exemplifies how far mobile has gone in terms of being able to offer console-quality experiences, as game publishers are increasingly prioritizing mobile as part of their platform of choice to expand their user base, and provide regular content updates such as additional characters and quests which further boost engagement and in-app-purchases.

- The MAU chart was even more stable with no change at all over the quarter in the top six titles: Among Us!, PUBG Mobile, Candy Crush Saga, ROBLOX, Free Fire and Call Of Duty : Mobile.

- For all the stability at the top, there were still plenty of notable games posting huge leaps in spend and users. Top of the ‘breakout’ chart in terms of consumer spend was Uma Musume Pretty Derby. It was based on a very niche but successful comic series and animated show in its primary market of Japan before being adapted as a mobile game for both iOS and Google Play in February 2021.

- The quarter’s biggest ‘breakout’ game by active users was Project Makeover, which offered a unique take on the casual puzzle genres by combining familiar match-3 mechanics with fashion, make-up and home decoration themes to bring more diversity and to keep players engaged.

- Ultimately, mobile gaming is at record highs as we head into Q2 2021. The pandemic accelerated this growth with game downloads outpacing overall downloads by 2.5x in 2020.

- In 2021, mobile gaming is set to reach $120 billion in consumer spend, 1.5x all other gaming formats combined. Mobile gaming strategy — product development, partnerships, international expansion, user acquisition, marketing, monetization and retention — is more important than ever before, and gaming publishers need to have a clear view of the market and the road ahead.

You can also find out more details on this story on App Annie’s latest blog here.