2020 saw subscription video on demand (SVOD) viewing time skyrocket by 43%, according to new data from Samsung.

Samsung Ads Europe has launched a new report, revealing insights from the full year of 2020 that show how viewership has dramatically changed.

‘Decoding the on-demand TV landscape’ explores the video on demand (VOD) landscape in detail, revealing that in Europe, SVOD viewership on Samsung TVs grew by 35%, while AVOD viewing time grew by 74% – emerging as a key trend for advertisers to watch.

Samsung Ads Europe, the media and advertising division of Samsung Electronics, leveraged insights from millions of Samsung Smart TV devices across ‘EU5’ countries: UK, Germany, France, Spain and Italy. The report reflects the increasing fragmentation of all TV audiences, not only across linear and OTT but across streaming types within OTT itself.

The report reveals that for the full year of 2020, viewing time has increased across all areas of television. Time spent streaming on Samsung TVs in Europe has increased by 61% to two hours and 53 minutes per day. By comparison, time spent watching linear TV on Samsung TVs is up 34% to two hours and 30 minutes. When looking at the UK specifically, time spent streaming on Samsung TVs is up by 62%, to three hours and five minutes per day, while time with linear TV averages two hours and 24 minutes per day.

The data also identifies a growing set of viewers who consume no linear content at all on their Samsung TV. The ‘Streaming Only’ TVs last year grew to 17% of UK devices – a steady growth from 14% in January 2020.

SVOD begins to mature

In absolute terms, SVOD has continued to show huge growth in viewing time on Samsung TVs in 2020, growing to account for 55% of UK streaming time. However, its share of total viewing time within the streaming environment has started to plateau, increasing by 1% in the UK but dropping by 1% over 2020 in Europe. This suggests that some viewers have perhaps started to reach ‘maximum spend’ on monthly subscriptions but are expanding their sources – looking for free content alongside their subscription packages.

AVOD – a growing trend in CTV

Ad-supported video on demand, while still in its infancy, is showing exciting potential as an emerging trend for advertisers to watch. The average time spent viewing AVOD on Samsung TVs grew at a rate of 74% year on year in Europe. In the UK, by the end of 2020 Brits consumed a total of 1 hour and 17 minutes of AVOD content per day on their Samsung TVs, up from 48 minutes at the start of the year. The arrival and growth of ad-supported streaming platforms such as Rakuten TV, Pluto TV and Samsung TV Plus may have contributed to the relative growth for AVOD.

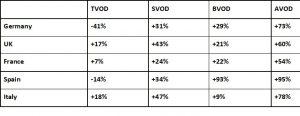

AVOD and SVOD viewing time grew most rapidly across the UK, Germany, France and Italy

AVOD and BVOD showed the strongest growth in Spain

Source: Samsung Proprietary Data. Streaming Time Variance (Hours per day per TV) Jan-Dec 2020

Samsung TV Plus

The demand for free, premium curated content has been reflected in the growth of Samsung’s free ad-supported streaming service, Samsung TV Plus, which delivers both live and on demand streamed TV. Throughout the past year the number of Samsung TV Plus viewers has grown by 110% across Europe. Interestingly, 43% of the TV Plus audience watched less than four hours of linear TV per month in the last quarter of 2020.

Alex Hole, Vice President of Samsung Ads Europe, commented: “Last year was a disruptive year for every industry. It’s clear that in TV, the events of 2020 accelerated growth but also fragmentation across formats. Our report reflects the fact that the evolution of viewership is incredibly complex. Even within the fast-growing streaming category, audiences are fragmenting across OTT environments.”

“As viewers get used to choosing what and when they watch, advertisers have an opportunity to evolve around those choices. The growth of streaming shows that appetite for content is only growing. This is a trend we expect to see continuing into 2021 as content options proliferate and viewers increasingly ‘go with the sh67ow’, hunting for new ways to find favoured content. This is an exciting time for advertisers looking to connect with viewers on the biggest screen in the home.”

Methodology

The insights and trends contained within this white paper are derived from proprietary, deterministic Samsung TV device data powered by Samsung ACR technology in Europe to understand linear viewership and OTT app usage. EU five represents consolidated average viewing data across the United Kingdom, Germany, France, Spain, and Italy. Samsung compared changes in 2020 (weeks 2–52 for weekly data, January-December for monthly and Q1–Q4 for quarterly). It is important to note that as the streaming landscape keeps evolving with new channels and apps being added to Samsung TVs globally together with the increasing growth of Samsung Smart TV universe (number of TVs), the insights will be reflective of this constant change and the variation in data during different study periods is expected. Samsung Ads Smart TV insights are not projected to a national population, but they represent viewing behaviour from millions of Samsung TVs across Europe.