Consumer electronics, sporting and consumer goods saw an uptick in digital ad spend towards the end of 2020, while hospitality, entertainment, travel, leisure & tourism reduced spending as the long-term effects of the Covid-19 pandemic are felt across many industries.

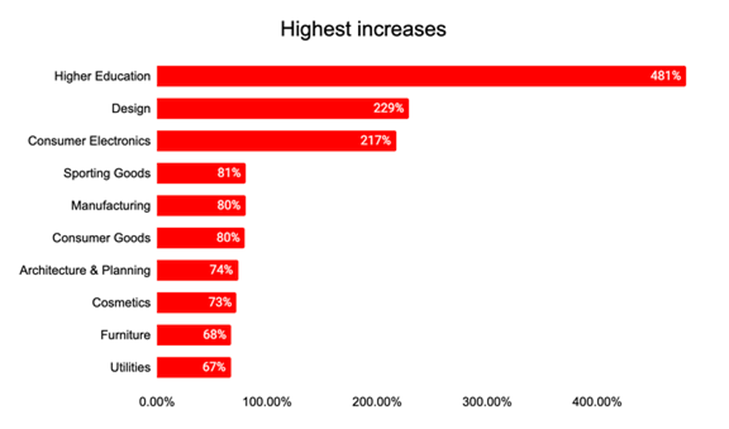

The research from Improvado shows that with more consumers forced to spend time at home during the pandemic lockdowns, the consumer electronics (+217%), sporting goods (+81%), consumer goods (+80%), furniture (+68%) and utilities (+67%) industries saw the highest increases in digital ad spend by the end of 2020,

Smaller, but significant, increases in ad spend budgets were apparent in the insurance sector (+2%), along with hospital & healthcare (+12%), financial services (+13%), food production (+16%), non-profit organisations (+17%) and business supplies and equipment (+17%).

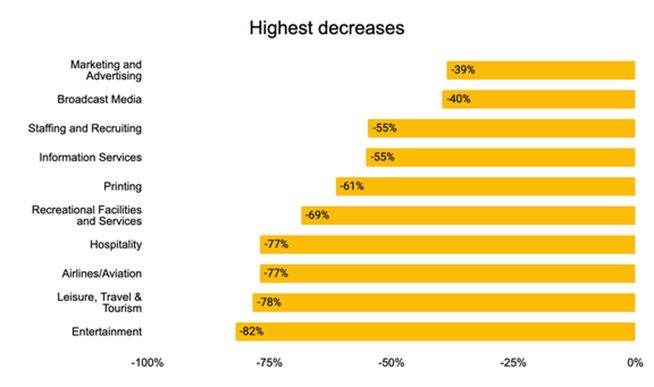

At the other end of the scale, industries which generally rely on large crowds of customers coming together, such as entertainment (-82%), leisure, travel & tourism (-78%), airlines & aviation (-77%), hospitality (-77%) and recreational facilities (-69%), saw the most significant drop in ad budgets during this time, in no small part due to the tough and stricter restrictions on consumers being able to use their services.

The computer software (-4%), real estate (-5%), information technology (-6%), construction (-8%), luxury goods & services (-11%) and automotive (-12%) industries also noted smaller declines in ad spend during this period.

Experts in marketing data management and aggregation, the purpose of this research was for Improvado to explore the changing nature of digital ad spend across all brand categories on Google Ads during the Covid-19 pandemic. Gathering data from third party services including SEMrush, SpyFu and SimilarWeb Pro, it looked at Google Ads spend estimates across 6,000 US companies and found that overall spending on Google Ads increased by 20%.

“Since Improvado is the leader in marketing specialized Data Extraction & Transformation, we were able to see first hand many trends in the past year, some more obvious than others,” said Courtney Griffin, VP of Global Sales at Improvado.io. “Of course we knew Travel/Entertainment was hit but it was interesting to learn where businesses and consumers invested more heavily, especially the extremely high increase in Higher Education. It seems as though many consumers tried to make the most of a tragic situation and improve their learning and homes indoors.”

Improvado also tracked these figures against the same research carried out at the beginning of the pandemic to compare and contrast these findings with the situation then, revealing some stark contrasts in how digital ad spend increased and decreased across industries during this time.