The UK ad market is now not expected to recover fully until 2022, as the global pandemic continues to hit marketing budgets, according to the latest WARC adspend forecast.

Figures from the latest Advertising Association/WARC Expenditure Report forecast slower growth in 2021 than previously expected, with any gains made in 2021 unlikely to offset this year’s losses, meaning the UK’s ad market is not expected to have fully recovered until 2022.

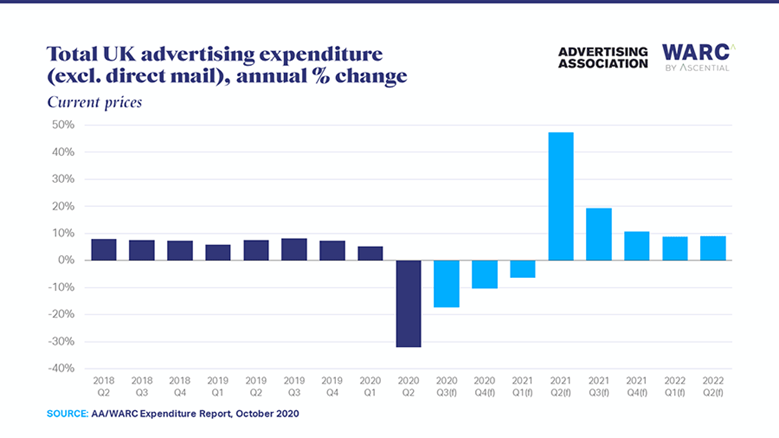

The report downgrades July’s 2020 forecast from a return-to-growth of 16.6% in 2021 to just 14.4%. Adspend is set to fall by 14.5% this year to £21.5bn as a result of the COVID-19 outbreak, equating to a loss of £3.6bn compared to 2019.

2020’s final quarter – typically a strong season thanks to the Christmas advertising boom – is set for a 10.5% drop compared to last year. In raw cash, that’s £724m less than 2019.

The biggest losses happened in Q2, when adspend fell by 33.8%: the worst ever quarter recorded, contributing to an overall first half dip of 14.9%, and £2bn lower than the same three months in 2019.

As expected, the formats that suffered worst were those that shut down outright, such as cinema, while others lost out from diminished consumer contact during lockdown. While online formats should be the obvious winners, none are back to the frothy heights of 2019.

“These stark figures demonstrate the strain that all parts of the advertising ecosystem were under during the second quarter. Large parts of our industry and the wider economy were effectively shut down”, said Stephen Woodford, chief executive of the Advertising Association.

“Events of recent weeks have shown this will be no straight-forward recovery as different parts of our country enter or leave local conditions at varying speeds. We must boost growth and support jobs through an advertising tax credit and a skills programme to aid colleagues facing unemployment. It is essential that our workforce, business, and Government work together on the recovery plan for our industry and our country.”

Some detail on 2021’s recovery: according to the forecast, cinema adspend is expected to rise by 138.3% as picture houses reopen and films that have been postponed make it to screens.

Other media predicted to perform well year-on-year include out of home (+57.1%), magazine brands (+18.8%) and regional newsbrands (+16.2%), underpinned by strong growth in their online formats. James McDonald, Head of Data Content at WARC noted that “advertising trade remains depressed, and the rising likelihood of sustained localised lockdowns over the winter, a disorderly exit from the European Union in December, and a prolonged economic recovery embodied by rising unemployment, now leads us to believe that the industry will not fully recoup this year’s losses until 2022.”

While the results will surprise few marketers who have lived through 2020’s turbulence, there are lessons. “There’s room for cautious optimism,” observes Azlan Raj, Chief Marketing Officer EMEA of the performance agency Merkle, “especially for those agencies using this period of turbulence as a time for reflection and re-evaluation.”

While a more online world (and advertising landscape) could see a pivot to performance, brands still matter, explains Shazia Ginai, CEO of NeuroInsight.

“As we head into the festive season – arguably one of the most emotional times of the year for people – many brands may need to reassess their current courses of action, or risk eroding those positive bonds in which they have invested so much. At a time when customers are seeking reassurance from the world around them, the potential rewards to be reaped could be massive.”

A sample report of the latest AA/WARC Expenditure Report figures for the Q2 2020 period, including 2020 and 2021 forecasts, is available here.

Industry comment

Ben Barokas, Sourcepoint co-founder and CEO comments: “The findings in the report come as no surprise as the world continues to feel the strain of the Covid-19 pandemic. However, it’s not just advertisers that have felt the pinch this year, as the domino effect of depleted ad spend is greatly felt by publishers, who are now struggling to generate revenue more than ever before. To curate a sustainable advertising ecosystem, brands need to maximise the remains of their budget and amplify return on ad spend by investing in compliant inventory. In turn, publishers need to ensure they are providing the highest level of compliance and consent on their sites. With the ‘Golden Quarter’ looking slightly dim, it’s important that publishers continue to diversify, providing readers with the option to consent to personalised advertising or pay with subscription as a good first step. Only by advertisers and publishers working together to build direct and transparent relationships with each other and their audience will we be able to successfully move into 2021 and beyond.”

Vihan Sharma, Managing Director Europe, LiveRamp, said: “It’s inevitable that 2021 will be another challenging year for the industry, but with these challenges comes a major opportunity for advertisers and publishers to innovate their strategies and make sure they drive the best returns in these difficult times. It goes without saying that any spend needs to be accountable. The key to this is identity and ensuring that messages are delivered to the most engaged audiences at the optimum time, and in the most privacy-centric way. Trust is imperative – consumers won’t share personal data without it, and distrust in the industry is the reason third-party cookies are rightly being phased out. The best approach to targeting consumers at scale in a respectful and engaging way is by implementing a first-party authentication strategy based on a trusted value exchange. Then, when brands activate on people-based identifiers that are connected to these authentications, they are also able to calculate and quantify return on ad spend through incremental campaign testing and analysis, which will allow them to consistently optimise. Placing consumers at the centre of digital strategies is crucial to building solid relationships that will redefine the value exchange in a privacy-first world. This is the first step to ensuring every pound spent is accountable, addressable and measurable, which is increasingly critical in the current landscape. Further, by employing a test, learn, optimise and repeat process, brands and publishers will be able to better sustain opportunities for ROAS and monetisation in spite of prevailing headwinds industry-wide.”

Craig Tuck, Chief Revenue Officer, The Ozone Project, said: “The latest AA WARC Expenditure Report paints a somewhat expected picture of an industry – like most others – that has had a very challenging year. However, while the pandemic might have made a significant dent in ad spend, its timing has forced the acceleration of changes that advertisers were demanding. This is particularly the case in digital where we’ve seen major challenges like programmatic supply chain transparency and how to navigate a cookieless future come even more to the fore. The result is advertisers taking a more considered and conscious approach to their media placements, to ensure they deliver the right outcomes in the right types of environments. While on the surface, the outlook may seem bleak and a full recovery a distant dream, we believe if we focus on solutions that truly put advertisers’ needs first, then we have every reason to be optimistic as we head into 2021.”

Ollie Vaughan, Chief Media Officer, Tug, said: “While disappointing, the downgrading of the forecast wasn’t completely unexpected given the reality of a ‘second wave’ facing the UK. As advertisers follow the changing media usage of their audiences during the pandemic, the strength of digital media is highlighted once more – for example, VOD being the only channel to grow in 2020 (by +1%) and Search and Online Display proving comparatively more resilient with a less than 10% fall. The forecast may appear bleak, but it also shows positives as advertisers become more adaptable and learn to experiment with other channels rather than pull activity altogether; hopefully signalling a much smaller ‘second wave’ of budget cuts in the industry than we saw in Q2 2020. Heading into 2021, agile advertisers with a strong digital presence will be the ones to come out on top – while those slow to react to changing consumer media habits will lose out to the competition – and it will be interesting to see whether the forecasted media landscape is temporary, or if a fundamental change has occurred that continues post-COVID.”

Lucy Hinton, Head of Client Operations, Flashtalking, said:“We have witnessed many companies scale back their ad spend as a short-term solution to lockdown and government restrictions, but what has become clear is those who continued with premium digital ad formats, such as dynamic ads and rich media, were able to adapt and respond to the growing online market quickly, and effectively. There are still pressures on marketer’s budgets, meaning companies must use the next few months wisely and reach consumers in impactful ways to stay ahead of the competition. Due to COVID, an even larger share of holiday shopping is being done online, which means marketers have access to a larger pool of consumer insights. Those that utilise this data, to create personalised and targeted dynamic ads, will be the ones to come out in 2021 on the front foot ”