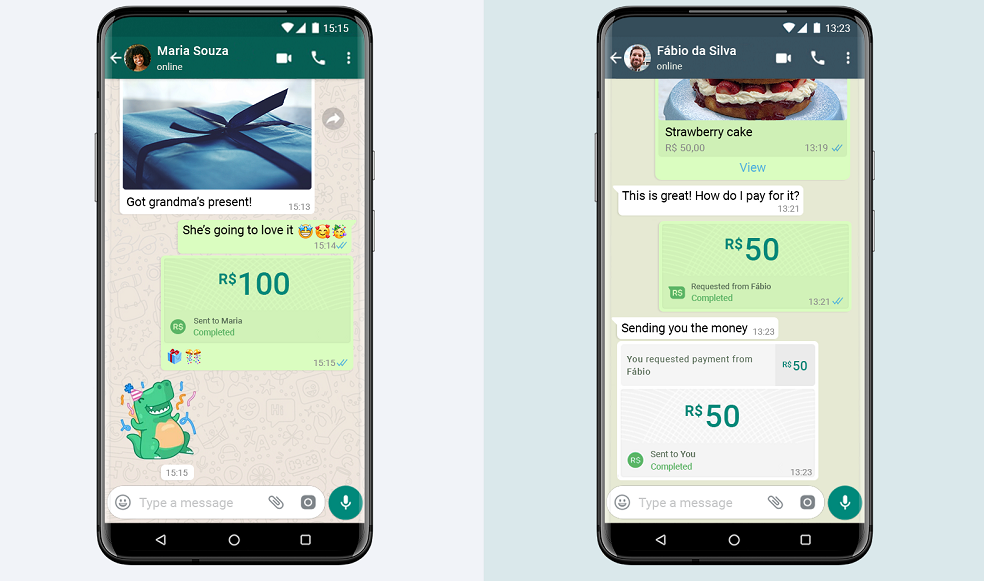

WhatsApp has launched its first in-app payments service, following a beta test in India.

The first service will go live in Brazil, with future plans to roll out to other regions, the company announced in a blog post on Monday.

The payments are enabled through Facebook Pay, which parent company Facebook said last year it would be rolling out to Instagram, Messenger, Facebook, and eventually WhatsApp.

“Payments on WhatsApp are beginning to roll out to people across Brazil beginning today and we look forward to bringing it to everyone as we go forward,” the company said in the post. WhatsApp says its digital payments are an open model that will allow it to add more partners in the future.

There will be no fees for consumers to use the payments service, but merchants will pay a processing fee to receive payments.

Users need to link a credit or debit card to their WhatsApp account, and transactions are secured with either fingerprint or a six-digit PIN. The company says it will support debit or credit cards from Banco do Brasil, Nubank, and Sicredi, and it’s working with Brazilian payments processor Cielo.

WhatsApp has had peer-to-peer digital payments in the works for some time. It launched a closed beta in India in 2018, and many expected that country to be the first official site for WhatsApp payments.

Facebook acquired WhatsApp for about $19 billion in 2014. As of February, the messaging service had more than 2 billion users.

Ian Bradbury, CTO of Financial Service at Fujitsu UK & Ireland, said: “While Facebook announced peer-to-peer payments via WhatsApp some time ago, its launch comes at a convenient time, as billions worldwide are limiting physical contact and the handling of cash. This has resulted in a huge surge in the use of fintech apps and a dramatic drop in the use of cash. If one thing is clear, it is that the lockdown has accelerated the use of non-traditional payment methods.

“As this shift toward digital payments continues, people will become more digitally savvy and expect tech to deliver a more streamlined payments and shopping experience. In times like today, technology can help meet societal demands and adapt to new ways of doing things, and we’re seeing this innovation not only within challenger banks, but also the well-established high street banks that are using technology in new and exciting ways.

“Consumers are digitally adventurous and are keen to use services that offer the greatest convenience, whoever might provide them. Financial services firms must continually offer the latest digital services for their consumers and seek to fit into their lives – or they may very well find themselves losing market share to new digital disruptors like WhatsApp.”