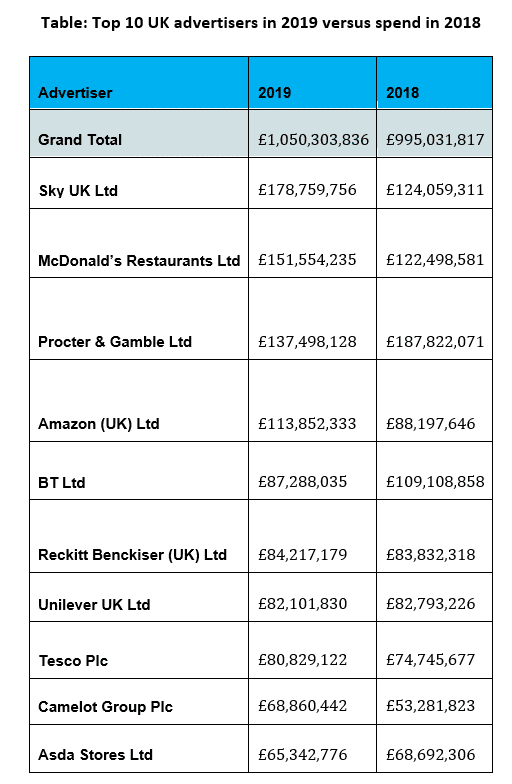

Sky was the UK’s biggest spender in traditional advertising in 2019, according to new data.

Nielsen AdIntel data released today. Procter & Gamble overtook Sky in 2018, but now falls to third place, whilst McDonald’s rises to second place.

Traditional advertising spend increased by over £55m in 2019, proving that these media channels continue to provide value for advertisers. Sky’s advertising spend increased by 44.1%, up from £124m in 2018 to £178.8m in 2019.

The broadcaster ran numerous campaigns throughout the year, two of which featured a collaboration with the film The Secret Life of Pets 2 to promote the Broadband Buddy parental control system and Wifi Guarantee. McDonald’s, which ranked third in 2018, increased its advertising spend by a significant 23.7%, securing the second spot ahead of Procter & Gamble. This was spearheaded by McDonald’s advertising pushes around its range of wraps and extended breakfast offerings. Procter & Gamble had the biggest decline of the top spenders, decreasing spend by -26.8%.

Amazon overtook BT (the latter of which was down -20.0% to £87.3m) to take fourth place, increasing its spend by 29.1% (£88.2m in 2018 to £113.9m in 2019) with campaigns for the Amazon Echo, and promotions of live premiership football coverage and special programming for Amazon Prime members. Unilever maintained its position in seventh place (down -0.8% to £82.1m), while Camelot Group (UK National Lottery) entered the top 10 for the first time, as it increased its spend from £53.3m to £68.9m in 2019.

As for supermarket retailers, Tesco remains the biggest supermarket spender in traditional advertising (up 8.1% to £80.9m), maintaining its position as the eighth biggest UK ad spender. Asda ranked at number 10 despite decreasing its ad spend from £68.7m to £65.3m, dropping one position from ninth in 2018. There was less consistency across the supermarket chains in terms of spend overall, with an even split between those that increased spend, and those that decreased spend in traditional advertising in 2019.

Barney Farmer, UK Commercial Director at Nielsen said: “Spend on traditional advertising has increased by more £55m over the last year, which shows just how important brands and retailers feel these channels are in helping them to reach their consumers within the trusted media environments that these provide. We can see there has been a slight shift in budgets for the top five biggest ad spenders who have either moved up or down in the rankings over the last year. For Procter and Gamble, this has taken less of a priority, whilst Sky and McDonald’s have invested more in these channels as a way to promote their biggest offers widely. Much like last year, this decision does not appear to be consistent across sectors.”

The data covers the time period from 01 January 2019 to 31 December 2019 and covers Cinema, Outdoor, Press, Radio and TV advertising spend only. Report figures run on 10 February 2020 and are subject to change.