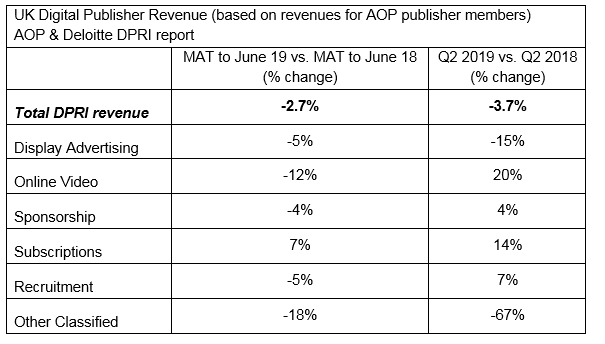

Digital publishing revenues declined to £113.1m in Q2 2019, a 3.7% fall in comparison to Q2 2018, according to the latest Digital Publishers Revenue Index (DPRI), a quarterly report on UK publishing from the Association for Online Publishing (AOP) and Deloitte.

A 15% decrease in display advertising in Q2 2019 was almost entirely responsible for the negative growth. However, the fall in revenues was partially offset by online video and subscriptions, which saw increases of 20% and 14% respectively, in comparison to Q2 2018.

When looking across platforms, desktop-only revenues decreased by 58% and revenues from mobile devices (smartphones and tablets) fell by 12% from Q2 2018 to Q2 2019. However, multi-platform revenues (campaigns containing more than one platform) increased by £15.8m (20%), indicating that more campaigns are multi-platform than solely desktop – reflective of responses to changing consumer behaviours.

B2B revenue increased by 4% to £19.8m in Q2 2019, from £19.1m in Q2 2018, driven by a rise in sponsorship (53%) and a modest increase in display revenues (3%) and subscriptions (2%). B2C quarterly revenue declined by 5.2% in Q2 2019 in comparison to the same quarter in 2018, fuelled by a significant decrease in display advertising, dropping from £53.3m to £45.0m (-16%).

Despite the overall decline in revenues, optimism among AOP board members regarding their own company’s financial prospects rose to 75%, a 31 percentage points increase compared to Q2 2018.

Looking ahead to the next 12 months, AOP board members are prioritising diversifying revenue streams, with 88% of respondents reporting non-advertising revenue growth as a high priority focus. Half (50%) of publishers also reported the introduction of new products and services as a high priority over the next 12 months.

Richard Reeves, Managing Director, AOP, commented: “These are challenging times for the UK publishing industry and this is certainly reflected in the latest DPRI findings. Publishers across the board are looking to diversify their revenue sources and move away from solely relying on advertising revenue. While industry challenges remain constant, especially given the increased scrutiny from the ICO, there is a continued need for publishers to take responsibility and find solutions to address these issues. By working together we can create change and the examples of innovation I see every day give me confidence that we are on the path of a better, more secure future for our industry.”

Dan Ison, Lead Partner for Telecoms, Media and Entertainment at Deloitte, commented: “Investments in developing content for multi-platform purposes are clearly paying off, however the overall fall in digital publishing revenues underlines that more needs to be done. Research from Deloitte’s Global Mobile Consumer Survey highlights that people are turning to a higher number of digital devices for a wider range of tasks. Organisations have a pressing task ahead of them to create high-quality content that appeals to consumers in a range of formats. Digital publishing is an ever-competitive market, and the key to survival will be innovation.”

About the DPRI Report

The Q2 2019 DPRI report – conducted by AOP and Deloitte – is based on a survey of 21 UK digital publishers comprising 15 B2C publishers and six B2B publishers. The aim of the report is to provide an overview of revenue levels across multiple channels and platforms – as well as insight into publisher sentiment – and to benchmark these findings against previous quarters. The information contained in this press release is correct at the time of going to press.