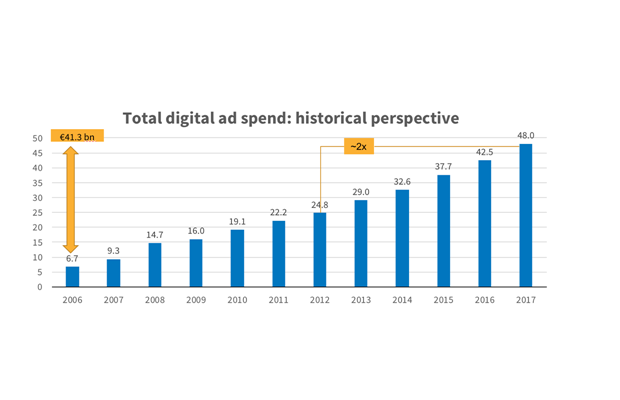

The European Digital Advertising market reached €48bn in 2017 compared with €24.8bn in 2012, according to new data.

At its annual Interact conference today, IAB Europe announced that digital advertising grew 13.2% in 2017 to €48bn, driven by strong growth in social, mobile and video investment.

The AdEx Benchmark study is the definitive guide to the state of the European digital advertising market and is now in its twelfth year. A total of twenty markets grew double-digit. Mobile dominated with double-digit growth in all 27 markets in the study. Mobile display grew by more than 40% and now accounts for 42% of total display advertising whilst video now accounts for more than a quarter of total display. Social grew at a similar rate at 38% and increased its share of display whilst video grew by 4x the rate of non-video display at 35%. The growth in video is driven by out-stream advertising which experienced a 73.4% growth compared with in-stream at 6.9%.

Townsend Feehan, CEO of IAB Europe, commented “The digital advertising industry has experienced another year of strong double-digit growth in Europe confirming its role in underpinning the delivery of digital content and consumer experiences. With GDPR coming into force in just three days’ time we are at a crossroads for the industry and we must continue to improve user experiences as well as highlight the contribution that digital advertising makes to the European economy.”

The IAB Europe AdEx Benchmark study divides the digital ad market into three categories: Display, Search and Classifieds and Directories. Growth in these advertising formats has been underpinned by shifting uses in devices and changing consumption patterns.

Display advertising outperformed search and classifieds with a growth rate of 14.9% to a value of €19.3bn. Search is still the largest online advertising category in terms of revenue with a growth of 14.4% and a market value of €21.9bn.

Daniel Knapp, Executive Director TMT at IHS Markit, said “Social, mobile, video and search were the growth drivers behind digital advertising in Europe in 2017. They stand for the power of connection, location, emotion and path to purchase that make digital advertising so versatile and indispensable for today’s brands.”

The top 3 individual growth markets reveal strong growth in the CEE region:

1. Belarus – 33.9%

2. Serbia – 23.7%

3. Russia – 21.9%

There was also strong growth in the most mature markets (in line with or above the European average) such as the UK (14.3%), Norway (16.6%), Sweden (18.4%), Switzerland (12.5%) and Denmark (9.7%) demonstrating that maturity doesn’t hinder opportunity for further innovation and growth.

Top 10 rankings (by market size)

1. UK – €15.6bn

2. Germany – €6.6bn

3. France – €5.1bn

4. Russia – €3.3bn

5. Italy – €2.6bn

6. Sweden– €1.8bn

7. Netherlands – €1.8bn

8. Switzerland – €1.8bn

9. Spain – €1.8bn

10. Belgium – €1bn