While 81% of UK marketers measuring Customer Lifetime Value (CLV) have seen a sales spike as a result, but 76% feel they are not able to measure it effectively, according to a new survey.

The state of Customer Lifetime Value study, from Criteo, also demonstrates that social media platforms are having a dramatic effect upon millennial conceptions of shopping and loyalty.

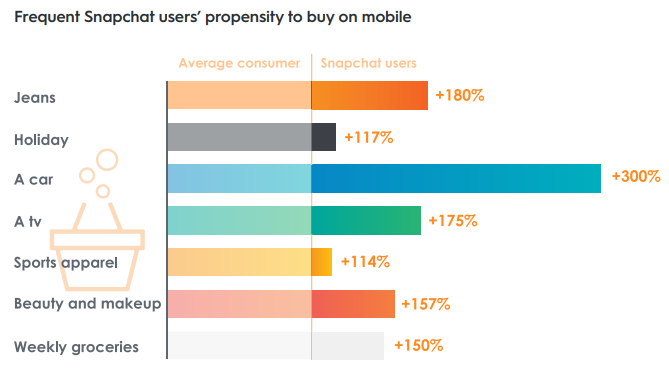

Regular Snapchat users are up to 300% more likely to buy items on their phone compared to the average Brit. They also spend more – one in three (33%) is happy to spend more than £100 on their mobile.

Furthermore, millennials are least likely to be swayed by price (-9% on average) and are bigger fans of freebies (+58%), added experiences (+45%) and free personalisation (+138%).

Key findings:

• 81% of UK marketers see sales spike as a result of measuring customer lifetime value; 79% able to implement more timely marketing initiatives

• But only one in four (24%) are effectively monitoring the lifetime value of their customers, 72% believe better data use is essential to CLV success in 2018

• Lifetime value essential as younger shoppers increasingly incentivised by longer-term brand rewards

The study indicates that marketers across the UK are missing out on revenue and delivering an improved customer experience by not measuring the lifetime value of their customers.

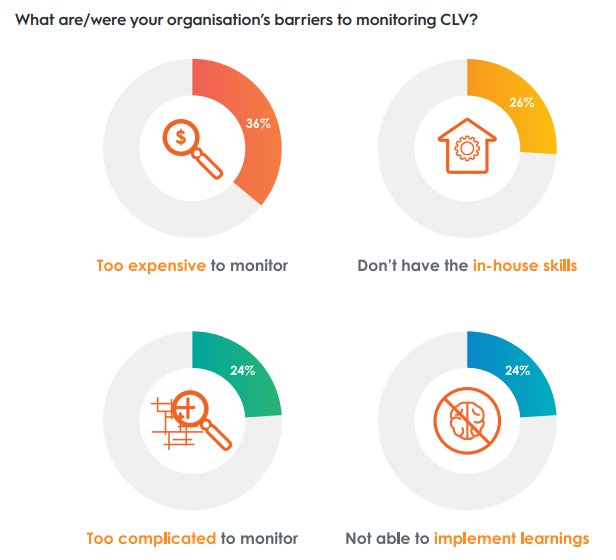

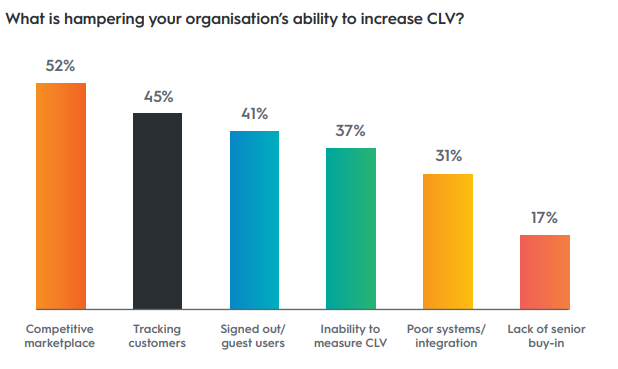

The challenges facing marketers looking to capitalise on a long-term customer view means that a three out of four (76%) UK organisations are not able to effectively measure CLV despite its tangible impact on sales, customer loyalty and speed to market. Every marketer surveyed agreed that the importance of CLV will increase in 2018 with the vast majority (72%) identifying better use of data as key to successfully measuring customer value this way.

The findings are part of a new UK-wide study in to 100 marketers’ views on measuring customer lifetime value. Coupled with the opinions of over 2,000 UK consumers, the report also explores how brands and retailers can better meet evolving customer expectations. Key insights include:

– A missed opportunity: While a quarter (24%) of organisations are effectively monitoring CLV, a huge majority (69%) know that improvements could be made. As a testament to the strategic importance of CLV to modern marketing, only a small number of businesses (7%) are doing nothing to monitor

– Long-term gains: 81% of marketers that are monitoring CLV have seen sales increase as a result. 79% of those marketers have also been able to action more timely marketing. Of the marketers planning on implementing CLV, 68% expect to see an increase in retention and over half (56%) believe it will enhance brand loyalty in the long-term

– The data challenge: 7/10 marketers (72%) cite better use of data as a key barrier to employing CLV. For the majority of Britain’s marketers, customer data holds the key to unlocking the potential of CLV and is crucial to reaping the rewards associated with its implementation

– The changing face of customer loyalty: Short-term transactional models are no longer representative of an evolving customer base with millennials who are 11% less likely than the general populous to be swayed by price alone. However, they are significantly more likely to be incentivised by longer term gains such as a free gift (60% more likely), added experiences (45% more likely) or free personalisation (140% more likely) suggesting that creating a customer for life is about more than just point of sale

“The UK’s marketing community couldn’t be clearer on the importance of data to successfully implementing CLV,” commented John Gillan, MD for UK and Northern Europe at Criteo. “Today’s findings confirm the central role information has to play in helping brands and retailers develop a clear, long term view of their customer – something which is boosting sales and improving the customer experience. Given these challenges, marketers should be considering better data collaboration in a bid to accelerate their ability to develop a complete, holistic view of their customer-base. Only by doing this can marketers start to think beyond short-term, transactional gains and look towards maximising the lifetime value of their existing customers.”

The full results of the study were revealed at Criteo’s annual Commerce Marketing Forum and mark the launch of its ‘The state of Customer Lifetime Value report: an examination of CLV as the marketing metric’. The report examines the face of marketing in the UK and the role data should be playing in building a better, more actionable view of the customer.

Consumer stats

Based off survey of 2000 UK-representative consumers

• Regular Snapchat users are up to 300% more likely to buy items on their phone compared to the average Brit

• They also spend more – one in three (33%) is happy to spend more than £100 on their mobile

• Millennials are least likely to be swayed by price (-9% against average consumer) and are bigger fans of freebies (+58%), added experiences (+45%) and free personalisation (+138%)

• One in five (22%) 25-34 year olds would be happy spending more than £250 on their smartphone

• 6% of the population prefer shopping on their smartphone

• One in ten 18-24 year olds prefer to purchase a car on their smartphone

• One in ten 18-34 year olds would prefer to book flights on their mobile, while 12% would rather use their smartphone to book the whole holiday

• Ongoing communications such as emagazines and trend emails are a factor in securing the loyalty of one in ten (12%) 18-34 years olds while event invitations impact the same number

• In a stark contrast to millennials, customer service and aftercare is the second biggest factor (after price) for those aged 55+

Marketing stats

Based off survey of 100 marketers

• Three out of four (76%) UK organisations are not able to effectively measure CLV despite its tangible impact on sales, customer loyalty and speed to market

• 81% of UK marketers which are measuring customer lifetime value see a sales spike as a result

• 7/10 marketers (72%) cite better use of data as a key barrier to employing CLV

• Short-term transactional models are no longer representative of an evolving customer base with millennials admitting they are 11% less likely to be swayed by price versus the general population

Methodology

UK marketer research:

Criteo commissioned independent market research specialist Vanson Bourne to undertake the Criteo research about Customer Lifetime Value. A total of 100 marketing decision makers were interviewed during February 2018. All respondents came from retail or wholesale organisations in the UK, with at least 150 employees or more. Interviews were conducted online using a rigorous multi-level screening process to ensure that only suitable candidates were given the opportunity to participate.

UK consumer research:

All data, unless otherwise stated, is from Walnut Unlimited, the human understanding agency, part of the Unlimited Group. Source: Walnut Omnibus, a nationally representative omnibus survey of [final sample size] adults across GB between 07/03/2018 – 09/03/2018. The figures have been weighted and are representative of all GB adults (aged 18+).

Source: Criteo