Asda has won the Christmas battle of the inbox and Aldi topped a separate consumer study for its ability to engage shoppers on a personal level with advertising and marketing, according to new research.

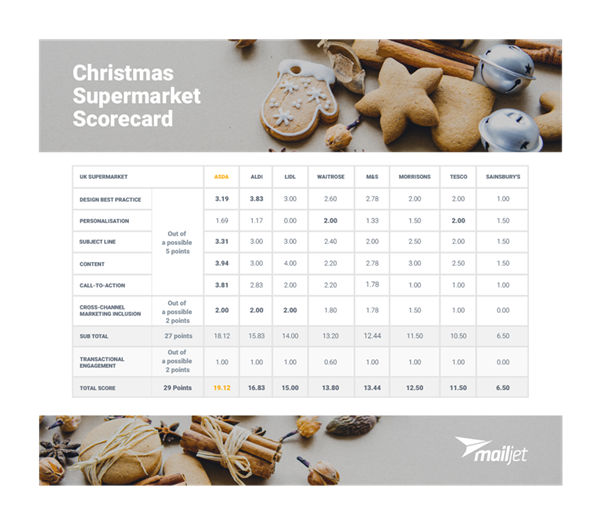

Annual research from email marketing and transactional experts at Mailjet, reveals that Asda’s score of 19.12 points out of an available 29.0, marks the first year that a budget supermarket takes the top spot from premium competitor Waitrose. Waitrose’s overall performance dropped by an alarming 53% year-on-year, they also ranked least favourite for marketing and advertising on consumers’ lists this year despite the excitement and hype around Moz the Monster from sister brand John Lewis.

The research analysed emails sent by eight of the leading UK supermarkets and scored the emails according to a range of metrics including design best practices, personalisation, subject line, cross-channel marketing, creativity of the content and this year also tested the marketing elements of transactional email once an item had been purchased.

Consumers’ choice

Aldi was named consumers’ favourite for Christmas marketing. Already a wallet winner for families, pricing a turkey which can feed between 9 and 11 people at just £17.99, Aldi has offered to give all its unsold fresh food away to charities and good causes when its stores close on Christmas Eve.

Complementing this philanthropic marketing strategy, the direct marketing team at Aldi have also done a fantastic job on the design side of emails, keeping a clean user interface able to be viewed consistently across desktop, mobile and tablet devices.

From favourite to least favourite, consumers’ ranking of supermarkets for advertising and marketing this year is as follows:

- Aldi – 21%

- Marks and Spencer’s – 20%

- Tesco – 15%

- Asda – 12%

- Sainsbury’s – 11%

- Lidl & Morrison’s (joint sixth) – 7%

- Waitrose – 6%

It’s the thought that counts…

The study carried out by email marketing experts at Mailjet, discovered a significant decline in overall best-performance by 11% compared to last year.

While Morrison’s and Tesco failed to send any communications to consumers who had not yet purchased through their online shopping systems. Personalisation and call-to-action were the biggest downfall across the eight supermarkets.

Lidl failed to personalise any emails, instead referring to recipients as ‘Lidlers’, whilst Morrison’s, Tesco and Waitrose offered minimal call-to-action throughout all correspondence. Considering half of consumers (50%) admit they are knowingly less patient with brands at this time of year and their loyalty will shift quicker, this puts these brands at significant risk.

Josie Scotchmer, UK marketing manager at Mailjet, comments; “It comes as no surprise that Aldi topped the consumer list and ranked high on the professional one too. With five out of eight of the leading supermarkets only scoring less than half of the points available, it’s clear the competition is expecting the same types of messages to work year on year, failing to appreciate the heightened expectations of digital consumers.”

Post-purchase transactional engagement

Asda was the only supermarket to send regular emails post-purchase. Further analysing transactional engagement, none of the eight supermarkets went beyond simply branding their purchase confirmation emails. In fact, Sainsbury’s purchase confirmation emails were sent in plain text.

Josie concludes; “It is still disappointing to see that brands are not ensuring customers are engaged pre- and post-purchase, not only is this a fantastic opportunity to suggest complementary products and services for an order, but also a crucial moment in winning consent for wider marketing communications. A number of supermarkets still have ‘opt-out’ subscriptions with pre-ticked checkboxes, demonstrating that there is still a lot of work to be done in terms of GDPR preparation.

Methodology:

A team of marketing experts analysed emails sent by the eight leading supermarkets in the UK between November and December 2017. Each email was individually scored according to how well it met the below criteria, (e.g. scoring system: 5 = best possible score, 0 = worst possible score) the average result was then calculated for each candidate.

Scoring criteria:

- Design best practices (up to 5 points) – email is viewed on a desktop, mobile and tablet device and scored according to whether it is responsive and how well the design works across formats

- Personalisation (up to 5 points) – any evidence of changed fields or gender-bias for example

- Subject line (up to 5 points) – optimum length, word inclusion, personal, Cross-channel marketing inclusion (up to 5 points) – social media buttons, directing to app or website content

- Creative impact of content (up to 5 points) – format, appeal, interactivity, tone, strong brand personality

- Automation (up to 5 points) – whether the email uses automation technology

- Call-to-Action (up to 5 points) – whether a call to action is included, the strength of their CTA copy and the number of CTA’s

- Cross-Channel Marketing Inclusion (up to 2 points) – evidence that email is being used with other channels, both online and offline. Transactional engagement (up to 2 points) – whether emails were onbrand. and if they included marketing elements such as; cross/up-sell products, marketing subscriptions, loyalty programs.

The consumer research, conducted by Morar Consulting and commissioned by Mailjet in December 2017, was the result of surveying 1,000 consumers across the UK.