Whether public service or paid-for, the UK’s TV channels are most likely to be recommended by viewers- but Netflix is on the rise, according to new research.

The study, from Ampere Analysis suggests that the UK’s free and pay TV channels enjoyed the highest Net Promoter Score (NPS) compared to their counterparts in the top five European markets and the USA.

NPS quantifies loyalty and brand affinity, measuring a customers’ propensity to recommend a service to others, a benefit that is key to success in a market as competitive, price sensitive and vulnerable to churn as TV. The research also identified a significant performance gap between public service broadcasters (PSBs) and commercial pay TV channels.

Key findings:

• In the UK, national broadcaster the BBC performs well, with a strong correlation between the percentage of people that watch its channels and their likelihood to recommend them. In the USA, it’s the opposite – national broadcasters are the most watched, but least recommended and major US networks including CBS, the CW and ABC either don’t make, or just scrape, the top 20. Here, targeted channels with smaller audiences such as HBO, Starz, Showtime and Sony enjoy better NPS scores.

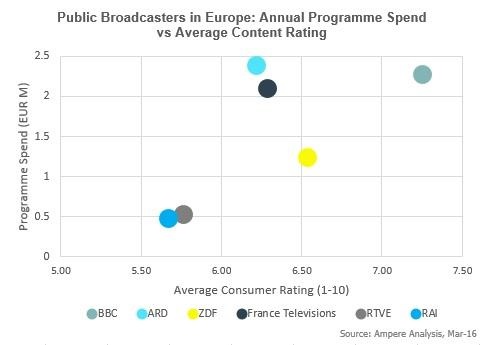

• The BBC is the best performing national PSB, with a higher percentage of viewers and higher NPS ratings than all European counterparts. The closest rivals are ARD and ZDF in Germany, and RAI in Italy, while France Televisions and RTVE are far behind. According to Ampere Analysis’s Markets data, the BBC, ARD and France Televisions all invested between €2bn and €2.3bn in content in 2015, suggesting the BBC is making its investments here wisely, resulting in a stronger audience approval for its content relative to its European equivalents.

• Looking further at national commercial broadcasters (NCBs) across the big five European markets, Mediaset in Italy has the most strongly recommended channel portfolio, and 76% of homes in Italy said they watched Mediaset channels. But here again, British NCBs outperformed their European counterparts with ITV, Channel 4 and Sky in second, third and fourth place respectively across the major European markets. This both highlights the strength of competition in the UK, and the investment in content by its major broadcasters in 2015.

• But what of Netflix? In its established markets such as France, UK and USA, the SVoD platform enjoys a much higher NPS than traditional pay TV competitors. In fact, Netflix customers are the most likely entertainment consumers to promote its service to others. But in newer territories like Spain and Italy, although it beats local SVoD competitors, it has yet to worry local pay TV players. The most interesting market is Germany. Here Netflix is established, but strong local competitors, particularly Maxdome, make this market more challenging and have a higher recommendation rating than Netflix.

• Other SVoD brands such as Hulu in the USA and Amazon Prime Instant Video in the UK also rank highly, as do strong pay TV operators like AT&T and DirecTV in the US.

Ed Border Principal Analyst at Ampere Analysis, says: “Our analysis shows a big difference in engagement between new and old TV players. What does become clear is that content and brand are key. The strength of brand BBC shines through. Comparing the performance of the BBC with other European pubcasters shows that despite major groups in France and Germany spending similar sums on programming, there is a stark difference in viewer engagement and average channel ratings.

The lesson from the US is that the more targeted, lower-audience channels are offering content that is meeting their viewers’ needs. The same is true of the new SVoD services like Netflix where original content strategy, powerful brand and strong positioning help it achieve the highest Net Promoter Score among pay channel brands.”

Source: www.ampereanalysis.com