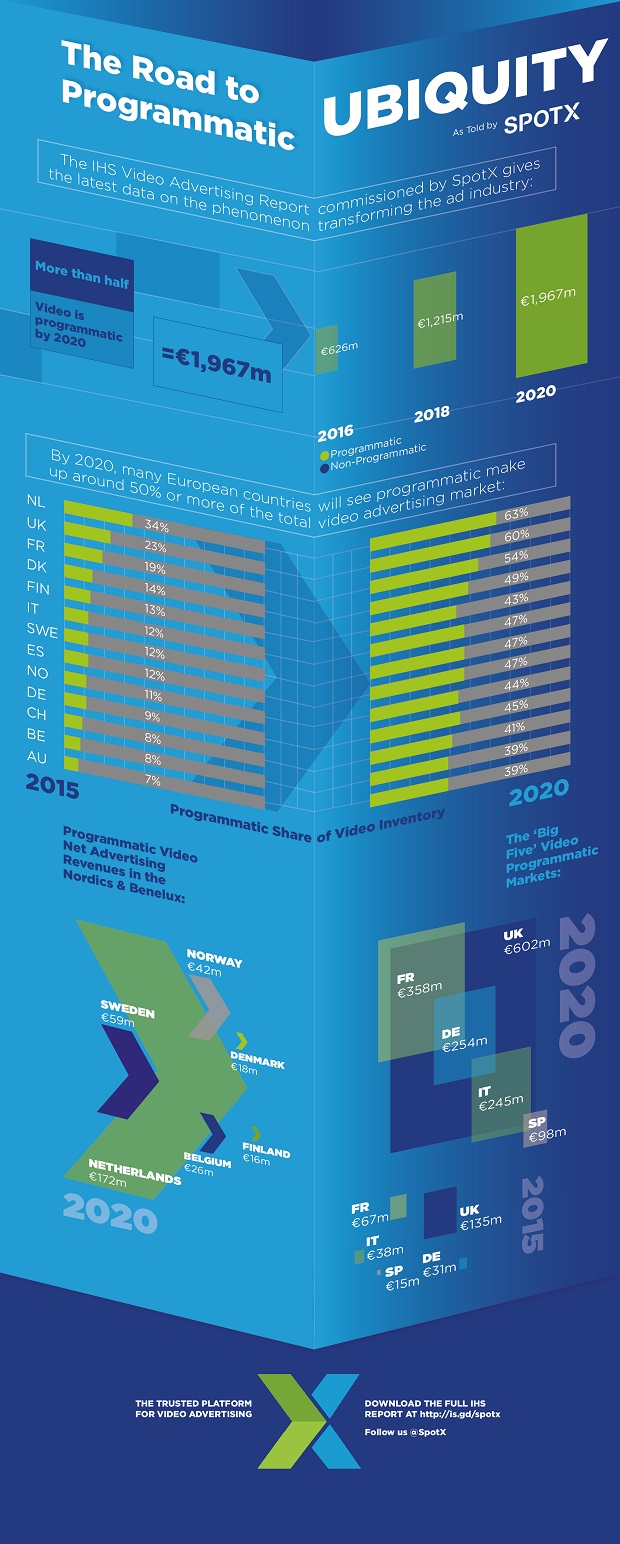

More than half of online video advertising in Europe is expected to be traded programmatically in 2020, growing at rate of 38.7% to become a €2bn industry by 2020, according to new research.

The study, from SpotX, charts the rise of programmatic online video advertising across Europe.

The industry has grown almost twenty-fold from €22m in 2012 to €375m in 2015 and will grow at a rate of 38.7 per cent between now and 2020, to become a €2bn industry in 2020, by which time more than half of all online video advertising revenue in Europe will be generated programmatically.

The ‘big five’ European markets are highlighted as responsible for €286m of programmatic online video advertising revenue generated in 2015, which is expected to climb to €1,512m by 2020.

The Benelux region is forecast to triple from €62m in 2015 to €198m in 2020, whilst Nordics saw €21m programmatic online video advertising revenue in 2015, predicted to reach €138m in 2020.

View the infographic below:

Based on research conducted by global analyst firm IHS (NYSE: IHS), the source of information and insight, the infographic shows the UK as the largest market for programmatic video advertising in the region, generating more than one third of all programmatic online video revenue in Europe in 2015 (36 per cent).

The UK programmatic video advertising market was worth €135m in 2015 and is expected to be worth more than €600m by 2020 with the proportion of video advertising traded programmatically expected to almost triple from 23 per cent in 2015 to 60 per cent by 2020.

Programmatic online video advertising is pictured as worth €31m in Germany with growth expected to reach €254m in 2020, making it the third largest market in Europe. The Austrian market is predicted to grow from €2m in 2015 to €19m in 2020 and Switzerland will grow from €3m in 2015 to €22m in 2020, revealing a compound annual growth rate (CAGR) across the DACH region of 53 per cent.

In France, the infographic sizes the market at €67m – where 19 per cent of video advertising is traded programmatically – and highlights expected growth to €358m in 2020 more than half of which (54 per cent) will be traded programmatically. The Netherlands is expected to grow from 34 per cent traded programmatically in 2015 to 63 per cent in 2020 and Belgium is expected to move from 8 per cent in 2015 to 39 per cent by 2020 when the market will be worth €26m.

The infographic charts the growth of programmatic video in Italy from €6m in 2013 to €38m in 2015 to a predicted size of €245m in 2020, a compound annual growth rate of 45 per cent. 12 per cent of online video advertising in Italy was traded programmatically in 2015 and it is predicted to grow to 47 per cent. The Spanish will also trade 47 per cent of online video advertising programmatically in 2020, by which point the market is expected to be worth €98m, up from €4m in 2013 and €15m in 2015.

Mike Shehan, CEO of SpotX explains, “The data shows the dramatic rise of video advertising across Europe, which has been reflected in our own growth across Europe with rising revenues every year. We introduced video real time bidding in 2010, and now have established offices in London, Hamburg and Amsterdam contributing to the global growth of SpotX. The UK, France and the Netherlands are leading the adoption of programmatic online video in Europe, followed by a sizeable and important market in Germany, as well as emerging markets with high potential including the Nordics, Spain, Italy, Switzerland and Austria.”

Daniel Knapp, Senior Director of Advertising Research at IHS, adds, “This infographic illustrates the research we conducted showing how programmatic online video advertising has exploded across Europe from experimentation in 2013 to ubiquity by 2015. Publishers and broadcasters have embraced a programmatic mindset. They are innovating with video content and exploring different programmatic video advertising strategies including acquisitions and partnerships as well as building in-house capabilities to drive revenue growth.”

The infographic is based on research titled ‘Video Advertising in Europe: The Road to Programmatic Ubiquity’ commissioned by SpotX, from IHS.

The full report from IHS can be downloaded here

. (registrarion required).