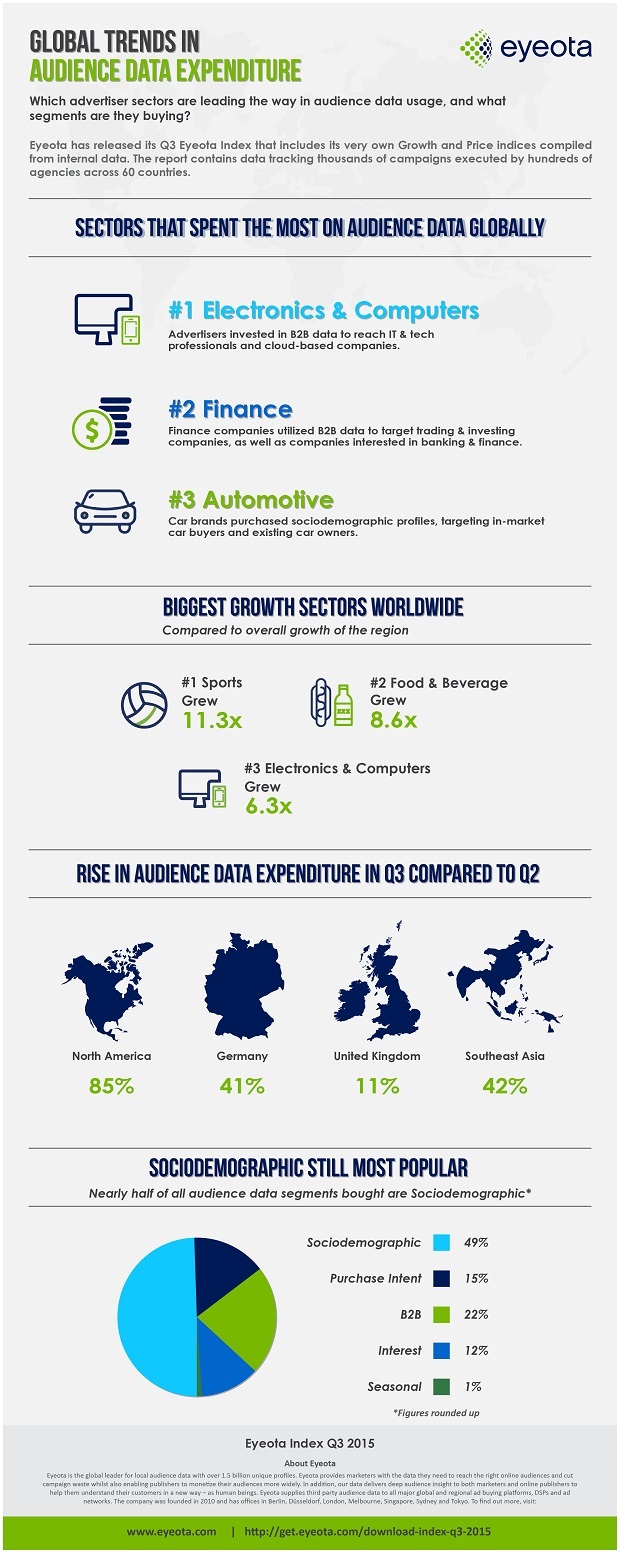

Audience data expenditure in the United Kingdom increased by 11%, with F&B, Multi-media and Retail sectors utilising data more, according to new research.

The data, from the Eyeota Index, identifies global audience data trends tracked from thousands of campaigns by hundreds of agencies across 60 countries.

In this report, the leading spenders in audience data in the United Kingdom were in line with the global trend: Electronics & Computers, Finance and Automotive. The Electronics & Computers sector was the major spender globally, mostly due to software and computer companies utilising audience data for prospecting purposes, and to increase awareness for new products. This sector also saw profound growth across Germany, France, the United States and Australia.

The sectors that amplified their budget the most were the F&B, Multi-media and Retail sectors.

The F&B sector expansion was driven by fast-food chain restaurants targeting student sociodemographic profiles, especially during the school holiday period. The expansion in audience data investment within the Multi-media sector was due to the launch of new television programmes through online streaming companies seeking families and households with children.

Conversely, the Retail sector’s expansion was due to department stores that were new to audience data and other brands boosting spend to promote campaigns to mothers and parents.

This is unique as it shows that it’s not just the ‘usual suspects’ such as the Electronics and Computers sector utilising audience data to target potential customers.

The most popular segment category utilised in the UK was Sociodemographic data; this had a vast majority of 66 per cent, which was significantly higher than the global picture (49 per cent). Purchase Intent was the second most popular segment and accounted for 17 per cent of advertisers. This demonstrates a continued relevance of Sociodemographic data as the ‘backbone’ for programmatic campaigns, as it complements most campaign strategies.

Kevin Tan, CEO at Eyeota, says: “We can see how programmatic advertising is diversifying in the United Kingdom as more and more brands are using it to engage their consumers. The combination of Sociodemographic and Purchase Intent builds an overall fitting image of the consumer, enabling companies to target them with relevant information.

“The growth in demand for audience data worldwide reflects the increasing importance of audience data, which empowers brands to connect with audiences at a human level. By highlighting trends in audience data expenditure in the Eyeota Index, we are showing brands which sectors are leading the way in audience data usage, and we hope the trends allow both advertisers and publishers to understand their customers as human beings so more targeted ads are delivered more effectively.”

United Kingdom Key Trends Overview

The Eyeota Index highlights the following Q3 UK trends:

· In line with global results, the UK’s three leading spenders were Finance, Automotive and Electronics & Computers

· The F&B, Multi-media and Retail sectors grew the most in Q3

· Most popular segment categories: Sociodemographic (66%) and Purchase Intent (17%)

Source: www.eyeota.com.