What do Zoella, Minecraft, Ed Sheeran and political documentaries have in common? They all have their own YouTube channels that are part of the Multi-Channel Networks owned by traditional media groups including RTL, Warner Music, Disney and Discovery. New research from Ampere Analysis looks at the growing importance of YouTube for brands.

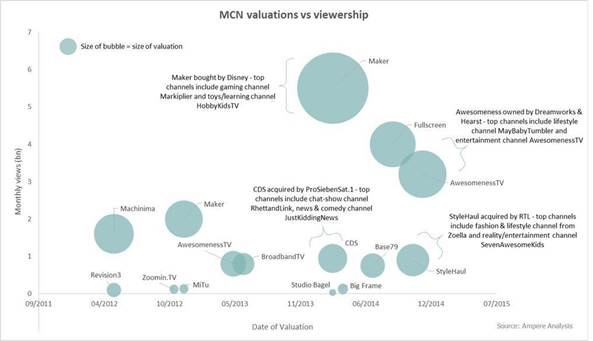

Over the past three years, the biggest of these Multi-Channel Networks (MCNs) have been snapped up for sums ranging from $200m to up to nearly $1bn, mainly by the larger media groups. Now this land grab is all-but over, leaving some major players with the option of acquiring and consolidating smaller MCNs or building their own, according to the latest research by Ampere Analysis.

KEY FINDINGS

• Over 75% of the MCNs acquired in the last three years were bought by traditional media groups.

• Our analysis of MCN investments spanning the last three years reveals that the average MCN is worth 10 cents per monthly view. On this basis, an MCN with 1 billion monthly views would be worth $100m. There are 22 MCNs now worth at least this much.

• Ampere’s analysis shows that the combined value of these 22 MCNs is $6.5bn. Collectively the top 100 MCNs receive 100bn views per month, making them worth nearly $10bn.

• 42% of all YouTube’s video views in Q1 2015 were on the top 100 MCNs.

• MCN valuations typically represent multiples of between 25x and 35x of their annual revenues, yet return on investment is good for buyers.

• Both Dreamworks and Disney have seen the investments they made in MCNs increase in value by more than 240% in just 18 months.

• The YouTube channel business is now valued at over $20bn.

Monetising Multi-Channel Networks

MCNs build, aggregate and monetise audiences across a variety of OTT video outlets, with the primary one being YouTube. Content is typically available in short clips of up to 20 minutes, with topics ranging from music to beauty and fashion, comedy, cartoons, documentaries and “mockumentaries”, in fact any niche interest or experimental content. Some MCNs create their own material, such as RTL’s StyleHaul and Discovery’s Revision3, while others sell advertising against videos from third-party content creators.

The value of an MCN lies in its audience, similarly to traditional TV channels. The monthly audience and ad impressions any single YouTube channel achieves is typically equivalent to a minor broadcast channel, but when aggregated with other YouTube channels by an MCN to reach billions of viewers, there’s the potential to capture a share of YouTube’s $4.5bn-and-growing annual advertising revenue. Not to mention access to global viewers in new markets.

Wherever they are located, each monthly view adds an average of $0.10 to the valuation of an MCN. On this basis, there are now 22 MCNs worldwide that would command a purchase price of at least $100m.

Richard Broughton, Research Director, says: “The business model of MCNs is a good fit for many traditional media companies, which understand advertising business models. They are also an extremely effective way for traditional media players to reach a younger audience which is leaving traditional media in droves, as well as to experiment with new programme formats and content types.”

The MCN land grab

Acquisition activity began in earnest in 2012, with early moves by the leading media groups including Discovery Communications’ purchase of Revision3 for $30m, Telegraaf Media Groep’s 70% stake in Zoomin.TV, and Time Warner’s $40m play for Maker Studios. Today MCNs are owned by groups including RTL, ProSiebenSat.1, Vivendi, Disney, Dreamworks and production company Fremantle. For these larger players, MCNs have thus far represented good value for money and return on investment.

The MCN hype bubble

Analysis suggests that a typical MCN with 1bn views per month would be valued at $97m and make approx. $21m in gross revenue per year. YouTube’s entire audience could be valued on this basis at over $20bn.

But after YouTube and channel partner shares of an MCN’s revenue are shared out, the amount an MCN actually gets to keep can be slim – as little as just a tenth of the overall revenue generated by its advertising sales.

Ampere’s research suggests that typical MCN valuations represent a multiple of between 25x and 35x their annual revenues – many times higher than a mature broadcasting business.

In a market with so much M&A activity, we might expect valuations and prices to have spiralled out of proportion, but according to Ampere Analysis, this isn’t currently the case. Richard Broughton, Research Director, says: “Growth rates for MCNs are huge, and early buyers into the sector have seen their acquisitions triple in value within a few short years. Furthermore, buying an MCN delivers instant global reach, opening up new territories and helping to future-proof businesses in an increasingly unpredictable media sector.

For those players without a stake in the MCN game, sand is rapidly running through the hourglass. Very few top MCNs remain that don’t now have an affiliation to a major media group. And with no apparent decline in valuations over time, those rare MCNs that are still independent are becoming increasingly expensive. Many media companies are playing a waiting game: the million dollar question now is when to stop waiting and start acting.”

Source: www.ampereanalysis.com