IT professionals are no longer the primary decision-makers for B2B technology purchasing instead finance, business development and sales and marketing calling the shots, according to new research.

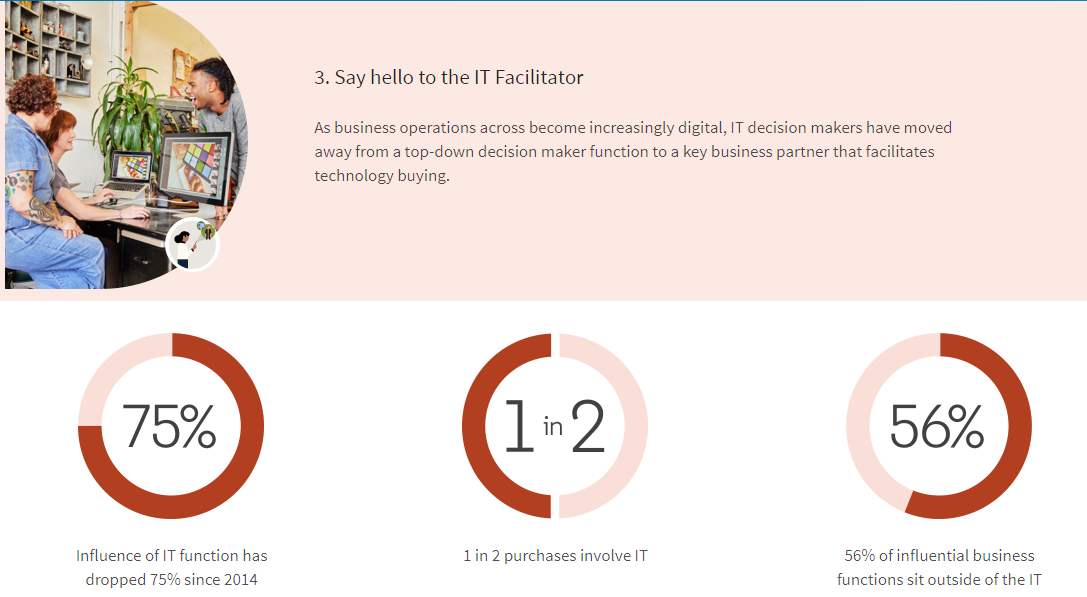

The study, by LinkedIn, found that IT is the most influential voice in only a third (39%) of technology buying decisions, down from 75% in 2014. Meanwhile, over half of tech decision-makers (56%) now sit outside the IT department, in roles such as sales and marketing, business development, and finance.

The LinkedIn B2B Technology Buying Survey, now in its seventh year, surveyed over 2,000 technology decision-makers across EMEA about their involvement in purchasing tech hardware and software, and their plans for the next 12 months. It found that budgets are holding up for many organisations, despite the impact of Covid-19, with nearly half (43%) of respondents saying their budget will stay the same or increase. This compares to 47% who said their budget will decrease or halt altogether in the next 12 months.

The study found that traditional B2B technology buyers are increasingly hard for marketers to target, and, with a growing breadth of departments involved in the process, it is important to target the buyer committee rather than individual decision-makers. Over half of respondents (55%) said they are involved in the researching and shortlisting stages, while only a third are actually involved in purchasing (36%). Furthermore, nearly three quarters (70%) of tech buyers do their own research before reaching out to a vendor.

While IT is no longer the tech gatekeeper, they are still a big facilitator of technology buying decisions, with 57% of respondents reporting that IT is involved in the purchasing process. However, as a facilitator, they are influenced by different factors when reviewing the options. Whereas technology buyers – led by sales and marketing – are actively looking at functionality, ease of use and the business impact of purchasing a solution, facilitators – led by IT, along with finance and procurement – are zoning in on price, integration and adoption.

“Technology buyers are conflicted between the need to invest in digital solutions to adapt to the post-Covid world, while also, in many cases, managing with tighter budgets than they might have had access to before the pandemic,” commented Tom Pepper, Head of Marketing Solutions, LinkedIn UK, Ireland and Israel.

“In the current environment, it is more important than ever for technology marketers to design campaigns to target the right audiences, with the right messages, at the right time. What our research shows is that technology buyers are frequently not who you might expect, and, in most cases, are anonymous to brands because they will never hear from them directly. As a result, it is vital to ensure that these individuals have all the information that they need during these ‘invisible stages’ of the buying process.”

Overall, respondents listed price (73%), and the right products and features (67%) as the most important factors when choosing a technology solution. Post-sales support was also named as a key consideration for over half of respondents (56%), reflecting the need for close contact during what are often lengthy implementation phases, taking over five months on average for enterprise buyers.

The study also highlights the importance of brands demonstrating both the reliability and experience of established providers, alongside the innovation and flexibility associated with challenger brands. Over three quarters of tech buyers report that deep experience and knowledge (76%) are important when making a decision, however 45% would consider a new vendor if they are more innovative than the established brands.

To read the full findings and analysis, the LinkedIn Technology Buyers Survey Report can be downloaded here.

About the research

LinkedIn surveyed 5,894 technology decision-makers globally between July and August 2020, of whom 2,298 were based in EMEA. Respondent base had researched, evaluated, bought, implemented or renewed hardware for end users, software for end users, hardware for data centres or software for data centres within the past six months. Respondents spanned finance, marketing, sales, business development, research & development, product, supply chain/logistics, legal/compliance, HR, procurement, IT, engineering, and communications. Respondent base was equally weighted between small and medium sized business, mid-market, and enterprise businesses.