41% of UK grocery stores are experiencing a decline in sales volume, despite the rocket-fuelled overall growth in sales in the grocery FMCG sector, reveals new data from Nielsen.

Nielsen data shows that FMCG grocery sales growth overall currently averages around 8% in the UK year to date, equivalent to an estimated £9 billion of incremental sales from January to November 2020, compared to last year.

However, despite this significant growth, the highest revenue stores – known as ‘golden stores’ – that account for 80% of UK FMCG sales have undergone a dramatic shift.

According to Nielsen, in 2019, 20% of UK retail outlets accounted for 80% of FMCG sales. However, in 2020, this has lowered to 19% – a small shift that accounts for billions in consumer spend moving to different locations.

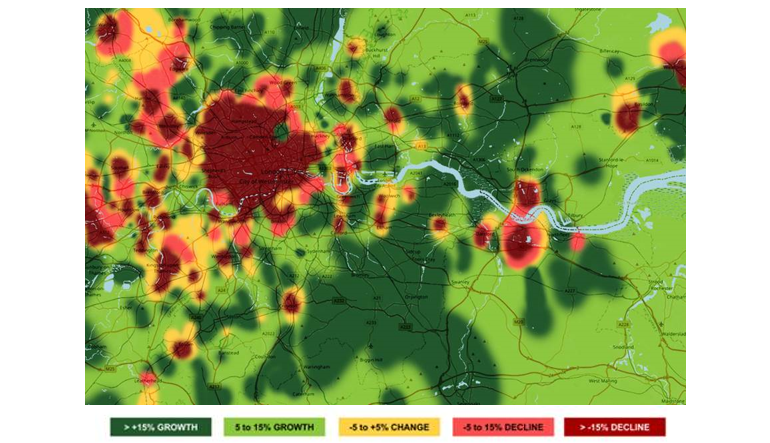

This is being driven by the ongoing travel and Covid-related restrictions, with the majority of losses seen in high density city centre districts filled with offices, commuter hubs and tourist attractions, and stores in these locations have seen massive declines. This extreme is matched only by the unprecedented growth in stores around residential areas. With Londoners forced to work from home in huge numbers, sales at stores in these suburban areas have seen significant increases, with 9% of all stores experiencing over 100% growth in sales.

Scott McKenzie, Global Intelligence Leader at Nielsen, said: “COVID-19 has forced us all to shop differently but this investigation demonstrates just how deep the changes in our habits are – and the need for retailers and manufacturers to respond quickly to the massive changes we’re now seeing in store dynamics.”

McKenzie continues: “Companies around the world are already signaling they will no longer operate the way they did in the past. People will commute less, work from home more and move further away from urban settings. The consequences of this for the locations of stores, the formats of stores, and the assortment in those stores are far reaching. If you add in the dynamic of a massive rise in ecommerce for the FMCG space, the need to respond to these new shifts are critical.”