UK advertising spend will grow by 5% in 2019 to reach £24.74bn, according to the latest Advertising Association/Warc Expenditure Report.

The 5% growth figure is an upward revision of 0.4 percentage points on the estimated growth rate given by the AA/Warc in the last report in July.

Expenditure Report published today and which predicts full year spending of £24.7bn.

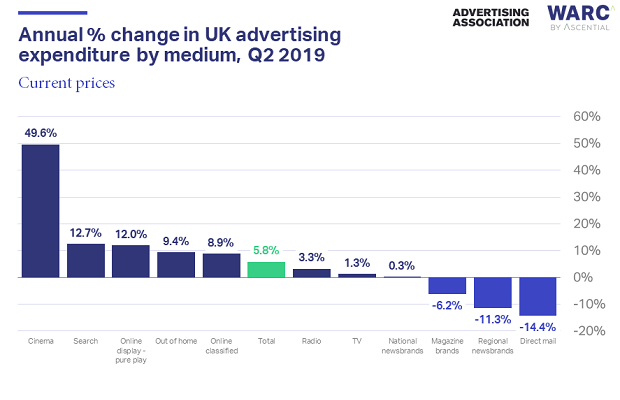

The data show that adspend rose 5.8% year-on-year to reach £6.0bn in Q2 2019, marking UK advertising’s 24th consecutive quarter of expansion.

After recording “stellar” growth across online formats, full year adspend growth figures for 2019 have been upgraded 0.4 percentage points to 5%, reaching £24.7bn in total.

UK ad expenditure is then expected to grow a further 5.3% in 2020, according to the latest Advertising Association/WARC Expenditure Report for the second quarter of the year.

“An upgrade to our 2019 projection of almost half a point is reflective of stellar online growth, as well as over-performance for a number of traditional channels against the expectations we laid out in July,” said James McDonald, managing editor at WARC.

“There is little in the data we receive from media owners across the industry to suggest an impending downturn, but growth cannot be taken for granted while economic prosperity remains in the balance.”

Q2 saw ad expenditure climb 5.8% year-on-year (YoY) to a record £6bn, and 5.2% for the first six months of the year. The quarter saw notable YoY rises in spend on digital radio (+15.9%), digital out of home (+17.2%) and TV VOD (20%).

Online national newsbrands also recorded an impressive 15.6% increase – +12.2pp higher than previously forecast – though national newsbrands overall only grew 0.3%. Meanwhile, magazine brands continued to see adspend tumble, down -2.6% digitally and -6.2% overall.

However, it was spend on cinema which most defied expectations, climbing 49.6% YoY – +44.5pp ahead of forecast.

Looking ahead, digital formats are expected to continue growing through to the end of the year. TV VOD is to rise 18.7% YoY in 2019 (though TV as a whole is expected to fall -0.9%), followed by 15% in 2020.

The report also forecasts a 13.3% growth for DOOH and 20.4% growth for digital radio, as well as a 5% rise for online national newsbrands.

Elsewhere, cinema’s expected to see its ad investment grow 16.4% in 2019 – though forecasts for 2020 expect a -3.2% drop to follow.

“An upgrade to our 2019 projection of almost half a point is reflective of stellar online growth, as well as over-performance for a number of traditional channels against the expectations we laid out in July,” said James McDonald, managing editor at WARC Data.

“There is little in the data we receive from media owners across the industry to suggest an impending downturn, but growth cannot be taken for granted while economic prosperity remains in the balance.”

Stephen Woodford, chief executive of the Advertising Association, observed that the Q2 figures, which cover the period immediately following the original Brexit date of March 29, demonstrated “the continued strength of UK advertising during a time of political uncertainty.

But with another departure date about to be passed this week, he added that “we are acutely conscious of industry’s desire for clarity and the need to continue investing for the future during these uncertain times.”

Industry analysis

Jem Lloyd-Williams, CEO, Mindshare UK, said: “Despite the ongoing uncertainty around Brexit, it’s encouraging once again, to see the resilience of the UK’s ad market. With growth recorded across multiple formats – namely, digital out of home, online radio and TV VOD – it’s encouraging that advertisers continue to invest, putting audiences, and the way they consume media, at the heart of their media plans. This ensures we create dynamic campaigns that appeal to people’s motivations and emotions, particularly as people are feeling more and more powerless about today’s political situation. Although we’ve seen UK adspend reach record level for this quarter, it’s more important than ever that as marketers, we take the time to truly understand our target audiences and adjust the media plan accordingly. This will no doubt provide a competitive advantage as we look to 2020.”

Ali MacCallum, CEO, Kinetic UK: “With the report highlighting growth of 9.4% in OOH spend, it is clear that OOH is increasingly viewed as a channel through which to deliver against both long-term brand building and shorter-term sales activation goals.

“Advancements in digital OOH inventory and infrastructure have provided marketeers with a brand safe, data driven and transparent alternative or accompaniment to purely online ad formats in order to drive sales results. We are seeing more advertisers utilise the dynamic creative and near real-time audience buying opportunities to deploy activity in faster and smarter ways.”

“As digital OOH campaigns become ever more integrated with tactical activation in other channels such as mobile and social, the role of the medium is evolving to help solve the challenge brands face in delivering those immediate business outcomes alongside the brand fame at real scale that OOH has always delivered.”

Eve Lee, Founder and CEO, The Digital Fairy: “It’s encouraging to see just how the growth and record levels of adspend in the AA/WARC Q2 report is being driven by increased spend on online advertising. If companies are to maintain and grow brand awareness amongst all consumers, they need to be smart with their spend and have a clear understanding of which medium will make the biggest impact.”

“Online and social-media based campaigns can be – and should be seen – as the adspend ‘superpower’ for those brands looking to attract the attention of youth audiences – specifically Generation Z. The power and impact both have on brand awareness and brand image for this segment of customer is undeniable.”

“As adspend continues to gain momentum and grow in 2020, we would hope that the budgets allocated to online and social media based campaigns continue to rise and these channels receive the full recognition they deserve.”

Keith Pieper, VP Product Operations, Sovrn, said: “With a looming Brexit facilitating many concerns in the industry over the past couple of years, it’s positive to see that, despite this, UK advertising spend is continuing to grow, and particularly encouraging to see it reach a record level of £6 billion.

“With the UK’s ad market expected to grow a further 5.3% in 2020, the resilience of UK advertising has never been clearer. This report ultimately demonstrates the way in which the industry has used this time of political uncertainty to drive more innovative methods, strengthening the industry and boosting overall market growth. I’m confident ad spend will continue to increase across all formats as more advertisers look to invest in the media landscape.”

Dominic Satur, VP Business Development Europe, Flashtalking,said: “It’s promising to see digital fuelling the overall growth in UK ad spend, driven by advertisers understanding the value and impact of digital platforms. But assuring continued digital investment requires the ecosystem to collaborate and address the issue of transparency.

“Advertisers are looking for transparency to ensure their digital media budgets can be optimised for the best return. By addressing this, the industry will be taking steps to ensure digital continues to play a key role in growing ad spend.”

Alex Steer, Chief Product Officer, Wavemaker UK, said: “The various shocks of the last six months – including multiple Brexit delays and further uncertainty – have not disrupted the momentum of the advertising economy, the latest AA/WARC report has shown. UK advertising spend reached record levels in Q2, but adspend over the first six months of 2019 was 5.2% higher than a year earlier. The results are a reminder of the vital role of advertising in shock-proofing businesses in uncertain times, by building strong brands and attracting new customers.

“Much of the positive trajectory comes from the growth of internet advertising, but these headline numbers disguise a lot of variation. Online spend growth is driven more by the long tail of small digital-only advertisers, than by shifts in the behaviour of established brands. The growth in OOH, VOD and especially cinema, where budgets rose by nearly 50% in Q2, gives us a clear signal that major advertisers are maintaining a broad media mix.

“These figures remind us that there is no one-size fits all answer for different brands. Advertisers need to be making intelligent trade-offs across a broad media mix. Brands shouldn’t just follow trends in how other brands are spending – they need to invest in understanding how media drives growth, making smart choices about where to spend, and learning what’s going to make the biggest impact.”

Kirsty Giordani, Executive Director, IAA UK, said: “Together with the recent Q3 IPA Bellwether report – which forecast rising adspend in 2020 despite current budget cuts – today’s findings paint a promising picture for the UK ad industry. Six years of consecutive market growth is a hugely positive trend – especially given the uncertainty that has presided over spending since the 2016 referendum.

“With online advertising the predictable growth driver, it’s encouraging to see other digital ad formats (such as DOOH) and more traditional mediums (including newsbrands) also experiencing solid rises. TV VOD and cinema, however, are stand out performers in comparison to this time last year – reflecting the increasing popularity of these formats among audiences and adding to what is set to be a more diverse advertising landscape to year-end and beyond.”