Food product quality and good service are a bigger factor than price for UK shoppers, according to a new report.

The study, from Shoppercentric, also found that shoppers are seeing less benefit to putting all their eggs in one basket, with more shopping around for the best deal.

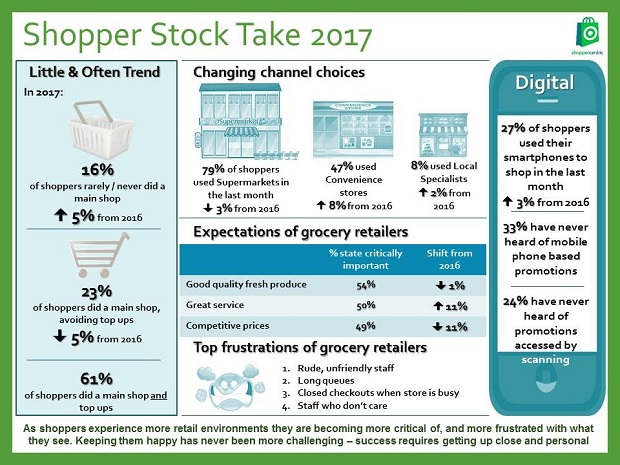

Independent shopper research agency Shoppercentric, have for a second year, launched its Shopper Stock Take Index, enabling valuable year-on-year comparisons across UK shopper’s thoughts and feelings about the grocery retail sector. More than a thousand online survey responses were collected from shoppers and findings indicate that there are a number of changes a-foot.

“The big four grocers are still coming to terms with the fact that big box grocery retail is not the future so it’s important that changes in shopper behavior are noted – and acted upon,” said Danielle Pinnington, Managing Director at Shoppercentric. “It’s also essential news for the brands that supply these retailers, because small store distribution and ranging takes far more thinking than the one-size-fits-all template of the 90’s and 00’s.”

The 2017 Shopper Stock Take index launching today reveals:

• Changing expectations of grocery retailers (percentage saying it’s ‘critically important’):

o Topping the list of shopper desires is product quality – with 54 percent of shoppers looking for good quality fresh meat, fish and produce.

o Providing great service comes in second place with 50 percent of shoppers (up 11 percent from 2016).

o Competitive pricing falls as a critically important expectation into third place with 49 percent (down 11 percent from 2016).

o Having the cheapest prices falls to 37 percent (down six percent).

o Other increases include to feel like they’re being listened to and cared for (up four percent) and for ways to make their lives easier (up four percent), and ways to help them save time when shopping (up three percent).

• Shoppers are seeing less benefit to putting all their eggs in one basket:

o The proportion of shoppers who do lots of small shops and rarely / never a main shop has increased to 16 percent (up from 11 percent in 2016). On average these shoppers visit six different stores a fortnight – meaning they can cover a lot of ground, experience a lot of retail environments, and can therefore be very clear on who delivers well, and on what.

o 23 percent of shoppers still do a main shop and try to avoid top up shops in between.

o A main shop combined with top up shops are carried out by 61 percent of shoppers.

o 60 percent of shoppers agree that ‘I save time if I stick to stores I know well’ – a drop from 67 percent in 2016.

o ‘Fewer, bigger shops is more efficient than lots of little ones’ agree 51 percent of shoppers (down from 58 percent in 2016).

• Channel hopping:

o Of the five key channels covered by the report, supermarkets were the only channel in decline (down to 79 percent – a drop of three percent from 2016) – all others, including local specialists, saw increases in claimed usage.

o Convenience stores saw the biggest gains (47 percent of shoppers used them in the past month – an increase of four percent on 2016), reflecting their fit with changing shopping habits.

o Local Specialists gained two percent of shoppers (to eight percent), reflecting a positive shift in attitudes towards British & local businesses:

• 66 percent of UK shoppers agreed that ‘I prefer it if the money I spend benefits British businesses’.

• 67 percent of UK shoppers agreed that ‘I prefer it if the money I spend benefits local businesses’.

• Key annoyances about grocery stores:

o The average number of factors which are seriously annoying shoppers has increased from 4.2 in 2016 to 4.8 in 2017.

o The top frustration for shoppers is rude or unfriendly staff (62 percent – up eight percent on 2016 figures) and in second place with 55 percent were long queues – also up eight percent on last year.

o The biggest increases in annoyance included: promoted products running out too quickly and messy shelves were key annoyances (with 49 percent and 35 percent respectively) both were up by 13 percent; and lack of staff followed closely with a 12 percent increase on 2016 figures to stand at 45 percent.

• Connected shoppers

o Touchpoints used to shop (in the last month):

Physical stores were used the most – by 59 percent of shoppers (down two percent from 2016). Computers/laptops closely follow in second place with 57 percent – up just one percent on last year.

Smartphone usage for grocery shopping was up three percent to 27 percent and tablets usage was up by one percent to 21 percent.

• 1 in 2 shoppers who had used their smartphones instore did so during the consideration phase of the purchase process (75 percent – up 15 percent on 2016).

• Using the smartphone to research products increased by ten percent to 61 percent of those using smartphones to shop. Using it to find and actually buy items both increased by seven percent (to 56 and 35 percent respectively).

Using a digital / touch screen instore was cited by six percent of shoppers (up two percent from 2016)

Contact with staff instore (20 percent) and the use of catalogues (18 percent) both saw decreases this year – down two and one percent respectively.

Talking to staff online (via Twitter, Facebook, chat lines), using a Smart TV and using a wearable device saw no percentage changes in usage.

o Mcommerce marketing:

• Shoppers are playing hard to get in the digital space – with 33 percent of shoppers stating that they had never heard of mobile phone based promotions – and 75 percent of those who had heard of them, had never use them.

• 24 percent of shoppers had never heard of promotions they could access by scanning the barcode or a QR code – and 66 percent of those who had heard of them, had never used them.

Pinnington concludes: “The changing priorities for today’s UK shoppers are critical to note and retailers must recognise that price is but one part of the value equation, along with time efficiency as well as satisfaction. With low prices having almost become a given, the more added value elements are now performing a critical role in differentiating between competitors. The retail experience, of which service is a core part, is becoming more of a focus for shoppers who want to feel important to the retailer, rather than just being a walking wallet. And they want their needs to be recognised and reflected, through retail experiences that save time and ultimately make life easier.

It’s no small task, but there is a very real need for a back to basics approach – with good housekeeping, clean and clear promotions and good stock availability etc., to ease shopper frustration and prevent undermining a positive retail experience. This year retailers must get amongst their shoppers, see retail through their eyes, build the stores, merchandise the categories and create the digital solutions that truly support the purchase process. Everything counts to the shopper as they continue to flex their spending powers.”

About the research

This report is based on a national representative sample of 1108 online interviews among UK shoppers aged 18+. Nationally representative quotas were placed on gender, age, social grade and geography.

Interviews were conducted in December 2016.

Source: www.shoppercentric.com