While total UK video ad spend is up, less money is being allocated to the traditional pre-roll format, according to new research.

The findings, from Collective’s 2016 UK Online Video Advertising Market Report, indicates that as the UK online video advertising market continues to mature, advertisers and buyers are moving away from a focus on larger, traditional pre-roll video towards buying more strategic and varied video solutions.

The annual report, now in its ninth year, draws together the thoughts of over 100 key video buyers from across the top 30 media agencies.

It reveals that while Broadcaster Video On Demand (VOD) still takes the lion’s share of video advertising spend, clients are increasing their investment in display, YouTube, social channels and other more niche providers.

This has led to a drop in the number of bookings valued at £100,000+, down from 21% of total bookings in 2015 to 13% in 2016, and a rise in bookings valued between £25,000 to £50,000, up from 22% last year to 29% this year, as buyers spread their budgets across multiple video platforms and formats.

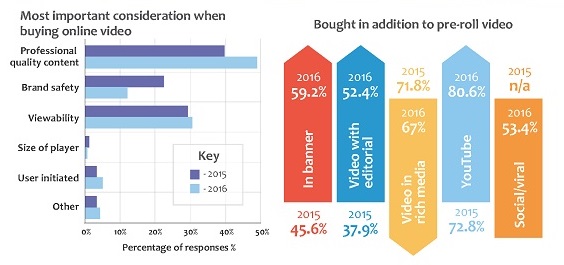

View the infographic showing key findings below:

Feedback from the survey reveals that the move towards buying a more varied range of video advertising solutions has also led to a change in buyers’ responsibilities.

Whereas 56% of respondents in 2015 were buying both video and display, in 2016 the figure has jumped to 73%, while the percentage of those buying TV and Video (the traditional AV/TV heartland) has fallen from 38% last year to 26% in 2016.

“As advertisers take advantage of an increasing number of video solutions outside of the traditional pre-roll market, the responsibility for who buys online video has also changed,” said Simon Stone, Commercial Director, Collective. “Video budgets are increasingly being allocated from TV to digital teams. We have seen a shift in the market since launching both our native and YouTube video products in the last year. There has also been a huge increase in the number of display campaigns that include video assets.”

Given the hype over programmatic advertising, it is interesting to note that the percentages investing in programmatic video have only slightly grown year on year, 70% of respondents are investing more than 25% of their budget into programmatic video vs 60% in 2015. Similar to last year, 69% of buyers invest less than half their budgets into programmatic video whilst 31% are investing more than half.

The responses also show that even though there is increasing interest in alternative video solutions, the industry is still heavily reliant on TV video content. Just over half (54%) said that they used made-for-digital creative in less than a quarter of their campaigns. “We expect the amount of bespoke digital content to grow considerably over the next few years, as agencies and their clients realise the benefits it offers,” says Stone.

Collective has also identified a change in how video buyers measure the effectiveness of their marketing budgets, with Incremental Reach, once the central measurement for success, now considered important by only 14% of respondents, compared with 25% in 2015. In part, this could be because of the launch of various new products (such as Collective’s TV Accelerator audience targeting technology) and the wider availability of alternative video solutions. The most important measurement for success in 2016, according to video buyers, has become VTR, which rose from 35% in 2015 to 52% in 2016.

Media buyers and their clients report more confidence in the safety and accountability of the video advertising market, with the result that hygiene factors such as brand safety, viewability and transparency have become less of a barrier to increasing spend on video advertising.

However, there are still obstacles to be overcome, the survey found, including frequency between providers (21%), a lack of premium inventory for pre-roll (21%) and the ability to prove effectiveness (27%).

With a plethora of digital video partners, solutions and formats, the issue of frequency needs to be tackled, otherwise the market is likely to see huge consolidation.

As the demand for video grows more premium inventory is required to deliver quality content that is also viewable.

The market has to be able to demonstrate that video contributes to sales and other brand performance metrics and that it can offer the targeting to support programmatic campaigns that exploit data to reach the right audience at the right time.

The video ad buyers surveyed are watching current innovations in the marketplace with interest, but no single standout video solution was identified — 360° video, Virtual Reality, vertical video, snackable video and live video were all identified as exciting opportunities, but all with similar scores of around 20%.

Key Findings:

· 73% of digital media buyers claim to be responsible for both Display and Video

· 41% of budgets are being spend on video formats aside from pre-roll

· The average video budget is £66k (down from £76k in 2015)

· 48% of respondents said that content alignment was the most important factor for online video

· 70% of buyers are investing more than a quarter of their budget into programmatic video

· 54% of buyers said that under a quarter of their campaigns feature bespoke digital creative

· 52% of media buyers are placing an emphasis on VTR as the key measurement for success

· 27% of buyers state that proof of effectiveness is the biggest barrier to market growth.