Salmon, the global ecommerce consultancy in charge of online operations of some of the UK’s largest retail clients, has released some stats during the busy peak trading period of Black Friday week.

Salmon predicted a lengthening of online purchases beyond just Black Friday and coined ‘Black Fiveday’, the period from Thursday 24th to Cyber Monday 28th. IMRG announced today that online sales on the actual Black Friday reached £1.23bn.

So what are some of the trends seen over the ‘Black Fiveday’ period?

The tipping point for mobile

Salmon predicted that 2016 would see the majority of orders taken through mobile devices. Its analysis of orders across a range of clients over the five day period indicates that this has occurred with 68% of traffic and 51.2% of orders made via mobile and tablet. Nearly three quarters (73%) of site visitors on Saturday 26th originated via mobile devices.

An earlier start but still a peak on Black Friday

There is no doubt that retailers were anxious to get going early this year with promotions and discounts. Some like Amazon and Argos started well in advance, and the trading results taken from IMRG confirmed that retailers grew Black Friday from a single day event to a much longer concept. According to the data, even before the week had started, 11 different Black Friday campaigns had been initiated by retailers.

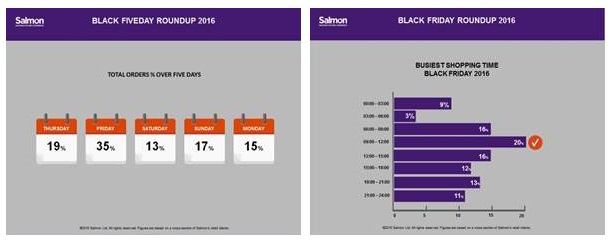

Salmon’s own data found that the majority started on Thursday 24th with 19% of the ‘Black Fiveday’ sales on that day. One of the major peaks occurred on Black Friday itself between 9:00am and 12:00pm with 35% of overall sales taking place.

Savvy shoppers lead to higher conversion

Salmon’s analysis of consumer behaviour indicates that Black Friday shoppers shop with a greater intent to buy:

• Salmon saw an 86% increase in the percentage of visitors adding items to their cart over the Black Fiveday compared to the previous week, indicating shoppers were ready to shop online during that period.

• Conversion rates were double the normal weekly rate +106%. The conversion rate was also up 10% on the previous year.

• Another trend observed by Salmon is the rise of the “Basket Bandit.” These are shoppers who identify items ahead of Black Friday weekend and place them in their online shopping baskets, ready to click ‘buy’ as soon as items are discounted. On the Thursday we saw a 6% increase in cart abandonment compared to the Wednesday and from Friday onwards we observed a steady decline in cart abandonment indicating shoppers had found that bargain and were buying immediately.

The Brexit impact

Two interesting potential impacts of Brexit were also observed on Black Friday sales.

1. Shoppers buying now before Brexit-led inflation kicks in.

There was news that shoppers were aware of retailers considering an increase of the price of goods to take into account current inflationary cost increases. As a result this may have led to the overall increase in sales over the ‘Black Fiveday’ period.

2. An increase in international sales.

Several retailers supported by Salmon reported a significant increase in international sales, which could have been impacted by Brexit and the depreciated value of the Sterling against international currencies. It’s now more economical for overseas shoppers to buy from UK retailers. Over the ‘Black Fiveday’ period there were increases in international traffic at peak hours across Europe, the US and as far as China. This had down the line implications for back end processes that potentially hadn’t planned for strong order numbers entering the system at off-peak times. It also reinforces the need for global brands to have a robust international online capability.

Source: Salmon