Digital and mobile ad spend in the US will grow modest amount in 2020, even as the pandemic cause overall ad spend to plunge $16.4bn, according to new research.

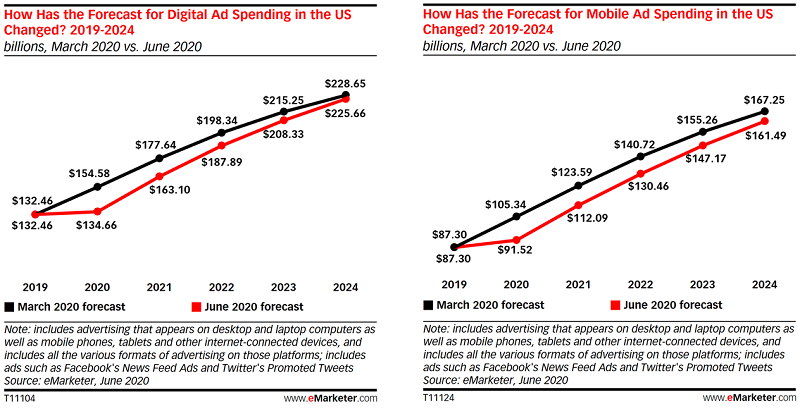

eMarketer says digital ad spend will increase $2.2bn to $134.66bn and mobile ad allocations will rise $4.22bn to $91.52bn. Digital alone would actually shrink without mobile’s projected growth, the report pointed out.

The digital measurement firm has revised its 2020 US ad spend forecast, with the pandemic effect in mind, and projects a swing from a $20 billion growth to a decrease of $16.4bn to total $225.79bn.

In the revised forecast, mobile ad spending will increase 4.8%, or $4.22 billion, this year to $91.52 billion. This is a far cry from the $105.34 billion previously expected. Mobile ad spending will regain some ground each year but still fall short in 2024 at $161.49bn.

Even so, mobile continues to increase its share of digital ad spending, reaching 68.0% in 2020, up from 65.9% in 2019. This share is slightly below our pre-pandemic forecast of 68.3% due to the relatively rapid growth of connected TV (CTV) viewership and advertising.

March and April were brutal months for most advertisers and publishers, but CPMs and spending bottomed out in April, according to advertisers and agencies we interviewed.

Some dollars began to return in May as advertisers started to grasp the opportunities better, but the rebound was minor for most platforms. Most publishers were still assessing their ad strategies with an eye to returning more forcefully in June and Q3.