In 2017, for the first time, smartphones will be the preferred method to access the internet among adults in the UK, according to eMarketer’s latest time spent forecast.

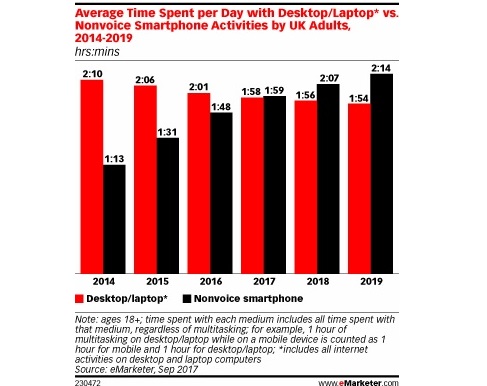

Adults in the UK will spend 1 hour 59 minutes a day on their smartphone, eclipsing their daily time spent on desktops and laptops by 1 minute. And eMarketer expects this gap to widen, with daily time spent on smartphones reaching 2 hours 14 minutes by 2019 vs. 1 hour 54 minutes for desktops/laptops.

eMarketer’s forecast also shows that UK adults will spend 2 hours 45 minutes per day with mobile-only devices (including tablets) this year, an increase of nearly 8.0% from 2016.

A rise in digital video viewing, particularly on social media, along with the popularity of messaging apps are the key drivers behind the mobile uptick. According to eMarketer’s forecast, adults in the UK will spend an average of 31 minutes per day watching digital video on a mobile device in 2017, up 13.5% from last year. In total, adults in the UK will spend 1 hour each day on social networks this year, and more than half of that time (34 minutes) will be done via smartphone.

“Mobile use is increasingly coming to mean smartphone use in the UK, so it’s no surprise to see the time spent forecast tilting ever-more in that direction,” said eMarketer senior analyst Bill Fisher. “The trend within this trend is the growth in social media and video time. More than any other media on any other device, UK adults are migrating their social media and video h abits to smartphones.”

Overall, adults in the UK will spend an average of 9 hours 31 minutes per day with major media in 2017, up 0.5% from last year. Digital media—including mobile—will account for almost half (49.6%) of all media time. Although all traditional media consumption has fallen at least slightly, TV continues to stay relatively steady. This year, TV will account for a 31.7% share of all media time, a 2.3% fall from 2016.

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.

Source: www.emarketer.com