More than 80% of the top retail and finance advertisers have a mobile optimised site and over half use responsive web design, brands dedicate as much time to their mobile sites as their desktop ones, according to new research.

The second IAB Europe Advertiser Mobile Audit is based on an audit of over 500 advertiser sites.

The insights in the report aim to inspire brand advertisers to develop their mobile understanding and presence further in the context of a mobile first consumer environment.

Mobile now accounts for a quarter of all European display ad spend, approaching 50% in most advanced markets and whilst the audit indicates that mobile is becoming an integral part of advertiser strategy it also highlights that there is opportunity to extend mobile marketing strategies. App development, such as e-commerce in the case of retail brands and branch locator in the case of finance brands is still limited in some markets.

Key findings of the research:

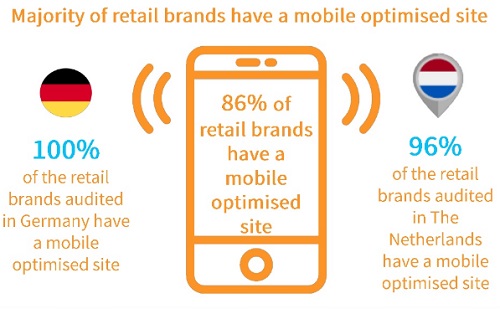

• The majority of retail and finance brands have a mobile presence. Over 80% of retail and finance brands have a mobile optimised site, over half of retail brands and nearly three quarters of finance brands use responsive web design. Germany and The Netherlands exceed in this area as all retail brands in Germany and all finance brands in The Netherlands have a mobile optimised site.

• Apps are a key part of mobile strategy. Over half of retail brands and nearly three quarters of finance brands have a mobile app. In the finance sector, personal banking apps are more developed than business banking apps; twice as many finance brands have personal banking apps than business banking apps. Finance brands in CEE markets are more likely to have a business banking app, whereas the vast majority of finance brands in Spain have a personal banking app.

• Mobile sites just as developed as desktop sites. In terms of functionality for retail brands, mobile sites are catching up with their desktop counterparts. Just over two thirds of retail brands have a transactional mobile (65%) or desktop (69%) site. Store locator functionality is also catching up as just over half of retail brands now have a GPS store locator on their desktop or mobile sites. Spain exceeds in the area of mobile sites as 90% have a GPS store locator.

• Over two thirds of finance brands have a finance calculator on their desktop site and mobile site. Just as many have a GPS branch locator on their desktop site as on their mobile site. Finance brands in Turkey are more likely to have a brand locator on their mobile site (80%).

• App development lags behind mobile and desktop browser sites. A similar story prevailed in the first European Advertiser Mobile Audit report undertaken in 2015 suggesting app development is lagging behind browser sites. Retail apps still have some way to go as less than half of retail brands have transactional functionality and GPS store locators on their mobile or tablet apps. Almost half of finance brands have a GPS branch locator on their mobile or tablet app.

IAB Europe collaborated with seven national IABs in Europe (BVDW / IAB Germany, IAB Ireland, IAB Netherlands, IAB Poland, IAB Serbia, IAB Spain and IAB Turkey) to audit the top media spending retail and finance advertisers in the local markets. Mobile is a key priority for IAB Europe and it aims to drive the uptake of mobile brand advertising through its recommendations, research and insights.

Ben Rickard, Head of Mobile EMEA, MEC said “We live in a mobile first environment so it is great to see that brands are developing their mobile strategies across web and apps. Mobile display experienced more than 60% growth in 2015, which goes to show its importance to advertisers as they look to engage with their best audiences.”

Download the Advertiser Mobile Audit report here.

Methodology

• The seven participating IABs reviewed two advertiser sectors, retail and finance, to establish how mobile ready the brands within those sectors are.

• The top retail and top finance brands according to total media spend in the local market were audited during July and August 2016. 525 advertiser sites across the seven markets were audited in total.

• Desk research was used to manually check each brand against a set of criteria.