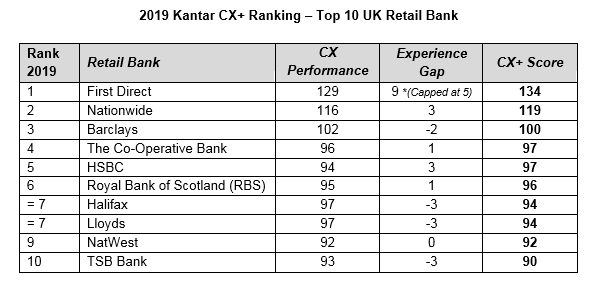

First Direct and Nationwide top the UK’s first retail banking customer experience (CX) index published today by Kantar, the world’s leading data, insights and consulting firm.

Kantar’s CX+ report, which surveyed almost 8,700 retail banking customers, is the only sector-specific index that measures the gap between the promise banks make to their customers and the actual brand experience they receive.

The report shows how banks can narrow that gap in order to achieve greater levels of satisfaction, loyalty and profitability. With CX+ scores of 134 and 119 respectively (100 being the average score), the two leading banks have a significant lead over the other eight banks in the ranking. Barclays (100) is positioned in third, followed by The Co-Operative Bank (97) in fourth and HSBC (97) in fifth place.

Over the last 10 years the UK’s retail banks have sought to recover from the 2008 crash against a background of reputational and trust issues, huge technological advances, new competition from challenger banks and government regulation to open up the sector. The importance of delivering a strong customer experience that aligns with a clear brand promise has never been more important.

Amy Cashman, CO-CEO, Insights Division, Kantar said: “Customer experience and brand strategy can no longer sit in organisational silos. The magic happens only when brand promise and customer experience come together. It’s no longer enough for banks to simply provide a good product or service; customers want and expect a great experience with it, and the better the experience the more value a brand can command. As Kantar’s report shows, in many ways the importance of experience now dwarfs everything else.”

Cashman continued: “With challenger banks and out-of-category brands, such as Amazon, re-defining what great experience looks like, established banks ignore the signs at their peril. Many traditional banks say that they want people to be better off but our CX+ leaders and disruptive fintechs are winning the battle for attention because they are taking purposeful action to ensure they consistently do things that aim to improve customers’ lives and allow them to feel more in control of their finances.”

Alongside the ranking, key trends identified in this year’s report include:

• Younger consumers have different expectations from their banks – Established retail banks must keep up with the tidal wave of technology advances in order to attract and retain younger generations of new customers. Millennials and Centennials bring with them demanding expectations for mobile-first products from banks that can also offer exceptional customer service.

• Customer centricity will disrupt the market – CX+ leaders in this index achieve this through offering better customer experience, while a second generation of fintechs are using technology to do the same.

• Customers and employees should be at the heart of any CX strategy – Customers expect more than banking products. They want empathetic advice and support. Employees must be empowered to deliver this, allowing banks to demonstrate clear differentiation.

• Omnichannel is imperative for retail banks wishing to deliver a seamless cross-channel customer experience – The future will be mobile first but not mobile only. Maintaining a human connection across all touchpoints will remain important to all generations.

• Growing brands are innovative brands – Across industries, and around the world, growing brands are innovating to create exceptional experiences by reframing how they see their business. For example, rather than thinking of their innovation challenge as creating new products or services, their starting point for innovation is how they can help people secure their families’ future.

Tim Pritchard, Managing Director of Customer Experience, Kantar added: “Brands need to accept that what has sustained them in the past, is unlikely to keep them growing in the future. Barriers to entry are falling all the time and those that aren’t disruptors themselves will be disrupted. The imperative for brands is as simple and as difficult as one clarifying idea – put the customer first by focusing on the customer experience. This is after all what makes or breaks a brand.”