UK desktop video ad viewability rose by 7.9 percentage points during 2017, driven by a narrowing performance gap between programmatic and publisher direct trading, according to new research.

The latest Integral Ad Science Media Quality Report highlights the state of viewability, brand safety, and ad fraud within the UK digital advertising industry

The H2 2017 report highlights brand safety, ad fraud, and viewability trends across UK desktop, video, and global mobile advertising.

The report reveals that two-fifths (37.9%) off all video ad inventory was viewed until completion, highlighting the level of engagement opportunity the medium presents. UK desktop video ad viewability rose from 58.3% in H1 2017, to 66.2% in H2 2017.

The rise was supported by a narrowing performance gap between programmatic and publisher direct trading – viewability when trading direct with publishers went up from 66.5% to 68.2%, while viewability when trading programmatically saw the greatest increase from 53.9% to 63.7%.

When looking at brand safety levels for video ads, total risk fell from 13.1% in H1 2017 to 12.2% in H2 2017. The most significant categories of risk in the UK are now violence (25.8%), illegal drugs (23.5%), and illegal downloads (21.5%). Interestingly, the illegal drugs category saw the greatest spike, rising from 1.7% during H1 2017, while hate speech fell the most, down from 22.1% in H1 2017 to 2.1% in H2 2017. The report also shows that non-optimised video ad fraud – where there is no ad fraud prevention in place – decreased by just over a quarter (27.2%) across buy types, with the overall number falling from 6.4% in H1 2017 to 4.7% in H2 2017.

Nick Morley, EMEA MD, Integral Ad Science, comments: “The H2 2017 Media Quality Report highlights positive progress for the video ad industry, with improvements attributed to an increase in premium video inventory as advertisers aim to secure the best possible environments for their creative. Video provides a great opportunity for advertisers to capitalise on not only sight, but sound and motion to capture consumer attention, ultimately driving campaign value. While 2017 was considered a challenging year by most, it’s clear to see that progress has been made, and we’ll continue to drive change into 2018.”

The report also highlighted UK desktop display trends, including:

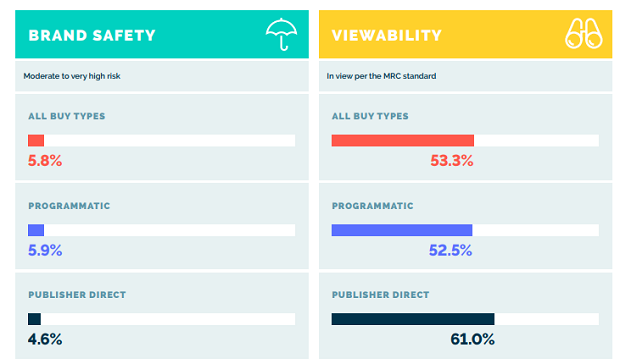

• Viewability saw improvement in H2 2017, increasing by 11% when in view for 1s (from 48% in H1 2017 to 53.3% in H2 2017), by 12.4% when in view for 5s (from 32.9% in H1 2017 to 36.9% in H2 2017), and, most impressively, by 15.9%% when in view for 15s (from 17.4% in H1 2017 to 20.2% in H2 2017).

• For brand safety, overall risk increased from 3.7% in H1 2017 to 5.8% in H2 2017 for the UK market.

• Illegal drugs represented the greatest risk category at 34.4% (up from 23.5% in H1 2017, while illegal downloads came in at the lowest risk, 2.0% (down from 21.5% in H1 2017).

• Optimised fraud levels remained consistent at 0.5%, while non-optimised – campaigns that did not employ ad fraud detection measures – saw more variation, rising from 7.4% in H1 2017 to 8.3% in H2 2017. While both publisher and programmatic buy types saw an increased risk, publisher direct experienced the greatest rise, up from 3.1% in H1 2017 to 5.7% in H2 2017.

Integral Ad Science’s H2 2017 Media Quality Report highlights brand safety, ad fraud, and viewability trends for programmatic and publisher direct advertising across multiple platforms, including display, video, global mobile and in-app data. The UK Media Quality Report analysed data, across nearly 500 billion global impressions, from advertising campaigns that ran between July 1st and December 31st.

*Viewability is determined as 50% of the ad unit in view for one continuous second, large formats as 30% of the ad unit in view for one continuous second and video formats as 50% of the ad unit in view for two continuous seconds as per MRC standard